Here's Why Upwork (NASDAQ:UPWK) Has Caught The Eye Of Investors

Here's Why Upwork (NASDAQ:UPWK) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

對於初學者來說,收購一家向投資者講述好故事的公司似乎是個好主意(也是一個令人興奮的前景),即使該公司目前缺乏收入和利潤記錄。但是,正如彼得·林奇在 One Up On Wall Street 中所說的那樣,「遠射幾乎永遠不會得到回報。」虧損公司可以像資本海綿一樣行事,因此投資者應謹慎行事,不要浪費好錢。

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Upwork (NASDAQ:UPWK). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

因此,如果這種高風險和高回報的想法不適合,你可能會對像Upwork(納斯達克股票代碼:UPWK)這樣的盈利成長型公司更感興趣。儘管這並不一定說明其估值是否被低估,但該業務的盈利能力足以保證一定的升值——尤其是在其增長的情況下。

How Fast Is Upwork Growing Its Earnings Per Share?

Upwork的每股收益增長速度有多快?

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It's an outstanding feat for Upwork to have grown EPS from US$0.097 to US$0.64 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company.

在商業中,利潤是衡量成功的關鍵指標;股價往往反映每股收益(EPS)的表現。因此,在潛在投資者眼中,每股收益的增長通常會引起公司的關注。Upwork在短短一年內將每股收益從0.097美元提高到0.64美元,這是一項了不起的壯舉。當你看到收益增長如此之快時,這通常意味着公司未來的好兆頭。

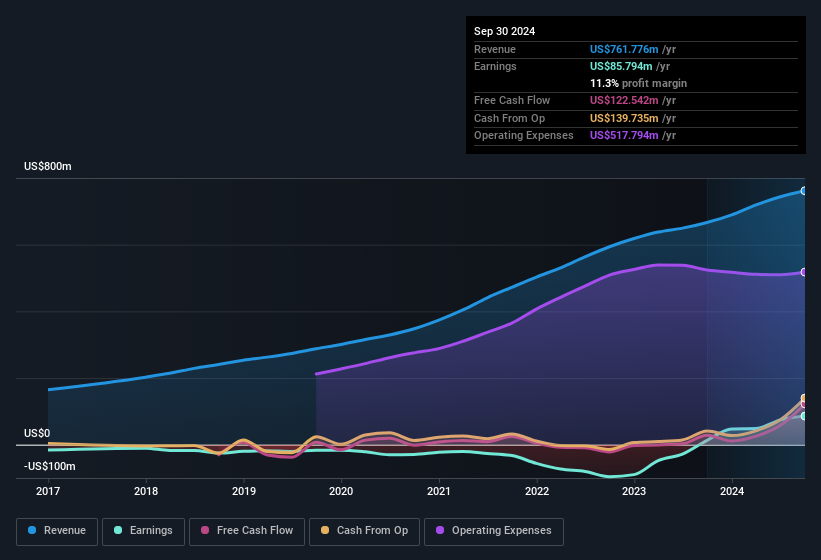

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Upwork shareholders is that EBIT margins have grown from -6.0% to 7.9% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

仔細檢查公司增長的一種方法是查看其收入以及利息和稅前收益(EBIT)利潤率如何變化。令Upwork股東聽到的消息是,在過去的12個月中,息稅前利潤率從-6.0%增長到7.9%,收入也呈上升趨勢。無論從哪個方面來看,都很高興看到。

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

在下圖中,您可以看到公司如何隨着時間的推移實現收益和收入的增長。點擊圖表查看確切的數字。

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Upwork?

雖然我們生活在當下,但毫無疑問,未來在投資決策過程中最重要。那麼,爲什麼不查看這張描繪Upwork未來每股收益估計值的交互式圖表呢?

Are Upwork Insiders Aligned With All Shareholders?

Upwork 內部人士是否與所有股東保持一致?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. So it is good to see that Upwork insiders have a significant amount of capital invested in the stock. We note that their impressive stake in the company is worth US$162m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

如果內部人士也擁有股份,這應該會給投資者一種擁有公司股份的安全感,從而使他們的利益緊密一致。因此,很高興看到Upwork內部人士將大量資本投資於該股。我們注意到,他們在該公司的可觀股份價值1.62億美元。這表明領導層在做出決策時會非常注意股東的利益!

Is Upwork Worth Keeping An Eye On?

Upwork 值得關注嗎?

Upwork's earnings have taken off in quite an impressive fashion. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So at the surface level, Upwork is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. Now, you could try to make up your mind on Upwork by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

Upwork的收入以令人印象深刻的方式實現了增長。每股收益的增長無疑引人注目,而龐大的內部所有權只會進一步激發我們的興趣。有時,每股收益的快速增長表明業務已經到了轉折點,因此這裏有潛在的機會。因此,從表面上看,Upwork值得列入你的觀察名單;畢竟,當市場低估快速增長的公司時,股東表現良好。現在,你可以嘗試只關注這些因素,在Upwork上下定決心,也可以考慮其市盈率與業內其他公司相比如何。

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in the US with promising growth potential and insider confidence.

雖然選擇收益不增長且沒有內幕買盤的股票可以產生業績,但對於估值這些關鍵指標的投資者來說,以下是精心挑選的具有良好增長潛力和內部信心的美國公司名單。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

請注意,本文中討論的內幕交易是指相關司法管轄區內應報告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?擔心內容嗎?直接聯繫我們。或者,發送電子郵件給編輯組(網址爲)simplywallst.com。

Simply Wall St 的這篇文章本質上是籠統的。我們僅使用公正的方法提供基於歷史數據和分析師預測的評論,我們的文章並非旨在提供財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不會考慮最新的價格敏感型公司公告或定性材料。華爾街只是沒有持有上述任何股票的頭寸。

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Upwork shareholders is that EBIT margins have grown from -6.0% to 7.9% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Upwork shareholders is that EBIT margins have grown from -6.0% to 7.9% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.