On Nov 28, major Wall Street analysts update their ratings for $Workday (WDAY.US)$, with price targets ranging from $200 to $330.

Morgan Stanley analyst Keith Weiss maintains with a buy rating, and adjusts the target price from $315 to $330.

Goldman Sachs analyst Kash Rangan maintains with a buy rating, and adjusts the target price from $305 to $300.

BofA Securities analyst Bradley Sills maintains with a buy rating, and maintains the target price at $285.

BofA Securities analyst Bradley Sills maintains with a buy rating, and maintains the target price at $285.

Evercore analyst Kirk Materne maintains with a buy rating, and maintains the target price at $310.

TD Cowen analyst Derrick Wood maintains with a buy rating, and maintains the target price at $290.

Furthermore, according to the comprehensive report, the opinions of $Workday (WDAY.US)$'s main analysts recently are as follows:

Workday management's recent adjustment of their medium-term outlook from the previously stated 15% for FY26/FY27 to a 14% subscription revenue growth for FY26 may lead to a considerable loss of investor confidence, supporting the bearish perspective. Nevertheless, the inherent strength of the core business and the potential for up-selling from an expanding range of solutions are believed to be undervalued at the present market prices.

Workday's Q4 and FY26 forecasts were found unsatisfactory, which can be largely clarified by some unique factors. Disregarding these factors, a continued growth trajectory in the mid-teens and a steady 200 basis point annual margin improvement remain intact. Despite a reduced outlook for FY26, it's assessed that with the market's reaction post-disclosure, the risk in the financial model has significantly diminished against the backdrop of an anticipated 14% growth in FY26.

The company's Q3 report was seen as neutral for the stock as the solid performance was balanced by somewhat weaker future guidance, according to an analyst. The negative reaction in after-hours trading was likely influenced by another reduction in the company's outlook. The belief is that this may represent a nearing low point in forecasts.

Workday is managing through a challenging yet improving economic climate, tempering its top-line growth expectations. It is now anticipating a 14% growth in subscription revenue for the next fiscal year, slightly lower than its prior forecast of 15%. The company's resilience, supported by its diverse product portfolio and customer base, positions it to sustain a medium-term target of 15% in subscription revenue growth annually.

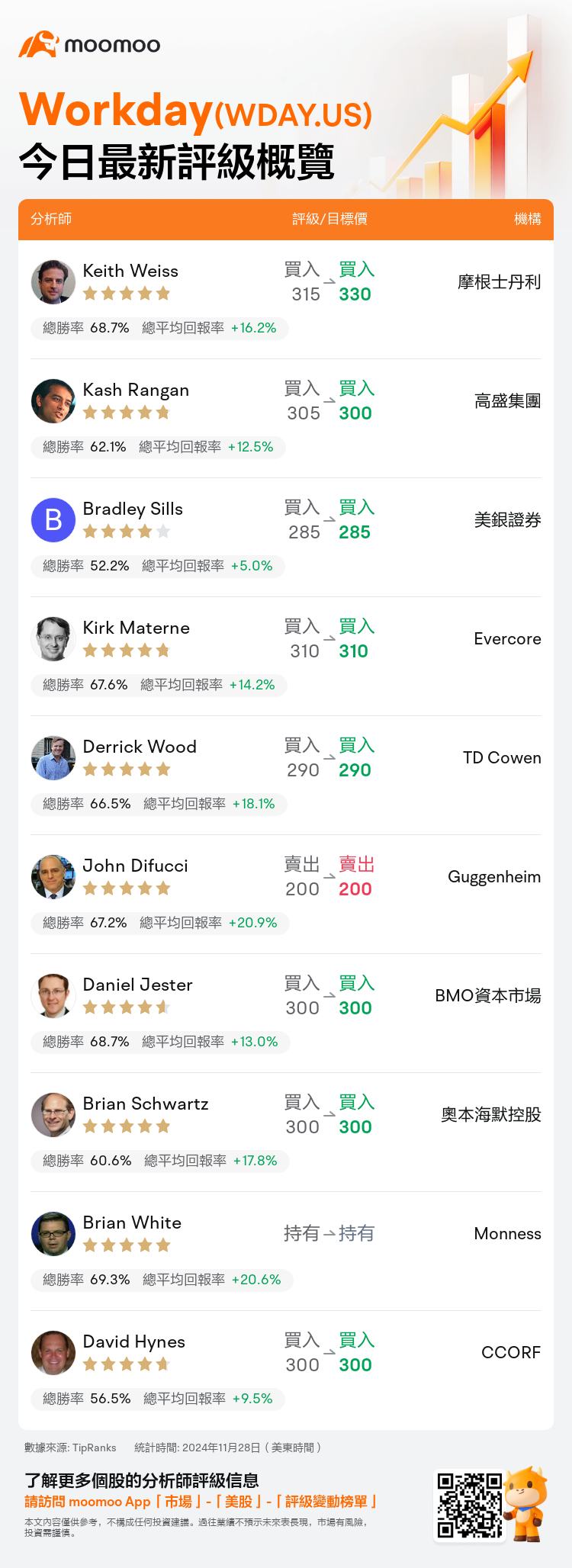

Here are the latest investment ratings and price targets for $Workday (WDAY.US)$ from 10 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月28日,多家華爾街大行更新了$Workday (WDAY.US)$的評級,目標價介於200美元至330美元。

摩根士丹利分析師Keith Weiss維持買入評級,並將目標價從315美元上調至330美元。

高盛集團分析師Kash Rangan維持買入評級,並將目標價從305美元下調至300美元。

美銀證券分析師Bradley Sills維持買入評級,維持目標價285美元。

美銀證券分析師Bradley Sills維持買入評級,維持目標價285美元。

Evercore分析師Kirk Materne維持買入評級,維持目標價310美元。

TD Cowen分析師Derrick Wood維持買入評級,維持目標價290美元。

此外,綜合報道,$Workday (WDAY.US)$近期主要分析師觀點如下:

Workday管理層最近將FY26/FY27之前預期的15%的中期展望調整爲FY26的14%訂閱營業收入增長,這可能導致投資者信心的顯著下降,支持看淡的觀點。然而,核心業務的內在實力以及從日益擴展的業務範圍中向上銷售的潛力被認爲在目前的市場價格下被低估。

Workday的Q4和FY26預測被認爲不令人滿意,這在很大程度上可以由一些獨特因素來解釋。忽略這些因素,中期持續增長在中位數十幾的軌跡和穩定的每年200個點子的利潤率改善仍然保持不變。儘管對FY26的展望降低,但評估認爲,由於市場在披露後的反應,財務模型的風險在預計FY26增長14%的背景下顯著降低。

根據一位分析師的說法,該公司的Q3報告被視爲對股票中立,因爲強勁的表現被稍弱的未來指引所平衡。盤後交易中的負面反應可能受到公司前景再次降低的影響。人們普遍認爲,這可能代表了預測的接近低點。

Workday正在通過一個充滿挑戰但正在改善的經濟氣候進行管理,減緩了其營業收入增長的預期。它現在預計下一個財政年度訂閱營業收入增長14%,略低於之前15%的預測。公司的韌性,得益於其多樣化的產品組合和客戶基礎,使其能夠維持每年15%的中期訂閱營業收入增長目標。

以下爲今日10位分析師對$Workday (WDAY.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

美銀證券分析師Bradley Sills維持買入評級,維持目標價285美元。

美銀證券分析師Bradley Sills維持買入評級,維持目標價285美元。

BofA Securities analyst Bradley Sills maintains with a buy rating, and maintains the target price at $285.

BofA Securities analyst Bradley Sills maintains with a buy rating, and maintains the target price at $285.