Market Whales and Their Recent Bets on TSM Options

Market Whales and Their Recent Bets on TSM Options

Financial giants have made a conspicuous bearish move on Taiwan Semiconductor. Our analysis of options history for Taiwan Semiconductor (NYSE:TSM) revealed 53 unusual trades.

金融巨頭對臺灣半導體採取了明顯的看跌舉動。我們對臺灣半導體(紐約證券交易所代碼:TSM)期權歷史的分析顯示了53筆不尋常的交易。

Delving into the details, we found 43% of traders were bullish, while 49% showed bearish tendencies. Out of all the trades we spotted, 13 were puts, with a value of $1,450,644, and 40 were calls, valued at $4,731,585.

深入研究細節,我們發現43%的交易者看漲,而49%的交易者表現出看跌趨勢。在我們發現的所有交易中,有13筆是看跌期權,價值爲1,450,644美元,40筆是看漲期權,價值4,731,585美元。

Expected Price Movements

預期的價格走勢

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $95.0 to $250.0 for Taiwan Semiconductor over the recent three months.

根據交易活動,看來主要投資者的目標是在最近三個月中將臺灣半導體的價格區間從95.0美元擴大到250.0美元。

Analyzing Volume & Open Interest

分析交易量和未平倉合約

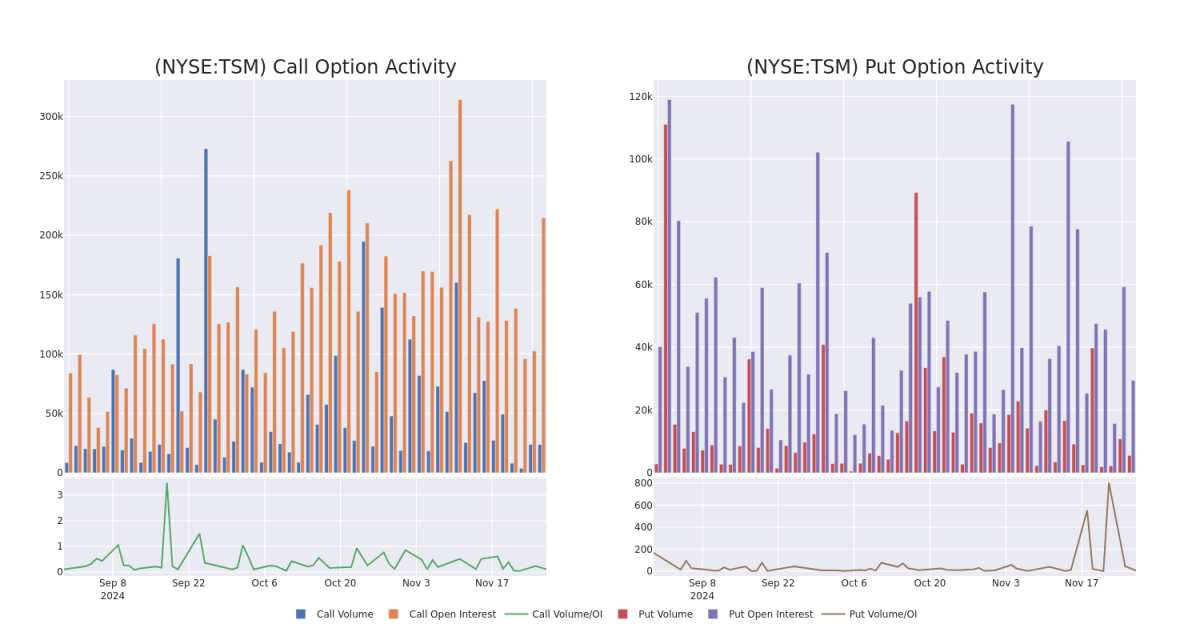

In terms of liquidity and interest, the mean open interest for Taiwan Semiconductor options trades today is 7179.62 with a total volume of 29,269.00.

就流動性和利息而言,今天台灣半導體期權交易的平均未平倉合約爲7179.62,總交易量爲29,269.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Taiwan Semiconductor's big money trades within a strike price range of $95.0 to $250.0 over the last 30 days.

在下圖中,我們可以跟蹤過去30天在95.0美元至250美元行使價區間內臺灣半導體大額資金交易的看漲和看跌期權交易量和未平倉合約的變化。

Taiwan Semiconductor 30-Day Option Volume & Interest Snapshot

臺灣半導體30天期權交易量和利息快照

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TSM | CALL | SWEEP | BULLISH | 03/21/25 | $35.7 | $35.4 | $35.6 | $150.00 | $1.1M | 663 | 307 |

| TSM | CALL | SWEEP | BULLISH | 01/17/25 | $8.2 | $8.1 | $8.2 | $185.00 | $630.3K | 12.2K | 1.1K |

| TSM | PUT | TRADE | BULLISH | 07/18/25 | $6.3 | $6.1 | $6.1 | $145.00 | $549.0K | 420 | 900 |

| TSM | CALL | SWEEP | BEARISH | 01/17/25 | $3.85 | $3.75 | $3.77 | $200.00 | $289.5K | 28.5K | 1.3K |

| TSM | CALL | SWEEP | BULLISH | 02/21/25 | $7.9 | $7.8 | $7.9 | $195.00 | $263.0K | 78.0K | 493 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TSM | 打電話 | 掃 | 看漲 | 03/21/25 | 35.7 美元 | 35.4 美元 | 35.6 美元 | 150.00 美元 | 110 萬美元 | 663 | 307 |

| TSM | 打電話 | 掃 | 看漲 | 01/17/25 | 8.2 美元 | 8.1 美元 | 8.2 美元 | 185.00 美元 | 630.3 萬美元 | 12.2K | 1.1K |

| TSM | 放 | 貿易 | 看漲 | 07/18/25 | 6.3 美元 | 6.1 美元 | 6.1 美元 | 145.00 美元 | 549.0 萬美元 | 420 | 900 |

| TSM | 打電話 | 掃 | 粗魯的 | 01/17/25 | 3.85 美元 | 3.75 美元 | 3.77 美元 | 200.00 美元 | 289.5 萬美元 | 28.5K | 1.3K |

| TSM | 打電話 | 掃 | 看漲 | 02/21/25 | 7.9 美元 | 7.8 美元 | 7.9 美元 | 195.00 美元 | 263.0 萬美元 | 78.0K | 493 |

About Taiwan Semiconductor

關於台積半導體

Taiwan Semiconductor Manufacturing Co. is the world's largest dedicated chip foundry, with over 60% market share. TSMC was founded in 1987 as a joint venture of Philips, the government of Taiwan, and private investors. It went public as an ADR in the us in 1997. TSMC's scale and high-quality technology allow the firm to generate solid operating margins, even in the highly competitive foundry business. Furthermore, the shift to the fabless business model has created tailwinds for TSMC. The foundry leader has an illustrious customer base, including Apple, AMD, and Nvidia, that looks to apply cutting-edge process technologies to its semiconductor designs. TSMC employs more than 73,000 people.

臺灣半導體制造公司是世界上最大的專用芯片代工廠,擁有超過60%的市場份額。台積電成立於1987年,是飛利浦、臺灣政府和私人投資者的合資企業。它於1997年作爲替代性爭議解決在美國上市。即使在競爭激烈的鑄造業務中,台積電的規模和高質量的技術也使該公司能夠創造可觀的營業利潤率。此外,向無晶圓廠商業模式的轉變爲台積電帶來了不利影響。這家晶圓廠的領導者擁有龐大的客戶群,包括蘋果、AMD和Nvidia,他們希望將尖端的工藝技術應用到其半導體設計中。台積電擁有超過73,000名員工。

Having examined the options trading patterns of Taiwan Semiconductor, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了臺灣半導體的期權交易模式之後,我們的注意力現在直接轉向了該公司。這種轉變使我們能夠深入研究其目前的市場地位和表現

Taiwan Semiconductor's Current Market Status

臺灣半導體的當前市場狀況

- With a volume of 6,722,385, the price of TSM is down -1.71% at $180.7.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 50 days.

- tSM的交易量爲6,722,385美元,下跌了-1.71%,至180.7美元。

- RSI 指標暗示標的股票可能已接近超賣。

- 下一份業績預計將在50天后公佈。

What Analysts Are Saying About Taiwan Semiconductor

分析師對臺灣半導體的看法

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $240.0.

在過去的30天中,共有1位專業分析師對該股發表了看法,將平均目標股價設定爲240.0美元。

Turn $1000 into $1270 in just 20 days?

在短短 20 天內將 1000 美元變成 1270 美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Barclays persists with their Overweight rating on Taiwan Semiconductor, maintaining a target price of $240.

20年專業期權交易員透露了他的單線圖技術,該技術顯示何時買入和賣出。複製他的交易,平均每20天獲利27%。點擊此處查看。* 巴克萊的一位分析師堅持對臺灣半導體的增持評級,維持240美元的目標價格。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Taiwan Semiconductor options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監控多個指標以及密切關注市場走勢來管理這些風險。藉助Benzinga Pro的實時警報,隨時了解最新的臺灣半導體期權交易。

In terms of liquidity and interest, the mean open interest for Taiwan Semiconductor options trades today is 7179.62 with a total volume of 29,269.00.

In terms of liquidity and interest, the mean open interest for Taiwan Semiconductor options trades today is 7179.62 with a total volume of 29,269.00.