The Future Fund LLC Managing Partner Gary Black argues that Tesla Inc. (NASDAQ:TSLA) needs new vehicle form factors, rather than stripped-down versions of existing models, to achieve its targeted 20-30% volume growth in fiscal year 2025.

What Happened: Black's analysis comes amid ongoing discussions about Tesla's strategy for maintaining growth in an increasingly competitive electric vehicle market.

Black emphasized on X, formerly Twitter, that Tesla's 2022-2023 price reduction strategy demonstrated that simply offering cheaper versions of the Model 3 and Model Y won't generate sufficient growth.

Instead, he suggests Tesla needs to expand into new market segments, specifically pointing to potential offerings like a four-seat Cybercab or a Model 3 hatchback that could tap into the compact segment, which represents 12-15% of global market share.

Instead, he suggests Tesla needs to expand into new market segments, specifically pointing to potential offerings like a four-seat Cybercab or a Model 3 hatchback that could tap into the compact segment, which represents 12-15% of global market share.

The investor's comments follow Tesla's recent third-quarter earnings report, where the company posted revenue of $25.18 billion, up 8% year-over-year, though missing analyst expectations.

Tesla maintains its commitment to launching more affordable vehicles in the first half of 2025, with CEO Elon Musk linking this initiative to the company's projected 20-30% annual volume growth.

Why It Matters: Black challenges the notion that these goals can be met through stripped-down versions of existing models, noting that Tesla needs an interim solution before the full deployment of autonomous Cybercab technology, expected in 2026.

His analysis suggests that Tesla's strategy must extend beyond price adjustments to include new vehicle categories that can capture additional market segments.

This discussion occurs against a backdrop of increasing competition in the electric vehicle market, with Tesla facing pressure from both U.S. automakers and Chinese manufacturers.

The company's third-quarter operating margin of 10.8% and record-low cost of goods sold per vehicle at $35,100 demonstrate its ongoing efforts to balance profitability with market expansion.

Price Action: Tesla stock closed at $345.16 on Friday, up 3.69% for the day, according to data from Benzinga Pro. In after-hours trading, the stock edged higher by 0.081%. Year to date, Tesla shares have surged 38.94%.

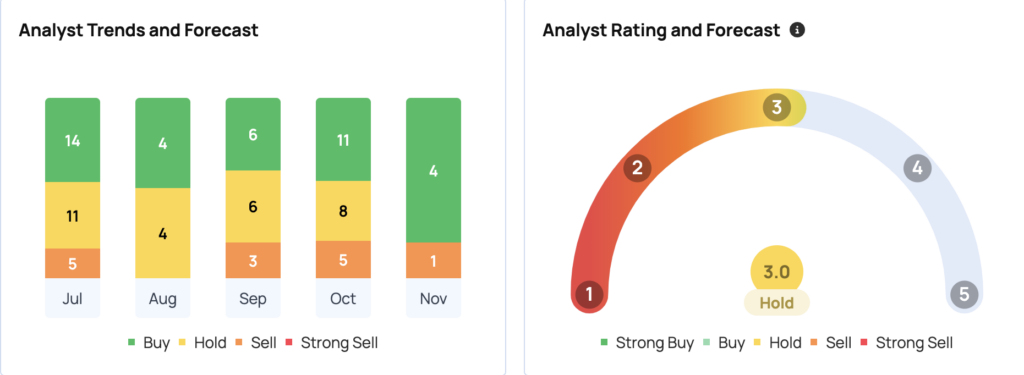

According to Benzinga Pro data, Tesla has a consensus price target of $232.20, with a high of $400 and a low of $24.86. Recent analyst ratings imply a 9.39% downside, with an average target of $313.

- Mohamed El-Erian Says November Was 'Strongest Month' Of The Year For Bitcoin As Top Crypto's YTD Gains Dominate Gold

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Future Fund LLC的管理合夥人Gary Black認爲,特斯拉公司(納斯達克:TSLA)需要新的車輛形態,而不是現有車型的簡化版本,以實現其在2025財年目標的20-30%的銷量增長。

發生了什麼:Black的分析正值關於特斯拉在日益競爭激烈的電動汽車市場保持增長的策略的持續討論中。

Black在X(前身爲Twitter)上強調,特斯拉2022-2023年的降價策略證明,僅僅提供Model 3和Model Y的更便宜版本無法產生足夠的增長。

相反,他建議特斯拉需要擴展到新的市場細分,特別指出潛在的產品,比如四座的Cybercab或Model 3掀背車,這可以進入佔全球市場份額12-15%的緊湊型細分市場。

相反,他建議特斯拉需要擴展到新的市場細分,特別指出潛在的產品,比如四座的Cybercab或Model 3掀背車,這可以進入佔全球市場份額12-15%的緊湊型細分市場。

投資者的評論繼特斯拉最近的第三季度業績之後,數據顯示該公司的營業收入爲251.8億美元,同比增長8%,雖未達到分析師預期。

特斯拉堅持計劃在2025年上半年推出更多可負擔的車輛,首席執行官埃隆·馬斯克將這一計劃與公司預計的20-30%的年度銷量增長聯繫在一起。

爲什麼這很重要:Black挑戰了這一目標可以通過簡化現有車型來實現的觀點,指出特斯拉需要一個過渡解決方案,在預計在2026年全面推出的自動駕駛Cybercab技術之前。

他的分析表明,特斯拉的策略必須超越價格調整,包含能捕獲額外市場細分的新車型。

這場討論是在電動車市場競爭加劇的背景下進行的,特斯拉麪臨着美國汽車製造商和中國製造商的壓力。

該公司的第三季度營業利潤率爲10.8%,每輛車的營業成本創下3.51萬美元的歷史低點,展示了其在盈利能力與市場擴展之間平衡的持續努力。

價格走勢:根據Benzinga Pro的數據,特斯拉股票在週五收盤時爲$345.16,當日上漲3.69%。在盤後交易中,股票小幅上漲0.081%。截至目前,特斯拉的股票上漲了38.94%。

根據Benzinga Pro數據,特斯拉的共識目標價格爲$232.20,最高價爲$400,最低價爲$24.86。最近的分析師評級暗示下行空間爲9.39%,平均目標價爲$313。

- 穆罕默德·埃爾-埃裏安表示,11月是今年比特幣的「最強月份」,而這一頂級加密貨幣的年初至今收益遠超黃金。

圖片來自Shutterstock。

免責聲明:本內容部分使用人工智能工具生成,並經Benzinga編輯審核發佈。

相反,他建議特斯拉需要擴展到新的市場細分,特別指出潛在的產品,比如四座的Cybercab或Model 3掀背車,這可以進入佔全球市場份額12-15%的緊湊型細分市場。

相反,他建議特斯拉需要擴展到新的市場細分,特別指出潛在的產品,比如四座的Cybercab或Model 3掀背車,這可以進入佔全球市場份額12-15%的緊湊型細分市場。

Instead, he suggests Tesla needs to expand into new market segments, specifically pointing to potential offerings like a four-seat Cybercab or a Model 3 hatchback that could tap into the compact segment, which represents 12-15% of global market share.

Instead, he suggests Tesla needs to expand into new market segments, specifically pointing to potential offerings like a four-seat Cybercab or a Model 3 hatchback that could tap into the compact segment, which represents 12-15% of global market share.