The Total Return for Transcat (NASDAQ:TRNS) Investors Has Risen Faster Than Earnings Growth Over the Last Five Years

The Total Return for Transcat (NASDAQ:TRNS) Investors Has Risen Faster Than Earnings Growth Over the Last Five Years

It hasn't been the best quarter for Transcat, Inc. (NASDAQ:TRNS) shareholders, since the share price has fallen 15% in that time. But in stark contrast, the returns over the last half decade have impressed. Indeed, the share price is up an impressive 216% in that time. We think it's more important to dwell on the long term returns than the short term returns. Only time will tell if there is still too much optimism currently reflected in the share price.

對Transcat, Inc. (納斯達克:TRNS)的股東來說,這並不是一個最佳季度,因爲在此期間股價下降了15%。但與此形成鮮明對比的是,過去五年的回報讓人印象深刻。事實上,股價在此期間上漲了216%。我們認爲關注長期回報比短期回報更爲重要。只有時間會告訴我們目前股價中是否仍然反映出過多的樂觀情緒。

Although Transcat has shed US$67m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

儘管Transcat本週市值減少了6700萬美金,但讓我們來看看其長期的基本趨勢,看看這些趨勢是否推動了回報。

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

雖然有效市場假說仍然被一些人教授,但被證明市場是過度反應的動態系統,投資者並不總是理性的。檢查市場情緒如何隨時間變化的一種方法是看一個公司的股價與其每股收益(EPS)之間的交互作用。

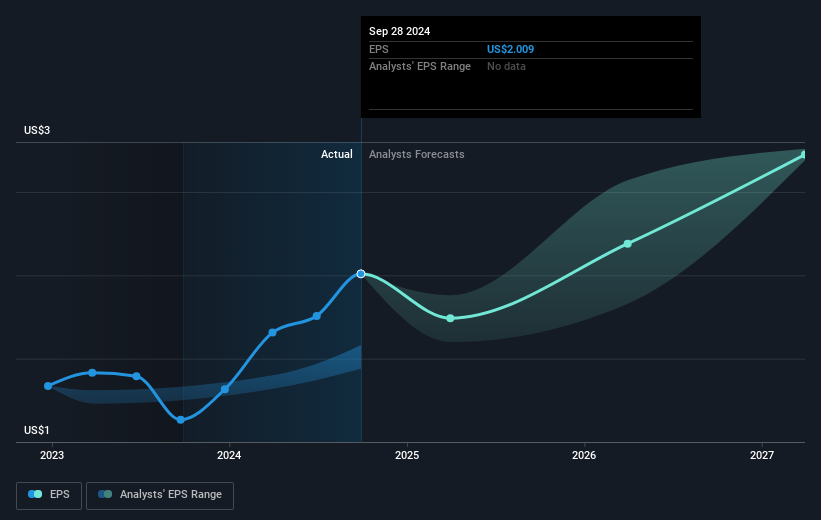

Over half a decade, Transcat managed to grow its earnings per share at 11% a year. This EPS growth is lower than the 26% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 53.81.

在過去的五年中,Transcat成功地將每股收益增長了11%。這一每股收益增長低於股價平均每年增加的26%。這表明市場參與者現在對公司的評價更高。考慮到五年盈利增長的記錄,這並不令人驚訝。這種有利的情緒體現在其(相當樂觀的)市盈率53.81中。

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

您可以看到EPS隨時間的變化如下(通過單擊圖像了解確切數值)。

We know that Transcat has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

我們知道transcat最近改善了其底線,但它的營業收入會增長嗎?如果您感興趣,可以查看這份顯示共識營業收入預測的免費報告。

A Different Perspective

另一種看法

Transcat shareholders are up 7.7% for the year. But that was short of the market average. If we look back over five years, the returns are even better, coming in at 26% per year for five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Transcat has 1 warning sign we think you should be aware of.

transcat的股東今年上漲了7.7%。但這低於市場平均水平。如果我們回顧過去五年,年均回報甚至更好,達到26%。考慮到市場對該業務持續的積極反應,可能值得關注這個業務。雖然市場條件對股票價格的影響值得重視,但還有其他更重要的因素。例如,風險 - transcat有1個我們認爲您應該注意的警告信號。

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

當然,您可能通過在其他地方尋找會找到一筆極好的投資。因此,請查看我們預計會增長收入的公司免費名單。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

請注意,本文所引述的市場回報反映了目前在美國交易所上市的股票的市場加權平均回報。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

Over half a decade, Transcat managed to grow its earnings per share at 11% a year. This EPS growth is lower than the 26% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 53.81.

Over half a decade, Transcat managed to grow its earnings per share at 11% a year. This EPS growth is lower than the 26% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 53.81.