Top 3 Defensive Stocks You'll Regret Missing In November

Top 3 Defensive Stocks You'll Regret Missing In November

The most oversold stocks in the consumer staples sector presents an opportunity to buy into undervalued companies.

必需消費品行業中超賣次數最多的股票爲買入被低估的公司提供了機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI是一個動量指標,它比較股票在價格上漲的日子裏的走強與價格下跌的日子的走強。與股票的價格走勢相比,它可以讓交易者更好地了解股票在短期內的表現。根據Benzinga Pro的數據,當相對強弱指數低於30時,資產通常被視爲超賣。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是該行業主要超賣參與者的最新名單,RSI接近或低於30。

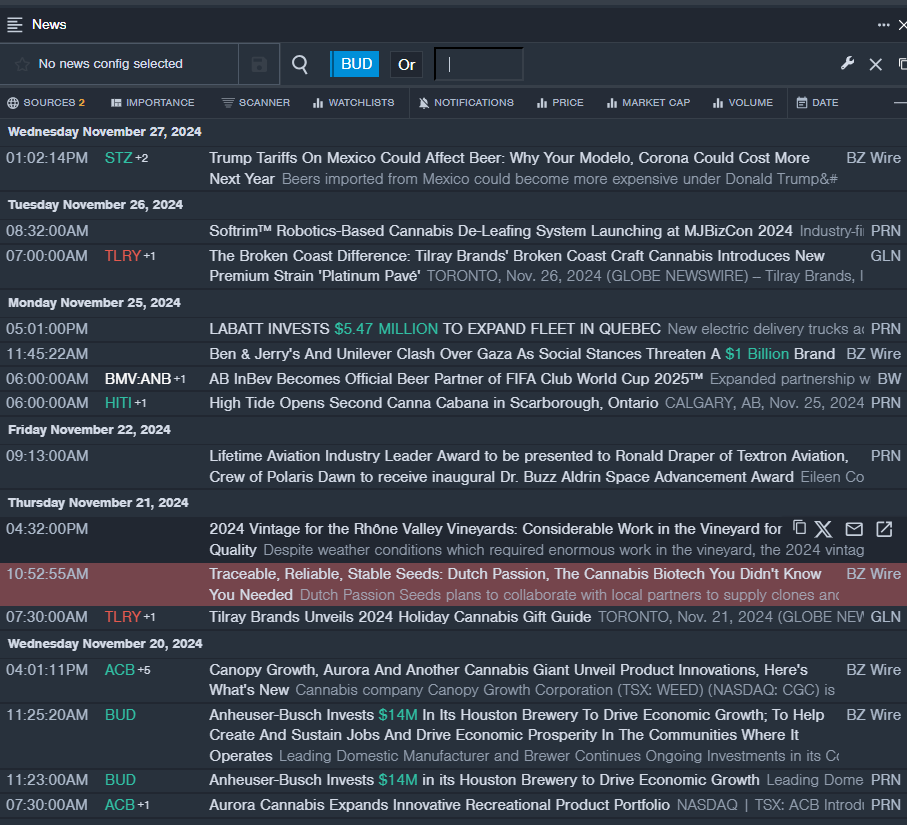

Anheuser-Busch Inbev SA (NYSE:BUD)

安海斯-布希英博股份有限公司(紐約證券交易所代碼:BUD)

- On Oct. 31, the company reported third-quarter adjusted earnings per share of 98 cents, beating the street view of 89 cents. Quarterly sales of $15.046 billion missed the analyst consensus estimate of $15.644 billion. "Consumer demand for our megabrands and the execution of our mega platforms delivered another quarter of top- and bottom-line growth with margin expansion," said Michel Doukeris, CEO. "Our teams and partners continue to execute our strategy and we are confident in our ability to deliver on our raised FY24 EBITDA growth outlook of 6-8%." The company's stock fell around 16% over the past month and has a 52-week low of $53.67.

- RSI Value: 23.33

- BUD Price Action: Shares of Anheuser-Busch Inbev gained 0.3% to close at $54.08 on Wednesday.

- Benzinga Pro's real-time newsfeed alerted to latest BUD news.

- 10月31日,該公司公佈的第三季度調整後每股收益爲98美分,超過了街景的89美分。季度銷售額爲150.46億美元,未達到分析師共識估計的156.44億美元。首席執行官米歇爾·杜克里斯表示:「隨着利潤的擴大,消費者對我們大品牌的需求以及我們超級平台的執行又實現了四分之一的收入和利潤增長。」「我們的團隊和合作夥伴繼續執行我們的戰略,我們有能力實現上調的24財年息稅折舊攤銷前利潤增長前景爲6-8%。」該公司的股票在過去一個月中下跌了約16%,跌至52周低點53.67美元。

- RSI 值:23.33

- BUD價格走勢:週三,安海斯-布希英博的股價上漲0.3%,收於54.08美元。

- Benzinga Pro 的實時新聞提醒注意最新的 BUD 新聞。

United-Guardian, Inc. (NASDAQ:UG)

聯合衛報公司(納斯達克股票代碼:UG)

- On Nov. 8, the company posted third-quarter earnings of 19 cents per share, up from 14 cents per share in the year-ago period. Donna Vigilante, President of United-Guardian, stated, "We are pleased to announce that sales and earnings increased in the third quarter and for the first nine months of 2024 compared with the same periods in 2023. We continue to have strong sales of our cosmetic ingredients, which increased by 8% in the third quarter and 68% in the first nine months of 2024." The company's stock fell around 30% over the past month and has a 52-week low of $6.80.

- RSI Value: 28.86

- UG Price Action: Shares of United-Guardian fell 0.5% to close at $9.55 on Wednesday.

- Benzinga Pro's charting tool helped identify the trend in UG stock.

- 11月8日,該公司公佈的第三季度每股收益爲19美分,高於去年同期的每股14美分。聯合衛報總裁唐娜·維吉蘭特表示:「我們很高興地宣佈,與2023年同期相比,第三季度和2024年前九個月的銷售額和收益都有所增加。我們的化妝品原料銷售繼續保持強勁勢頭,第三季度增長了8%,2024年前九個月增長了68%。」該公司的股票在過去一個月中下跌了約30%,跌至52周低點6.80美元。

- RSI 值:28.86

- UG價格走勢:聯合衛報股價週三下跌0.5%,收於9.55美元。

- Benzinga Pro的圖表工具幫助確定了UG股票的走勢。

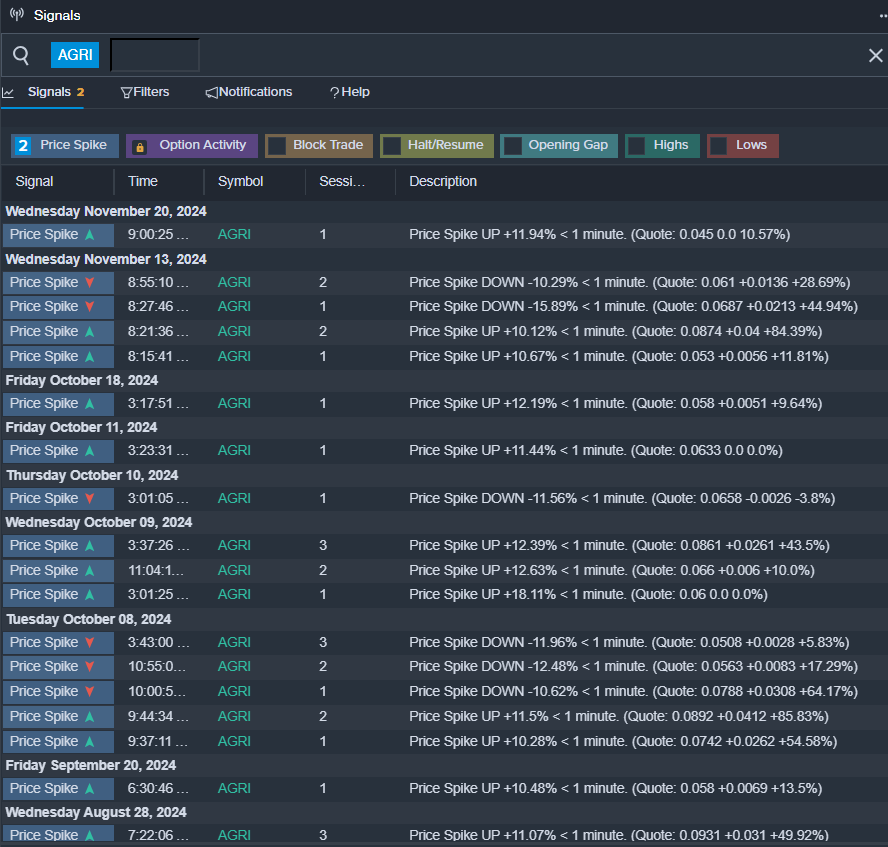

AgriFORCE Growing Systems Ltd (NASDAQ:AGRI)

農業生長系統有限公司(納斯達克股票代碼:AGRI)

- On Nov. 20, AgriFORCE announced evolution of business model to follow bitcoin mining facility acquisition. The company's stock fell around 41% over the past month and has a 52-week low of $0.035.

- RSI Value: 29.48

- AGRI Price Action: Shares of AGRI fell 3.5% to close at $0.036 on Wednesday.

- Benzinga Pro's signals feature notified of a potential breakout in AGRI shares.

- 11月20日,AgriForce宣佈了繼收購比特幣採礦設施之後商業模式的演變。該公司的股票在過去一個月中下跌了約41%,跌至52周低點0.035美元。

- RSI 值:29.48

- 農業價格走勢:週三,AGRI股價下跌3.5%,收於0.036美元。

- Benzinga Pro的信號顯示AGRI股票可能出現突破。

Read This Next:

接下來閱讀這篇文章:

- Jim Cramer: Reddit Is 'Fabulous,' Dow Is A 'Tough' One

- 吉姆·克萊默:Reddit 「太棒了」,道瓊斯指數是 「艱難」 的