Merck & Co Unusual Options Activity For December 02

Merck & Co Unusual Options Activity For December 02

Deep-pocketed investors have adopted a bearish approach towards Merck & Co (NYSE:MRK), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MRK usually suggests something big is about to happen.

富有的投資者對美國默沙東(紐交所: MRK)採取了看淡的態度,這是市場參與者不應忽視的。我們在Benzinga追蹤公開期權記錄發現了這一重大舉動。這些投資者的身份仍然是未知的,但在MRK上這樣的重大舉動通常意味着即將發生重大事情。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 12 extraordinary options activities for Merck & Co. This level of activity is out of the ordinary.

我們今天通過觀察獲得了這些信息,當時Benzinga的期權掃描儀突顯了默沙東的12個飛凡期權異動。這種交易活動水平相當不尋常。

The general mood among these heavyweight investors is divided, with 41% leaning bullish and 58% bearish. Among these notable options, 4 are puts, totaling $162,182, and 8 are calls, amounting to $427,918.

這些重量級投資者的總體情緒存在分歧,41%的人看好,58%的人看淡。在這些顯著的期權中,有4個看跌期權,總計162,182美元,8個看漲期權,總計427,918美元。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $90.0 to $105.0 for Merck & Co over the recent three months.

根據交易活動,顯著投資者似乎將目標定在默沙東的價格區間爲90.0美元到105.0美元,時間跨度爲最近三個月。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

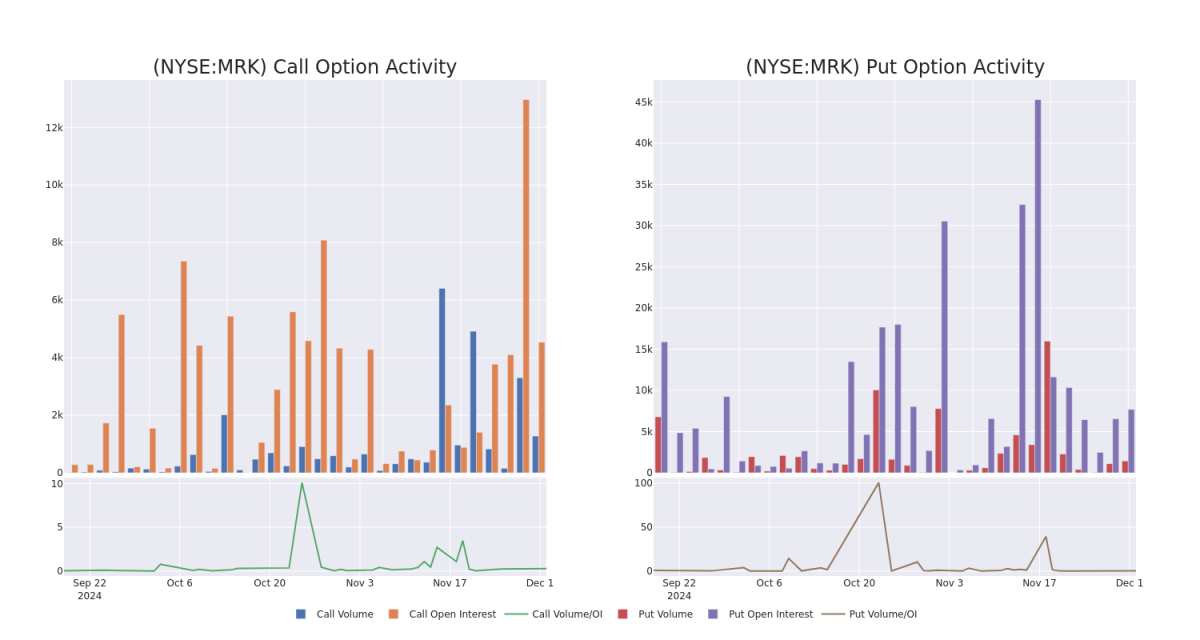

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Merck & Co's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Merck & Co's substantial trades, within a strike price spectrum from $90.0 to $105.0 over the preceding 30 days.

評估成交量和未平倉合約是進行期權交易的戰略步驟。這些指標揭示了在指定行權價下,投資者對默沙東期權的流動性和興趣。接下來的數據將展示在過去30天內,默沙東的大手交易所對應的看漲和看跌期權的成交量和未平倉合約波動。

Merck & Co Call and Put Volume: 30-Day Overview

默沙東的看漲和看跌成交量:30天概述

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRK | CALL | SWEEP | BEARISH | 01/15/27 | $21.1 | $20.4 | $20.4 | $90.00 | $81.6K | 62 | 22 |

| MRK | CALL | TRADE | BEARISH | 12/06/24 | $7.85 | $7.7 | $7.75 | $93.00 | $67.4K | 4 | 270 |

| MRK | PUT | SWEEP | BEARISH | 01/17/25 | $2.9 | $2.89 | $2.89 | $100.00 | $60.1K | 5.4K | 647 |

| MRK | CALL | TRADE | BULLISH | 12/06/24 | $7.8 | $7.45 | $7.79 | $93.00 | $59.9K | 4 | 183 |

| MRK | CALL | SWEEP | BULLISH | 12/18/26 | $15.05 | $14.35 | $15.1 | $100.00 | $52.8K | 502 | 0 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRK | 看漲 | SWEEP | 看淡 | 01/15/27 | $21.1 | $20.4 | $20.4 | $90.00 | $81.6K | 62 | 22 |

| MRK | 看漲 | 交易 | 看淡 | 12/06/24 | $7.85 | $7.7 | $7.75 | $93.00 | $67.4K | 4 | 270 |

| MRK | 看跌 | SWEEP | 看淡 | 01/17/25 | $2.9 | $2.89 | $2.89 | $100.00 | $60.1K | 5,400 | 647 |

| MRK | 看漲 | 交易 | BULLISH | 12/06/24 | $7.8 | $7.45 | $7.79 | $93.00 | $59.9千美元 | 4 | 183 |

| MRK | 看漲 | SWEEP | BULLISH | 12/18/26 | $15.05 | 14.35美元 | $15.1 | $100.00 | $52.8K | 502 | 0 |

About Merck & Co

關於默沙東

Merck makes pharmaceutical products to treat several conditions in a number of therapeutic areas, including cardiometabolic disease, cancer, and infections. Within cancer, the firm's immuno-oncology platform is growing as a major contributor to overall sales. The company also has a substantial vaccine business, with treatments to prevent pediatric diseases as well as human papillomavirus, or HPV. Additionally, Merck sells animal health-related drugs. From a geographical perspective, just under half of the company's sales are generated in the United States.

默沙東生產多種藥品,治療多種領域的疾病,包括心代謝症、癌症和感染。在癌症領域,該公司的免疫腫瘤學平台正在成爲總銷售額的主要貢獻者。該公司還具有實質性的疫苗業務,包括預防兒童疾病以及人類乳頭瘤病毒(HPV)治療。此外,默沙東出售與動物健康相關的藥品。從地理角度來看,公司銷售額的近一半來自於美國境內。

Having examined the options trading patterns of Merck & Co, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

經過對默沙東的期權交易模式的分析,我們現在直接關注這家公司。這一轉變使我們能夠深入了解其當前的市場地位和表現

Current Position of Merck & Co

默沙東目前的位置

- Currently trading with a volume of 5,098,978, the MRK's price is down by -1.06%, now at $100.56.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 64 days.

- 目前成交量爲5,098,978,MRK的價格下降了-1.06%,現報$100.56。

- RSI讀數表明該股票目前處於中立狀態,處於超買和超賣之間。

- 預計即將發佈的業績還有64天。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期權異動模塊可以提前發現潛在的市場熱點。了解大筆的資金在您喜歡的股票上的倉位變動。點擊這裏獲取訪問權限。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Merck & Co options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在回報。機智的交易者通過不斷學習、調整他們的策略、監測多個因子和密切關注市場動向來控制這些風險。通過Benzinga Pro實時提醒了解最新的默沙東期權交易。

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $90.0 to $105.0 for Merck & Co over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $90.0 to $105.0 for Merck & Co over the recent three months.