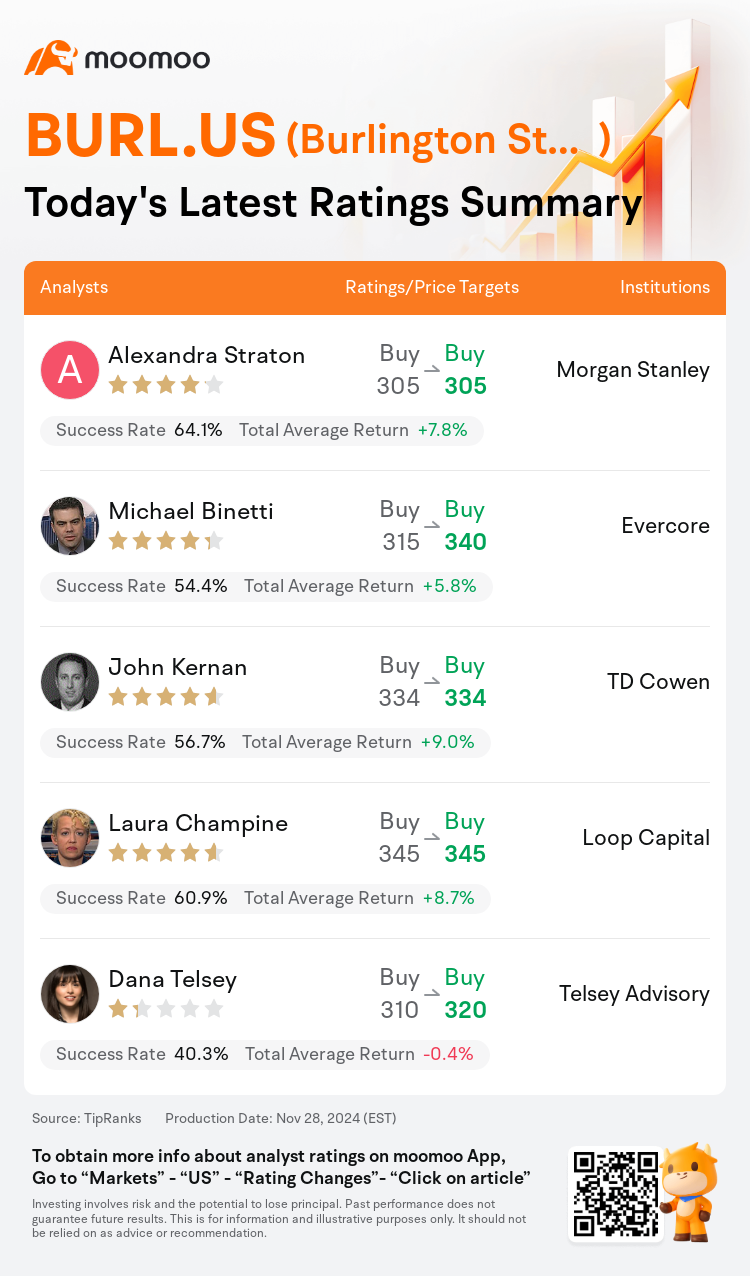

On Nov 28, major Wall Street analysts update their ratings for $Burlington Stores (BURL.US)$, with price targets ranging from $305 to $345.

Morgan Stanley analyst Alexandra Straton maintains with a buy rating, and maintains the target price at $305.

Evercore analyst Michael Binetti maintains with a buy rating, and adjusts the target price from $315 to $340.

TD Cowen analyst John Kernan maintains with a buy rating, and maintains the target price at $334.

TD Cowen analyst John Kernan maintains with a buy rating, and maintains the target price at $334.

Loop Capital analyst Laura Champine maintains with a buy rating, and maintains the target price at $345.

Telsey Advisory analyst Dana Telsey maintains with a buy rating, and adjusts the target price from $310 to $320.

Furthermore, according to the comprehensive report, the opinions of $Burlington Stores (BURL.US)$'s main analysts recently are as follows:

Warm weather and hurricanes adversely affected Q3 comparatives, yet analysts anticipate an 8% sales growth in FY24, propelled by a 2.5% comparative sales increase and significant gains from productive new stores. It is also noted that there are considerable opportunities for outsized sales and margin recovery at Burlington Stores.

Third quarter top-line and comparable results at Burlington Stores were influenced by temporary weather-related challenges. Despite these obstacles, the company demonstrated margin resilience and expansion, indicating steady progress in its BURL 2.0 strategy. This period is perceived positively upon a thorough analysis. The narrative of a compelling rate of change and the potential for near-term positive earnings revisions underpins Burlington's strong value positioning. This situates the company advantageously as it enters a competitive fourth quarter retail environment.

Burlington Stores' Q3 results were impacted by weather conditions, yet the underlying business strength was maintained. Margins surpassed expectations and are anticipated to remain a source of positive developments. The company is well-prepared for the holiday season and is expected to exceed Q4 guidance.

Burlington Stores' third-quarter earnings aligned with consensus expectations, but the company's comparable store sales increase of 1.0% did not meet expectations. Additionally, while Burlington has raised the lower end of its prior earnings guidance for fiscal 2024, it now anticipates comparable store sales to be at the lower end of prior projections.

Despite significant exposure to weather-related fluctuations, Burlington has adhered to its same-store sales guidance and effectively managed its profit and loss account. This occurred alongside what was considered one of the most significant intra-quarter peak-to-trough same-store sales decelerations that off-price retailers have experienced in recent years. Despite a somewhat harsher weather impact than anticipated in the third quarter, the long-term narrative remains unchanged. The analyst indicates that quarterly comps, adversely affected by severe weather conditions, should not be seen as a definitive gauge of ongoing advancements in maintaining competitive off-price comps alongside strong margin performance.

Here are the latest investment ratings and price targets for $Burlington Stores (BURL.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

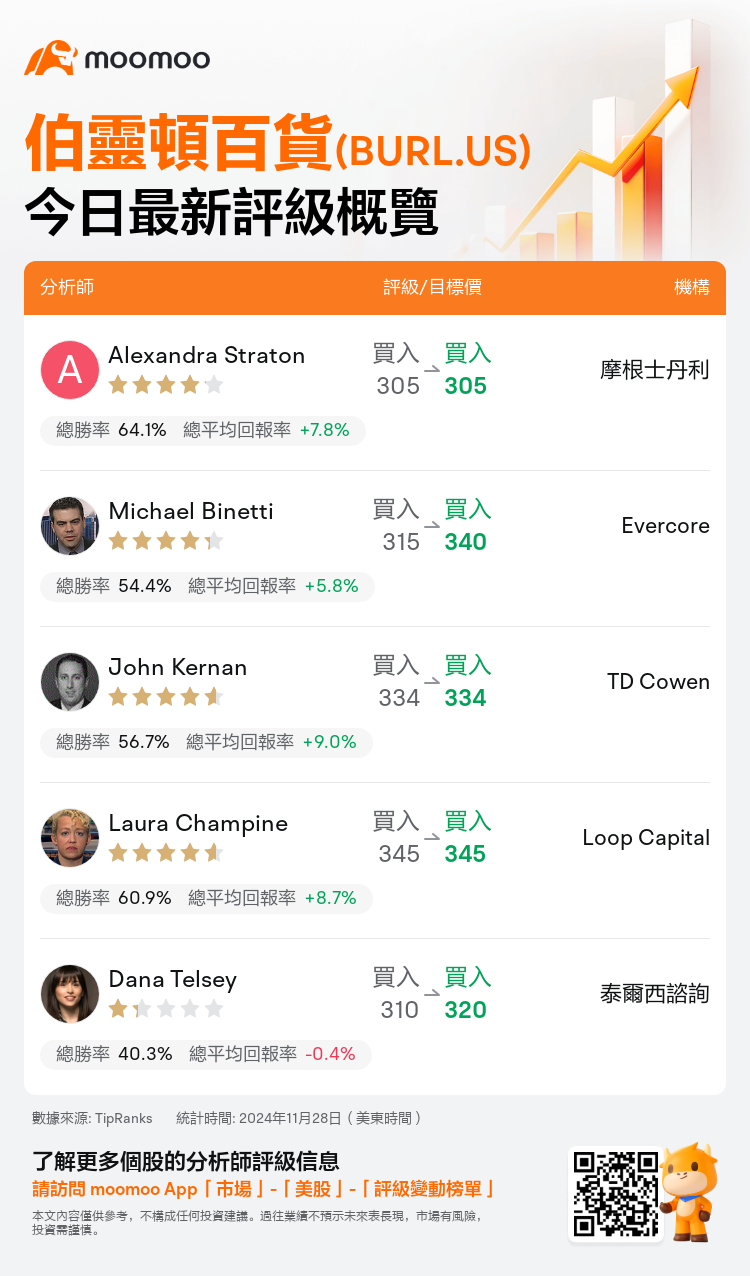

美東時間11月28日,多家華爾街大行更新了$伯靈頓百貨 (BURL.US)$的評級,目標價介於305美元至345美元。

摩根士丹利分析師Alexandra Straton維持買入評級,維持目標價305美元。

Evercore分析師Michael Binetti維持買入評級,並將目標價從315美元上調至340美元。

TD Cowen分析師John Kernan維持買入評級,維持目標價334美元。

TD Cowen分析師John Kernan維持買入評級,維持目標價334美元。

Loop Capital分析師Laura Champine維持買入評級,維持目標價345美元。

泰爾西諮詢分析師Dana Telsey維持買入評級,並將目標價從310美元上調至320美元。

此外,綜合報道,$伯靈頓百貨 (BURL.US)$近期主要分析師觀點如下:

溫暖的天氣和颶風對第三季度的比較產生了不利影響,但分析師預計2024財年的銷售增長將達到8%,這得益於2.5%的比較銷售增長和新店的顯著增益。同時還指出,伯靈頓百貨在超額銷售和利潤恢復方面有相當大的機會。

伯靈頓百貨第三季度的總收入和可比結果受到天氣相關臨時挑戰的影響。儘管面臨這些障礙,公司表現出利潤的韌性和擴張,表明其BURL 2.0策略正在穩步推進。經過徹底分析後,這段時期被積極看待。激動人心的變化速度和近期正面盈利修正的潛力支撐着伯靈頓的強大價值定位。這使得公司在進入競爭激烈的第四季度零售環境時處於有利位置。

儘管受天氣條件影響,伯靈頓百貨的第三季度業績仍維持了業務的內在實力。利潤超出預期,預計將繼續成爲積極發展的源泉。公司爲假日季做好了充分準備,預計將超出第四季度的指導。

伯靈頓百貨第三季度的收益與市場普遍預期一致,但公司可比店銷售增長1.0%未能達到預期。此外,雖然伯靈頓已提高了2024財年前期盈利指引的下限,但現在預計可比店銷售將處於先前預測的下限。

儘管受到天氣波動的顯著影響,伯靈頓仍然堅持同店銷售指引,並有效管理其損益帳戶。這發生在被認爲是近年來折扣零售商經歷的最顯著的季內高峰到低谷的同店銷售放緩之一。儘管第三季度的天氣影響比預期稍爲嚴峻,但長期敘述仍未改變。分析師表明,季度同比,受到惡劣天氣條件的影響,不應被視爲維護競爭性折扣同店銷售和強大利潤表現的持續進展的決定性衡量標準。

以下爲今日5位分析師對$伯靈頓百貨 (BURL.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

TD Cowen分析師John Kernan維持買入評級,維持目標價334美元。

TD Cowen分析師John Kernan維持買入評級,維持目標價334美元。

TD Cowen analyst John Kernan maintains with a buy rating, and maintains the target price at $334.

TD Cowen analyst John Kernan maintains with a buy rating, and maintains the target price at $334.