With EPS Growth And More, Life Time Group Holdings (NYSE:LTH) Makes An Interesting Case

With EPS Growth And More, Life Time Group Holdings (NYSE:LTH) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

投資者通常被發現"下一個大事件"的想法所指導,即使這意味着購買"故事股"而沒有任何營業收入,更不用說利潤了。 但正如彼得·林奇在《華爾街的勝利法則》中所說,「長期押注幾乎從不會得到回報。」 虧損公司始終在爭分奪秒地實現財務可持續性,因此投資這些公司的投資者可能承擔了比他們應該承擔的更多風險。

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Life Time Group Holdings (NYSE:LTH). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Life Time Group Holdings with the means to add long-term value to shareholders.

如果這類公司不符合你的風格,你喜歡能夠產生營業收入,甚至賺取利潤的公司,那麼你可能會對生命時光集團控股(紐交所:LTH)感興趣。即使這家公司在市場上被認爲是公允估值,投資者們也會同意,持續產生利潤將繼續爲生命時光集團控股提供增加長期價值的手段。

Life Time Group Holdings' Improving Profits

生命時光集團控股的利潤改善

Over the last three years, Life Time Group Holdings has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, Life Time Group Holdings' EPS catapulted from US$0.34 to US$0.69, over the last year. Year on year growth of 104% is certainly a sight to behold.

在過去三年中,生命時光集團控股的每股收益(每股收益)以相對較低的點子增長,以驚人的速度增長,導致三年的百分比增長率並不能特別指示未來的預期表現。因此,爲我們的分析隔離過去一年的增長率會更好。令人印象深刻的是,生命時光集團控股的每股收益在過去一年中從0.34美元飆升至0.69美元。年增長104%確實是一個值得矚目的景象。

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Our analysis has highlighted that Life Time Group Holdings' revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. Life Time Group Holdings shareholders can take confidence from the fact that EBIT margins are up from 11% to 13%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

通常,查看息稅前利潤(EBIT)利潤率以及營業收入的增長,有助於從另一個角度了解公司的增長質量。我們的分析突出顯示,生命時光集團控股在過去12個月的運營收入並未涵蓋其所有的收入,因此我們對其利潤率的分析可能無法準確反映潛在的業務。生命時光集團控股的股東可以放心,息稅前利潤率已從11%上升至13%,並且營業收入在增長。在我們看來,這兩個指標符合是增長的良好跡象。

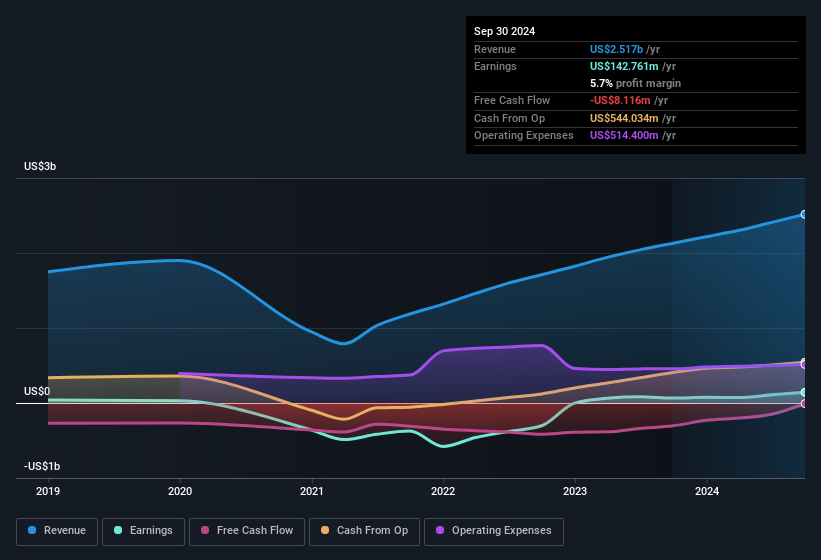

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

下圖顯示了該公司底線和頂線隨着時間的推移而發展的情況。點擊圖片以獲取更精細的詳細信息。

Fortunately, we've got access to analyst forecasts of Life Time Group Holdings' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

幸運的是,我們可以訪問對Life Time Group Holdings未來盈利的分析師預測。你可以自己做預測,也可以看看專業人士的預測。

Are Life Time Group Holdings Insiders Aligned With All Shareholders?

Life Time Group Holdings的內部人是否與所有股東保持一致?

Owing to the size of Life Time Group Holdings, we wouldn't expect insiders to hold a significant proportion of the company. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. We note that their impressive stake in the company is worth US$349m. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

由於Life Time Group Holdings的規模,我們並不期待內部人持有公司重要比例的股份。但由於他們對公司的投資,很高興看到他們仍然有動機將自己的行爲與股東對齊。我們注意到他們在公司中令人印象深刻的股份價值達34900萬美元。持有者應該會對這種內部承諾感到相當鼓舞,因爲這將確保公司領導者在股票上的成功或失敗也是他們所經歷的。

Does Life Time Group Holdings Deserve A Spot On Your Watchlist?

Life Time Group Holdings是否值得在你的自選中佔有一席之地?

Life Time Group Holdings' earnings have taken off in quite an impressive fashion. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So based on this quick analysis, we do think it's worth considering Life Time Group Holdings for a spot on your watchlist. You should always think about risks though. Case in point, we've spotted 2 warning signs for Life Time Group Holdings you should be aware of, and 1 of them makes us a bit uncomfortable.

Life Time Group Holdings的每股收益增長非常顯著。這個每股收益增長無疑引人注目,大量的內部持股更是激發了我們的興趣。在某些情況下,快速的每股收益增長是業務已達到拐點的標誌,因此這可能是一個潛在的機會。因此,基於這一快速分析,我們確實認爲值得考慮將Life Time Group Holdings列入您的自選中。 當然,您也應始終考慮風險。例如,我們發現了Life Time Group Holdings的2個警示信號,您需要知曉,其中1個讓我們有些不安。

Although Life Time Group Holdings certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of companies that not only boast of strong growth but have strong insider backing.

雖然Life Time Group Holdings看起來非常不錯,但如果內部人士正在購買股票,可能會吸引更多投資者。如果您喜歡看到業績更強的公司,那麼請查看這份精選名單,這些公司不僅擁有強勁的增長,還得到內部人士的強力支持。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

請注意,本文討論的內部交易是指在相關司法管轄區中報告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Our analysis has highlighted that Life Time Group Holdings' revenue

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Our analysis has highlighted that Life Time Group Holdings' revenue