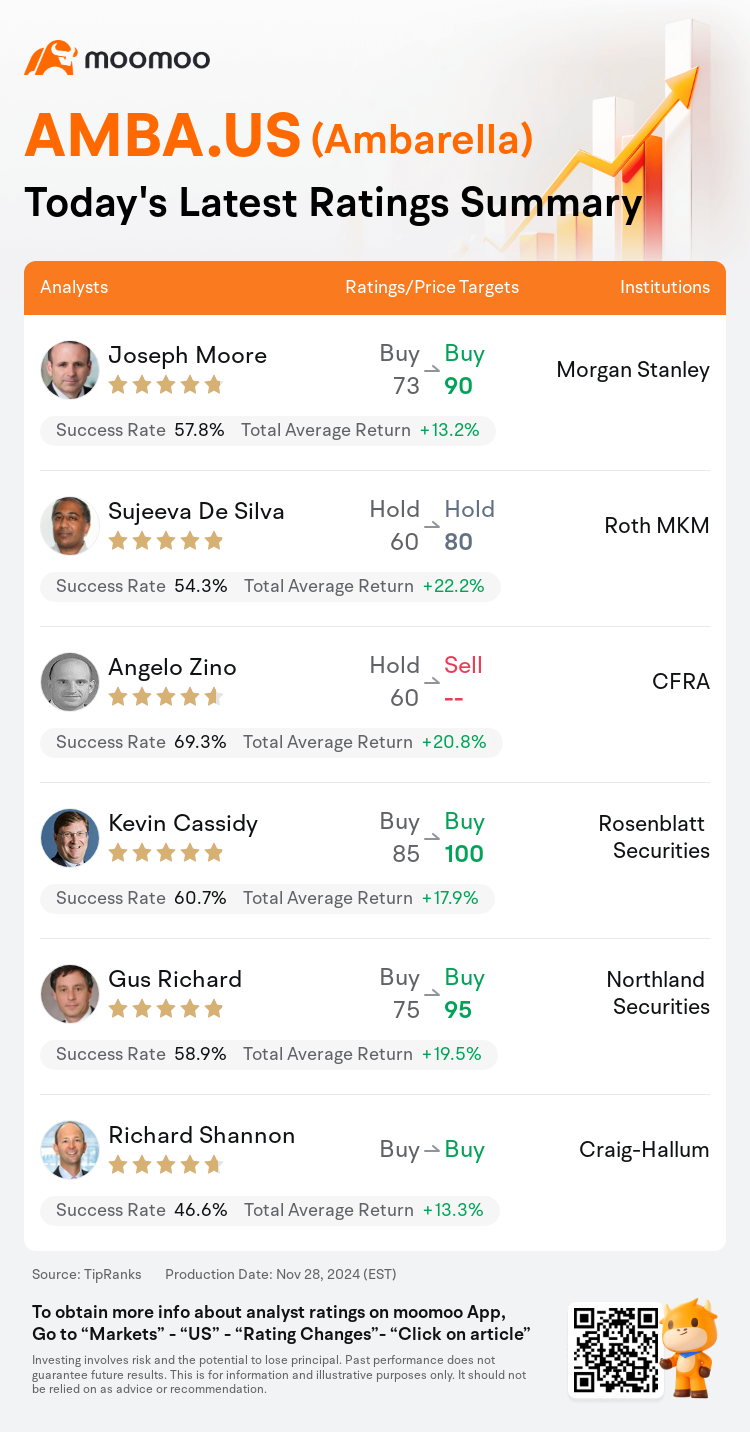

On Nov 28, major Wall Street analysts update their ratings for $Ambarella (AMBA.US)$, with price targets ranging from $80 to $100.

Morgan Stanley analyst Joseph Moore maintains with a buy rating, and adjusts the target price from $73 to $90.

Roth MKM analyst Sujeeva De Silva maintains with a hold rating, and adjusts the target price from $60 to $80.

CFRA analyst Angelo Zino downgrades to a sell rating.

CFRA analyst Angelo Zino downgrades to a sell rating.

Rosenblatt Securities analyst Kevin Cassidy maintains with a buy rating, and adjusts the target price from $85 to $100.

Northland Securities analyst Gus Richard maintains with a buy rating, and adjusts the target price from $75 to $95.

Furthermore, according to the comprehensive report, the opinions of $Ambarella (AMBA.US)$'s main analysts recently are as follows:

Ambarella reported strong October-end quarter results, leading to a positive response in its stock performance. However, concerns have been raised about the company's valuation, particularly questioning the justification for a relatively smaller-scale business where projections heavily rely on long-term growth prospects beyond 2025, which now appear uncertain. Despite a minor increase in sales estimates for 2025 and 2026, there's an expected decrease in pro-forma EPS for these years.

Ambarella's recent quarterly results and projections benefited from new product cycles, according to an analyst. There has been noticeable product strength in both IoT and automotive sectors. The robustness of their technology and the increasing demand for Edge AI are seen as factors that have sufficiently compensated for any challenges faced. Moreover, an anticipated significant advancement in automotive applications by 2026 was highlighted.

Ambarella's third-quarter performance exceeded the midpoint estimates and the fourth-quarter guidance was significantly above expectations. A noted concern was the decrease in auto revenue funnel, which dropped by 8% year-over-year to $2.2 billion from $2.4 billion, primarily due to lowered unit forecasts and delays and cancellations of projects, mainly associated with L2+ programs. Nevertheless, it's anticipated that product ramp-ups will drive stronger than usual seasonal revenue for the fourth quarter.

Following a solid third-quarter performance characterized by surpassing expectations and upward revisions, Ambarella continues to show strong execution in its CV product family pipeline. This success is propelling the company's status as a prominent figure in the expanding AI at the Edge ecosystem.

Here are the latest investment ratings and price targets for $Ambarella (AMBA.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

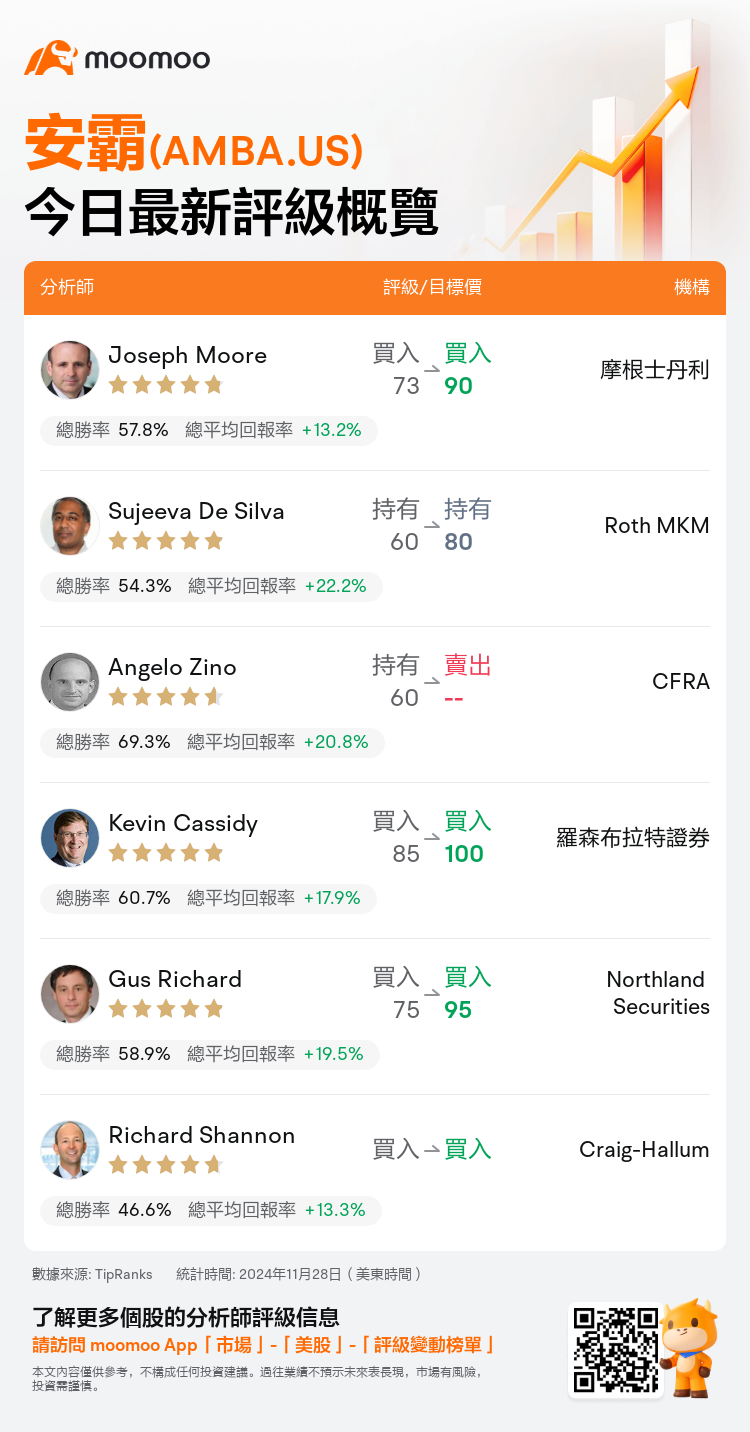

美東時間11月28日,多家華爾街大行更新了$安霸 (AMBA.US)$的評級,目標價介於80美元至100美元。

摩根士丹利分析師Joseph Moore維持買入評級,並將目標價從73美元上調至90美元。

Roth MKM分析師Sujeeva De Silva維持持有評級,並將目標價從60美元上調至80美元。

CFRA分析師Angelo Zino下調至賣出評級。

CFRA分析師Angelo Zino下調至賣出評級。

羅森布拉特證券分析師Kevin Cassidy維持買入評級,並將目標價從85美元上調至100美元。

Northland Securities分析師Gus Richard維持買入評級,並將目標價從75美元上調至95美元。

此外,綜合報道,$安霸 (AMBA.US)$近期主要分析師觀點如下:

安霸公佈了強勁的十月季度業績,導致其股票表現積極。然而,關於公司估值的擔憂被提出,特別是質疑這個相對較小規模的業務的合理性,因爲預測在很大程度上依賴於2025年之後的長期增長前景,而這些前景現在看來充滿不確定性。儘管對2025年和2026年的銷售預估略有上調,但預計這幾年每股收益將有所下降。

根據一位分析師的說法,安霸最近的季度業績和預測受益於新產品週期。在物聯網和汽車領域都出現了顯著的產品強勁。它們的科技堅固性以及對邊緣人工智能日益增長的需求被視爲足以彌補所面臨的任何挑戰的因素。此外,預計到2026年在汽車應用方面將有顯著進展。

安霸的第三季度業績超過了中位數預估,第四季度的指引也大大高於預期。一個顯著的擔憂是汽車營業收入管道的下降,同比下降8%,從$24億降低至$22億,主要是由於降低了單位預測以及項目的延遲和取消,主要與L2+項目相關。然而,預計產品的逐步上市將推動第四季度強於以往的季節性營業收入。

在第三季度表現穩健、超出預期並進行了上調修正之後,安霸在其計算機視覺產品系列的管道中繼續展現強勁的執行力。這一成功推動了公司在不斷擴展的邊緣人工智能生態系統中的地位。

以下爲今日6位分析師對$安霸 (AMBA.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

CFRA分析師Angelo Zino下調至賣出評級。

CFRA分析師Angelo Zino下調至賣出評級。

CFRA analyst Angelo Zino downgrades to a sell rating.

CFRA analyst Angelo Zino downgrades to a sell rating.