ASML Holding's Options Frenzy: What You Need to Know

ASML Holding's Options Frenzy: What You Need to Know

Financial giants have made a conspicuous bullish move on ASML Holding. Our analysis of options history for ASML Holding (NASDAQ:ASML) revealed 82 unusual trades.

金融巨頭對阿斯麥採取了明顯的看好舉動。我們對阿斯麥(納斯達克:ASML)期權交易歷史的分析顯示,有82筆飛凡交易。

Delving into the details, we found 57% of traders were bullish, while 36% showed bearish tendencies. Out of all the trades we spotted, 29 were puts, with a value of $2,588,601, and 53 were calls, valued at $4,795,957.

深入細節後,我們發現57%的交易員持看漲看法,而36%顯示出看淡趨勢。在我們發現的所有交易中,有29筆看跌交易,價值$2,588,601,有53筆看漲交易,價值$4,795,957。

Predicted Price Range

預測價格區間

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $580.0 to $800.0 for ASML Holding over the last 3 months.

考慮到這些合約的成交量和未平倉合約量,看起來大手交易者在過去3個月一直將阿斯麥的目標價區間定在$580.0至$800.0之間。

Insights into Volume & Open Interest

成交量和持倉量分析

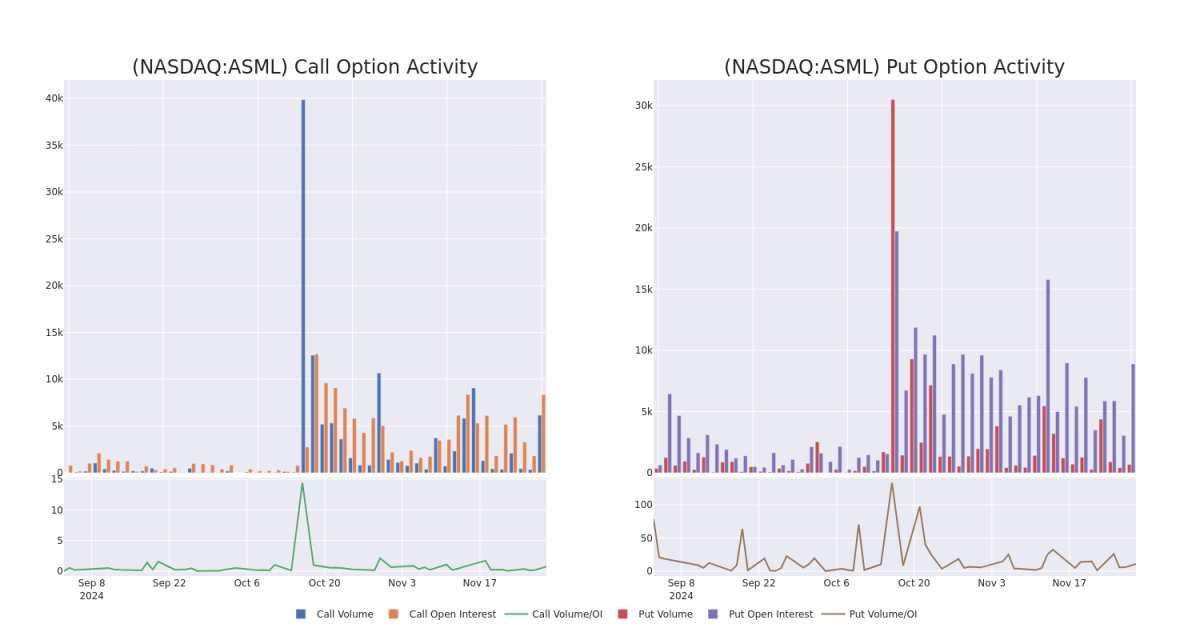

In today's trading context, the average open interest for options of ASML Holding stands at 313.4, with a total volume reaching 6,778.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in ASML Holding, situated within the strike price corridor from $580.0 to $800.0, throughout the last 30 days.

在今天的交易背景下,阿斯麥期權的平均未平倉量爲313.4,總成交量達到6,778.00。伴隨的圖表勾勒了過去30天中阿斯麥高價值交易的看漲和看跌期權成交量和未平倉量的發展情況,這些交易位於從$580.0到$800.0的行權價走廊內。

ASML Holding 30-Day Option Volume & Interest Snapshot

ASML Holding 30天期權成交量和持有量快照

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ASML | PUT | TRADE | BULLISH | 02/21/25 | $87.7 | $86.9 | $86.9 | $760.00 | $191.1K | 231 | 22 |

| ASML | PUT | TRADE | BULLISH | 02/21/25 | $86.8 | $86.0 | $86.0 | $760.00 | $189.2K | 231 | 66 |

| ASML | PUT | TRADE | BULLISH | 02/21/25 | $86.3 | $85.5 | $85.5 | $750.00 | $188.1K | 37 | 66 |

| ASML | CALL | TRADE | BULLISH | 01/17/25 | $41.2 | $40.8 | $41.2 | $680.00 | $168.9K | 334 | 281 |

| ASML | CALL | TRADE | BULLISH | 12/20/24 | $21.7 | $20.9 | $21.5 | $690.00 | $150.5K | 347 | 75 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 阿斯麥 | 看跌 | 交易 | BULLISH | 02/21/25 | $87.7 | $86.9 | $86.9 | $760.00 | $191.1K | 231 | 22 |

| 阿斯麥 | 看跌 | 交易 | BULLISH | 02/21/25 | $86.8 | $86.0 | $86.0 | $760.00 | $189.2K | 231 | 66 |

| 阿斯麥 | 看跌 | 交易 | BULLISH | 02/21/25 | $86.3 | $85.5 | $85.5 | $750.00 | 188.1千美元 | 37 | 66 |

| 阿斯麥 | 看漲 | 交易 | BULLISH | 01/17/25 | $41.2 | 目標價40.8美元。 | $41.2 | 680.00美元 | 168.9K | 334 | 281 |

| 阿斯麥 | 看漲 | 交易 | BULLISH | 12/20/24 | $21.7 | $20.9 | 21.5美元 | $690.00 | 1.5萬美元 | 347 | 75 |

About ASML Holding

關於阿斯麥控股

ASML is the leader in photolithography systems used in the manufacturing of semiconductors. Photolithography is the process in which a light source is used to expose circuit patterns from a photo mask onto a semiconductor wafer. The latest technological advances in this segment allow chipmakers to continually increase the number of transistors on the same area of silicon, with lithography historically representing a high portion of the cost of making cutting-edge chips. ASML outsources the manufacturing of most of its parts, acting like an assembler. ASML's main clients are TSMC, Samsung, and Intel.

ASML是半導體制造中使用的光刻系統領先者。光刻是一種利用光源將掩膜版上的電路圖案顯影到半導體晶片上的過程。該領域的最新技術進步使芯片廠商能夠不斷增加相同面積硅片上的晶體管數量,而光刻歷史上佔了製造前沿芯片成本的很高比例。ASML將大部分零件製造外包,充當裝配工的角色。ASML的主要客戶是TSMC,三星和英特爾。

Following our analysis of the options activities associated with ASML Holding, we pivot to a closer look at the company's own performance.

在分析與阿斯麥控股相關的期權活動之後,我們轉向更深入地了解該公司的表現。

ASML Holding's Current Market Status

ASML Holding當前市場狀態

- With a trading volume of 550,696, the price of ASML is up by 3.75%, reaching $695.64.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 61 days from now.

- 阿斯麥的交易量爲550,696,價格上漲3.75%,達到695.64美元。

- 當前RSI值表明該股票可能接近超買狀態。

- 下一個收益報告預定在61天后。

Professional Analyst Ratings for ASML Holding

阿斯麥的專業分析師評級

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $767.0.

在過去的一個月裏,有1位行業分析師分享了關於這支股票的見解,提出了767.0美元的平均目標價。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Bernstein persists with their Outperform rating on ASML Holding, maintaining a target price of $767.

20年期權交易專家揭示了他的一線圖技術,顯示何時買入和賣出。複製他的交易,這些交易平均每20天盈利27%。點擊此處獲取*,Bernstein的一位分析師堅持對阿斯麥給予表現評級,維持了767美元的目標價。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

In today's trading context, the average open interest for options of ASML Holding stands at 313.4, with a total volume reaching 6,778.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in ASML Holding, situated within the strike price corridor from $580.0 to $800.0, throughout the last 30 days.

In today's trading context, the average open interest for options of ASML Holding stands at 313.4, with a total volume reaching 6,778.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in ASML Holding, situated within the strike price corridor from $580.0 to $800.0, throughout the last 30 days.