Wall Street's Most Accurate Analysts Give Their Take On 3 Financial Stocks Delivering High-Dividend Yields

Wall Street's Most Accurate Analysts Give Their Take On 3 Financial Stocks Delivering High-Dividend Yields

華爾街最準確的分析師對3只高股息收益的金融股票發表看法。

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

在市場動盪和不確定的時期,許多投資者會轉向股息收益股,這些通常是具有較高的自由現金流並以高紅利派息獎勵股東的公司。

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Benzinga的讀者可以通過訪問分析師股票評級頁面,查看他們最喜歡的股票的最新分析師觀點。交易員可以瀏覽Benzinga龐大的分析師評級數據庫,包括按照分析師準確度排序。

Below are the ratings of the most accurate analysts for three high-yielding stocks in the financials sector.

以下是在金融板塊中三隻高股息股票中最準確的分析師評級。

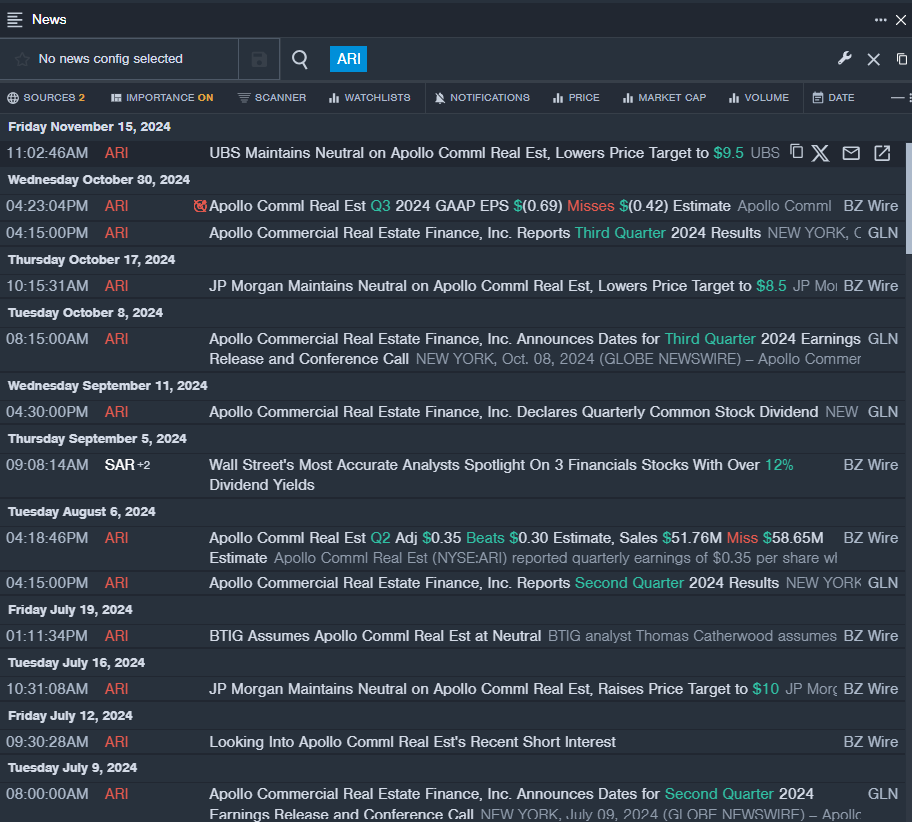

Apollo Commercial Real Estate Finance, Inc. (NYSE:ARI)

Apollo Commercial Real Estate Finance, Inc.(紐交所:ARI)

- Dividend Yield: 10.81%

- UBS analyst Douglas Harter maintained a Neutral rating and cut the price target from $10 to $9.5 on Nov. 15. This analyst has an accuracy rate of 66%.

- JP Morgan analyst Richard Shane maintained a Neutral rating and decreased the price target from $9.5 to $8.5 on Oct. 17. This analyst has an accuracy rate of 69%.

- Recent News: On Oct. 30, the company reported a quarterly loss of 69 cents per share which missed the analyst consensus estimate of a loss of 42 cents per share.

- Benzinga Pro's real-time newsfeed alerted to latest ARI news

- 股息率:10.81%

- 瑞銀分析師道格拉斯·哈特維持中立評級,並將價格目標從10美元下調至9.5美元,日期爲11月15日。該分析師的準確率爲66%。

- 摩根大通分析師理查德·謝恩維持中立評級,並將價格目標從9.5萬億.美元下調至8.5美元,日期爲10月17日。該分析師的準確率爲69%。

- 最新資訊:該公司於10月30日報告每股虧損69美分,低於分析師一致預期的每股虧損42美分。

- Benzinga Pro的實時新聞提醒了最新的ARI資訊

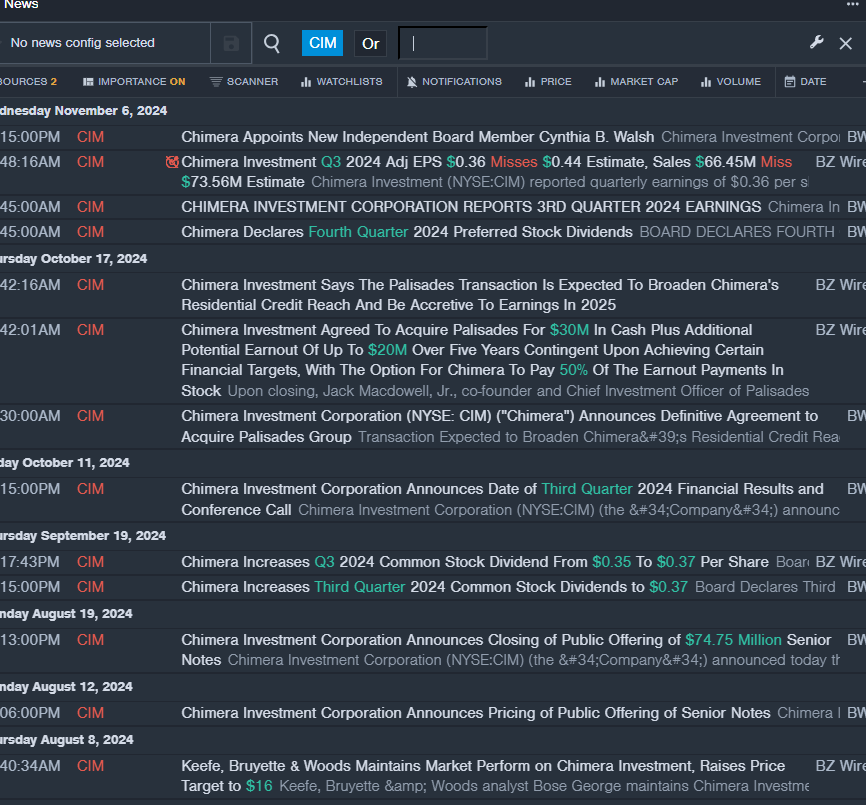

Chimera Investment Corporation (NYSE:CIM)

chimera investment corporation(紐交所:CIM)

- Dividend Yield: 9.97%

- Keefe, Bruyette & Woods analyst Bose George maintained a Market Perform rating and raised the price target from $15 to $16 on Aug. 8. This analyst has an accuracy rate of 70%.

- UBS analyst Douglas Harter initiated coverage on the stock with a Neutral rating and a price target of $16.5 on Dec. 6, 2023. This analyst has an accuracy rate of 66%.

- Recent News: On Nov. 6, the company posted downbeat quarterly earnings.

- Benzinga Pro's real-time newsfeed alerted to latest CIM news

- 股息率:9.97%

- Keefe,Bruyette&Woods分析師Bose George維持市場表現評級,並於8月8日將價格目標從15美元上調至16美元。該分析師的準確率爲70%。

- 瑞士銀行分析師Douglas Harter於2023年12月6日開始對該股票進行中立評級,並設定16.5美元的價格目標。該分析師的準確率爲66%。

- 最近資訊:公司在11月6日發佈了令人失望的季度收益。

- Benzinga Pro的實時新聞提醒了最新的CIm資訊

Starwood Property Trust, Inc. (NYSE:STWD)

Starwood Property Trust,Inc. (NYSE: STWD)

- Dividend Yield: 9.43%

- UBS analyst Douglas Harter maintained a Neutral rating and increased the price target from $19.5 to $20 on Nov. 15. This analyst has an accuracy rate of 66%.

- JMP Securities analyst Steven Delaney maintained a Market Outperform rating and lowered the price target from $24 to $23 on Nov. 7. This analyst has an accuracy rate of 69%.

- Recent News: On Nov. 6, the company posted better-than-expected quarterly earnings.

- Benzinga Pro's charting tool helped identify the trend in STWD stock.

- 股息率:9.43%

- 瑞士銀行分析師道格拉斯·哈特(Douglas Harter)維持中立評級,並在11月15日將目標價格從19.5美元上調至20美元。該分析師的準確率爲66%。

- JMP證券分析師史蒂文·德萊尼(Steven Delaney)維持市場跑贏評級,並在11月7日將目標價格從24美元下調至23美元。該分析師的準確率爲69%。

- 最新資訊:公司於11月6日發佈了好於預期的季度收益。

- Benzinga Pro的圖表工具有助於識別STWD股票的趨勢。

Read More:

閱讀更多:

- Salesforce Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

- 賽富時爲第三季度業績做準備;以下是華爾街最精準分析師近期的預測變化