Manufacturing and Export Growth Bolster Singapore Corporates

Manufacturing and Export Growth Bolster Singapore Corporates

Corporate debt servicing capabilities are expected to remain resilient, says MAS.

MAS表示,預計企業償債能力將保持彈性。

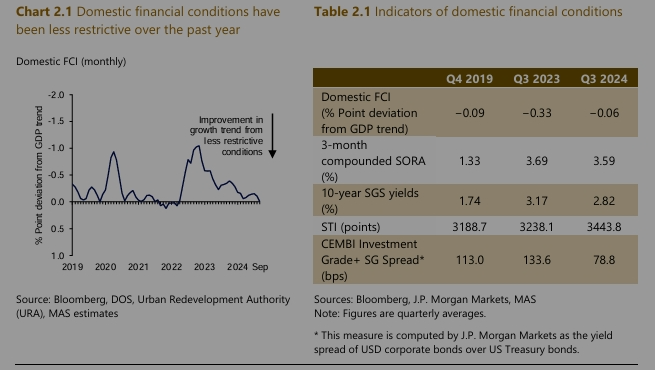

Singapore corporates benefitted from the growth in the manufacturing and export activities as well as less restrictive financial conditions in Q3 2024, according to the Monetary Authority of Singapore (MAS).

根據新加坡金融管理局(MAS)的數據,新加坡企業受益於2024年第三季度製造業和出口活動的增長以及較寬的金融條件。

Corporate balance sheets remained generally stable, the central bank said in its Financial Stability Review published in November 2024. Defaults– including those of small and medium enterprises (SMEs)-- have reportedly remained low.

央行在2024年11月發佈的《金融穩定報告》中表示,企業資產負債表總體保持穩定。據報道,違約率——包括中小型企業(SME)的違約率——一直很低。

Overall, corporate earnings are expected to improve in the second half of 2024, reflecting the economic growth pick-up in the third quarter of the year, MAS said, citing its macroeconomic review published in October 2024.

新加坡金融管理局援引其於2024年10月發佈的宏觀經濟報告稱,總體而言,預計2024年下半年企業收益將有所改善,這反映了今年第三季度的經濟增長回升。

Manufacturers and services firms anticipate improved business prospects between October 2024 and March 2025, compared to Q3 2024, according to a separate survey by the Economic Development Board (EDB) and the Department of Statistics (DOS).

根據經濟發展委員會(EDB)和統計部(DOS)的另一項調查,製造商和服務公司預計,與2024年第三季度相比,2024年10月至2025年3月的業務前景有所改善。

The strength of the tech cycle and less restrictive global financial conditions will also support improving earnings and stabilising domestic financing costs.

科技週期的強勁和較寬鬆的全球金融條件也將支持收益的提高和國內融資成本的穩定。

"In the year ahead, corporate debt servicing capabilities are expected to remain resilient with less restrictive domestic financial conditions," MAS said in the report.

新加坡金融管理局在報告中表示:「在未來的一年中,預計企業償債能力將保持彈性,同時減少國內金融條件的限制。」

Most firms have adequate buffers to manage unfavourable earnings and interest rate shifts that could arise from inflationary shocks, negative growth surprises, trade frictions or an escalation in geopolitical tensions, the central bank added, based on stress tests it conducted.

央行根據其進行的壓力測試補充說,大多數公司都有足夠的緩衝來管理不利的收益和利率變化,這些變動可能源於通貨膨脹衝擊、負增長意外、貿易摩擦或地緣政治緊張局勢的升級。

Corporate debt levels remain below pre-COVID levels.

公司債務水平仍低於COVID之前的水平。

However, corporates continue to suffer from weaker earnings and still-high borrowing costs, which contributed to an increase in leverage risk.

但是,企業繼續遭受收益疲軟和借貸成本居高不下的困擾,這導致了槓桿風險的增加。

'Less restrictive financial conditions'

The global easing of interest rates has also led to less restrictive financial conditions in Singapore. Bank credit to resident corporations has started to expand following the prolonged contraction in 2023, MAS said.

'減少對金融條件的限制'

全球放寬利率也導致新加坡放鬆了金融條件的限制。新加坡金融管理局表示,在2023年長期收縮之後,向居民企業提供的銀行信貸已開始擴大。

Borrowing costs rose in 2024, however, with corporates refinancing debt in a still high-interest rate environment.

但是,借貸成本在2024年上升,企業在仍然高利率的環境中爲債務進行再融資。

"Most firms in Singapore have continued to generate sufficient earnings to service their debt despite higher interest expenses," the central bank said.

央行表示:「儘管利息支出增加,但新加坡的大多數公司仍繼續創造足夠的收益來償還債務。」

Overall, corporate earnings are expected to improve in the second half of 2024, reflecting the economic growth pick-up in the third quarter of the year, MAS said, citing its macroeconomic review published in October 2024.

Overall, corporate earnings are expected to improve in the second half of 2024, reflecting the economic growth pick-up in the third quarter of the year, MAS said, citing its macroeconomic review published in October 2024.