Check Out What Whales Are Doing With LMT

Check Out What Whales Are Doing With LMT

Financial giants have made a conspicuous bullish move on Lockheed Martin. Our analysis of options history for Lockheed Martin (NYSE:LMT) revealed 8 unusual trades.

金融巨頭在洛克希德馬丁上表現出明顯的看好態勢。我們對洛克希德馬丁(紐交所:LMT)期權歷史的分析顯示出8筆飛凡的交易。

Delving into the details, we found 75% of traders were bullish, while 25% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $209,249, and 3 were calls, valued at $135,800.

深入分析細節,我們發現75%的交易者看好,而25%則表現出看淡的趨勢。在我們觀察到的所有交易中,5筆爲看跌,價值爲209,249美元,而3筆爲看漲,價值爲135,800美元。

What's The Price Target?

目標價是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $250.0 to $580.0 for Lockheed Martin over the last 3 months.

考慮到這些合約的成交量和未平倉合約,鯨魚們在過去三個月內將洛克希德馬丁的目標價格區間定在250.0美元到580.0美元之間。

Volume & Open Interest Trends

成交量和未平倉量趨勢

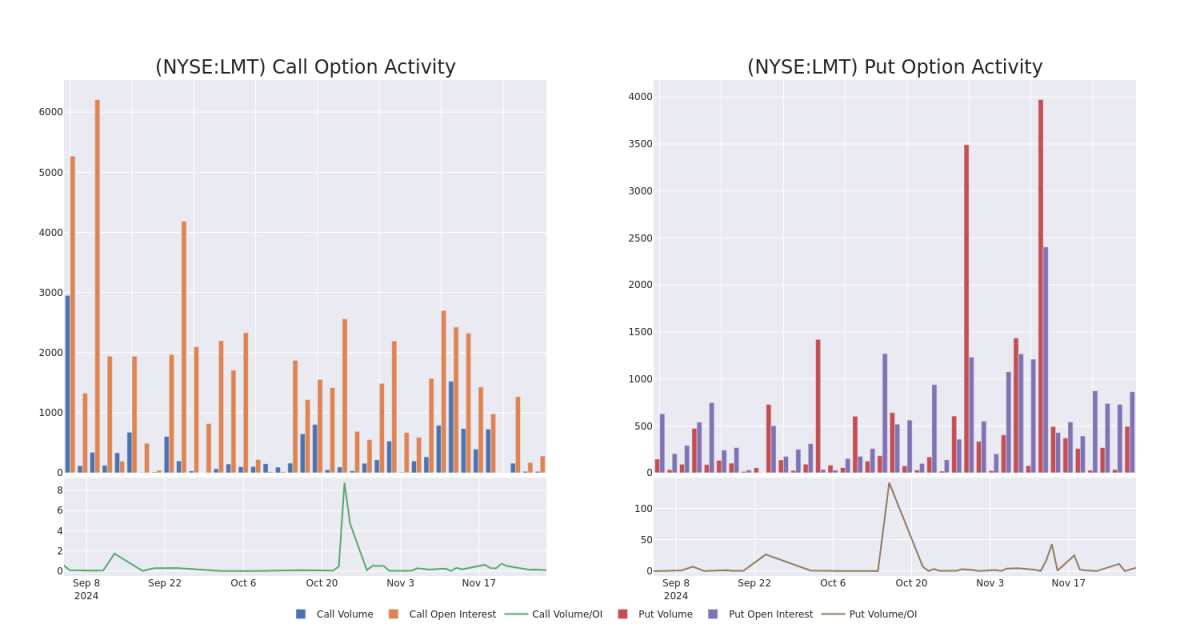

In terms of liquidity and interest, the mean open interest for Lockheed Martin options trades today is 163.29 with a total volume of 514.00.

就流動性和興趣而言,今天洛克希德馬丁期權交易的平均未平倉合約爲163.29,總成交量爲514.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Lockheed Martin's big money trades within a strike price range of $250.0 to $580.0 over the last 30 days.

在下圖中,我們能夠跟蹤洛克希德馬丁在250.0美元到580.0美元的行權價區間內的大手交易的看漲和看跌期權的成交量和未平倉合約的發展情況,時間跨度爲過去30天。

Lockheed Martin Option Volume And Open Interest Over Last 30 Days

過去30天洛克希德馬丁的期權成交量和未平倉合約量

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LMT | CALL | TRADE | BULLISH | 01/17/25 | $281.2 | $274.8 | $279.2 | $250.00 | $83.7K | 3 | 3 |

| LMT | PUT | TRADE | BULLISH | 06/20/25 | $31.0 | $29.4 | $29.9 | $525.00 | $71.7K | 40 | 24 |

| LMT | PUT | TRADE | BULLISH | 06/20/25 | $31.0 | $29.3 | $29.9 | $525.00 | $53.8K | 40 | 42 |

| LMT | PUT | SWEEP | BULLISH | 12/06/24 | $1.2 | $0.65 | $0.85 | $510.00 | $29.4K | 129 | 402 |

| LMT | PUT | TRADE | BEARISH | 12/06/24 | $55.3 | $55.3 | $55.3 | $580.00 | $27.6K | 11 | 5 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LMT | 看漲 | 交易 | BULLISH | 01/17/25 | $281.2 | $274.8 | $279.2 | $250.00 | $83.7K | 3 | 3 |

| LMT | 看跌 | 交易 | BULLISH | 06/20/25 | $31.0 | $29.4 | $29.9 | 525.00美元 | $71.7K | 40 | 24 |

| LMT | 看跌 | 交易 | BULLISH | 06/20/25 | $31.0 | $29.3 | $29.9 | 525.00美元 | $53.8K | 40 | 42 |

| LMT | 看跌 | SWEEP | BULLISH | 12/06/24 | $1.2 | $0.65 | $0.85 | $510.00 | $29.4K | 129 | 402 |

| LMT | 看跌 | 交易 | 看淡 | 12/06/24 | $55.3 | $55.3 | $55.3 | $580.00 | $27.6K | 11 | 5 |

About Lockheed Martin

關於洛克希德馬丁

Lockheed Martin is the world's largest defense contractor and has dominated the Western market for high-end fighter aircraft since it won the F-35 Joint Strike Fighter program in 2001. Lockheed's largest segment is aeronautics, which derives upward of two-thirds of its revenue from the F-35. Lockheed's remaining segments are rotary and mission systems, mainly encompassing the Sikorsky helicopter business; missiles and fire control, which creates missiles and missile defense systems; and space systems, which produces satellites and receives equity income from the United Launch Alliance joint venture.

洛克希德馬丁是世界上最大的國防承包商,自2001年贏得F-35聯合打擊戰鬥機計劃以來一直主導着西方高端戰機市場。洛克希德的主要業務領域是航空航天,該領域的營業收入超過三分之二來自F-35。洛克希德的其他業務領域包括旋轉和任務系統,主要涵蓋西科斯基直升機業務;導彈和防火控制,其創建了導彈和導彈防禦系統;空間系統,其生產衛星並從聯合發射聯盟獲得股權收入。

In light of the recent options history for Lockheed Martin, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考慮到洛克希德馬丁最近的期權歷史,現在適合關注該公司本身。我們旨在探討其當前的表現。

Where Is Lockheed Martin Standing Right Now?

洛克希德馬丁現在處於什麼地位?

- Trading volume stands at 657,680, with LMT's price up by 0.65%, positioned at $529.15.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 53 days.

- 成交量爲657,680,洛克希德馬丁的價格上漲了0.65%,現報529.15美元。

- RSI指標顯示該股票目前處於超買和超賣之間的中立狀態。

- 預計在53天內公佈收益。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的專業期權交易員揭示了他的單線圖技巧,可以顯示何時買入和賣出。複製他的交易,每20天平均盈利27%。點擊這裏獲取更多信息。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Lockheed Martin options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在回報。精明的交易者通過不斷學習,調整策略,監控多個因子,密切關注市場動向來管理這些風險。通過Benzinga Pro實時警報掌握洛克希德馬丁的最新期權交易信息。

In terms of liquidity and interest, the mean open interest for Lockheed Martin options trades today is 163.29 with a total volume of 514.00.

In terms of liquidity and interest, the mean open interest for Lockheed Martin options trades today is 163.29 with a total volume of 514.00.