PayPal Holdings Options Trading: A Deep Dive Into Market Sentiment

PayPal Holdings Options Trading: A Deep Dive Into Market Sentiment

High-rolling investors have positioned themselves bullish on PayPal Holdings (NASDAQ:PYPL), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in PYPL often signals that someone has privileged information.

一些高手投資者持看漲態度,對於零售交易者來說要注意。通過貝寧扎跟蹤公開期權數據,我們今天注意到了這種活動。這些投資者的身份尚不確定,但PYPL的這種重大變動通常意味着某人獲得了內幕消息。

Today, Benzinga's options scanner spotted 10 options trades for PayPal Holdings. This is not a typical pattern.

今天,Benzinga的期權掃描器發現了10筆paypal持倉的期權交易。這不是一個典型的模式。

The sentiment among these major traders is split, with 50% bullish and 30% bearish. Among all the options we identified, there was one put, amounting to $28,400, and 9 calls, totaling $483,061.

這些主要交易者之間的情緒分歧,有50%看好,30%看淡。在我們確定的所有期權中,有一個看跌,金額爲$28,400,還有9個看漲,總共爲$483,061。

What's The Price Target?

目標價是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $62.5 to $100.0 for PayPal Holdings over the last 3 months.

考慮到這些合同的成交量和未平倉合約量,看起來大鱷們過去3個月一直在瞄準paypal持倉的價格區間爲$62.5至$100.0。

Insights into Volume & Open Interest

成交量和持倉量分析

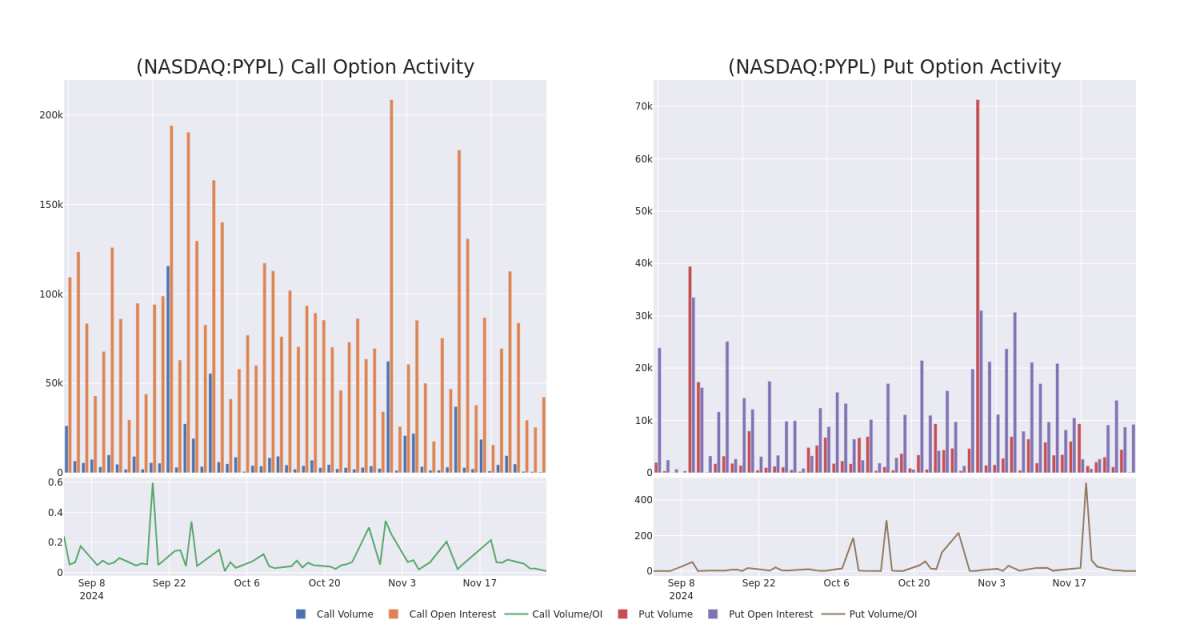

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for PayPal Holdings's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across PayPal Holdings's significant trades, within a strike price range of $62.5 to $100.0, over the past month.

檢查成交量和未平倉合約提供了股票研究的關鍵見解。這些信息對於評估paypal持倉特定行權價格的期權的流動性和興趣水平至關重要。以下是我們爲過去一個月paypal持倉的重要交易中看漲和看跌期權成交量和未平倉合約的趨勢快照,範圍爲$62.5至$100.0的行權價格。

PayPal Holdings Call and Put Volume: 30-Day Overview

PayPal Holdings的看漲和看跌成交量: 30日概述

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | CALL | SWEEP | BEARISH | 01/16/26 | $11.1 | $11.05 | $11.05 | $95.00 | $110.5K | 17.5K | 107 |

| PYPL | CALL | TRADE | BULLISH | 06/20/25 | $24.7 | $24.7 | $24.7 | $65.00 | $64.2K | 1.9K | 26 |

| PYPL | CALL | TRADE | BULLISH | 03/21/25 | $3.9 | $3.75 | $3.85 | $95.00 | $57.7K | 1.7K | 154 |

| PYPL | CALL | TRADE | BULLISH | 06/18/26 | $21.4 | $21.4 | $21.4 | $80.00 | $53.5K | 2.9K | 0 |

| PYPL | CALL | SWEEP | BULLISH | 08/15/25 | $27.95 | $27.5 | $27.95 | $62.50 | $53.1K | 10 | 19 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | 看漲 | SWEEP | 看淡 | 01/16/26 | $11.1 | $11.05 | $11.05 | $95.00 | 110.5K | 17.5K | 107 |

| PYPL | 看漲 | 交易 | BULLISH | 06/20/25 | $24.7 | $24.7 | $24.7 | $65.00 | 64.2K美元 | 1.9K | 26 |

| PYPL | 看漲 | 交易 | BULLISH | 03/21/25 | $3.9 | $3.75 | $3.85 | $95.00 | $57.7K | 1.7K | 154 |

| PYPL | 看漲 | 交易 | BULLISH | 06/18/26 | $21.4 | $21.4 | $21.4 | $80.00 | $53.5K | 2.9K | 0 |

| PYPL | 看漲 | SWEEP | BULLISH | 08/15/25 | $27.95 | $27.5 | $27.95 | $62.50 | $53.1K | 10 | 19 |

About PayPal Holdings

關於paypal控股

PayPal was spun off from eBay in 2015 and provides electronic payment solutions to merchants and consumers, with a focus on online transactions. The company had 426 million active accounts at the end of 2023. The company also owns Venmo, a person-to-person payment platform.

paypal控股於2015年從ebay分拆出來,爲商家和消費者提供電子支付解決方案,重點放在在線交易方面。該公司在2023年末擁有4.26億活躍帳戶。該公司還擁有Venmo,這是一個人對人的支付平台。

Where Is PayPal Holdings Standing Right Now?

paypal控股現在的處境如何?

- With a volume of 1,395,220, the price of PYPL is down -0.3% at $86.31.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 68 days.

- paypal的成交量爲1,395,220,股價下跌-0.3%,報$86.31。

- RSI因子暗示底層股票可能被超買。

- 下次盈利預計在68天后公佈。

What Analysts Are Saying About PayPal Holdings

關於PayPal Holdings的分析師觀點

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $89.0.

過去30天中,共有2位專業分析師對該股票發表了看法,並設定了$89.0的平均目標價。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Reflecting concerns, an analyst from Piper Sandler lowers its rating to Neutral with a new price target of $88.* An analyst from Phillip Securities downgraded its action to Accumulate with a price target of $90.

Benzinga Edge的期權異動板塊可以在市場變化發生之前發現潛在的市場走勢。查看大額資金在您最喜歡的股票上的持倉情況。點擊這裏進行訪問。* 反映擔憂,來自派傑投資的一個分析師將其評級調降至中立,設定新的目標價爲$88。* 菲利普證券的分析師降低其評級爲累計,目標價爲$90。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest PayPal Holdings options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在回報。精明的交易者通過不斷地自我教育、調整策略、監控多個因子以及密切關注市場動向來管理這些風險。通過Benzinga Pro的實時提醒了解最新的paypal控股期權交易動態。

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $62.5 to $100.0 for PayPal Holdings over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $62.5 to $100.0 for PayPal Holdings over the last 3 months.