Top 3 Financial Stocks That Could Lead To Your Biggest Gains In Q4

Top 3 Financial Stocks That Could Lead To Your Biggest Gains In Q4

The most oversold stocks in the financial sector presents an opportunity to buy into undervalued companies.

金融業中超賣最多的股票爲買入被低估的公司提供了機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI是一個動量指標,它比較股票在價格上漲的日子裏的走強與價格下跌的日子的走強。與股票的價格走勢相比,它可以讓交易者更好地了解股票在短期內的表現。根據Benzinga Pro的數據,當相對強弱指數低於30時,資產通常被視爲超賣。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是該行業主要超賣參與者的最新名單,RSI接近或低於30。

Inter & Co Inc (NASDAQ:INTR)

Inter & Co Inc(納斯達克股票代碼:INTR)

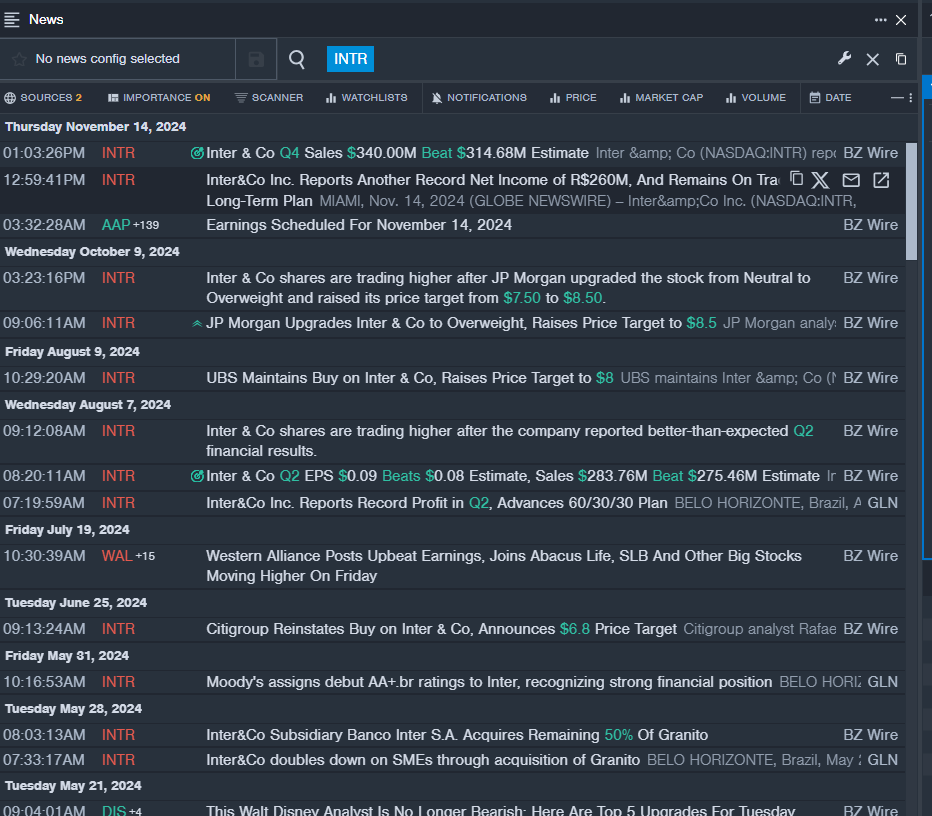

- On Nov. 14, Inter & Co posted better-than-expected quarterly sales. "We had a solid third quarter, reporting increased profitability and growth in both fee and interest income. Our focus on executing the 60/30/30 plan by increasing market share and product penetration, while we maintain efficiency gains is paying off." The company's stock fell around 29% over the past month and has a 52-week low of $4.32.

- RSI Value: 19.97

- INTR Price Action: Shares of Inter fell 1.3% to close at $4.56 on Monday.

- Benzinga Pro's real-time newsfeed alerted to latest INTR news.

- 11月14日,Inter&Co公佈的季度銷售額好於預期。「我們的第三季度表現穩健,盈利能力有所提高,費用和利息收入均有所增長。我們專注於通過增加市場份額和產品滲透率來執行60/30/30計劃,同時保持效率的提高,這正在獲得回報。」該公司的股票在過去一個月中下跌了約29%,爲52周低點4.32美元。

- RSI 值:19.97

- INTR價格走勢:週一,國際米蘭股價下跌1.3%,收於4.56美元。

- Benzinga Pro的實時新聞提醒了最新的INTR新聞。

Nu Holdings Ltd (NYSE:NU)

Nu 控股有限公司(紐約證券交易所代碼:NU)

- On Dec. 2, Citigroup downgraded its rating from Neutral to Sell on the stock and lowered its price target from $14.6 to $11. The company's stock fell around 14% over the past five days and has a 52-week low of $8.06.

- RSI Value: 26.71

- NU Price Action: Shares of Nu Holdings fell 4.2% to close at $12.00 on Monday.

- Benzinga Pro's charting tool helped identify the trend in NU stock.

- 12月2日,花旗集團將該股的評級從中性下調至賣出,並將目標股價從14.6美元下調至11美元。該公司的股票在過去五天中下跌了約14%,跌至52周低點8.06美元。

- RSI 值:26.71

- NU價格走勢:Nu Holdings的股價週一下跌4.2%,收於12.00美元。

- Benzinga Pro的圖表工具幫助確定了NU股票的走勢。

AppTech Payments Corp (NASDAQ:APCX)

AppTech 支付公司(納斯達克股票代碼:APCX)

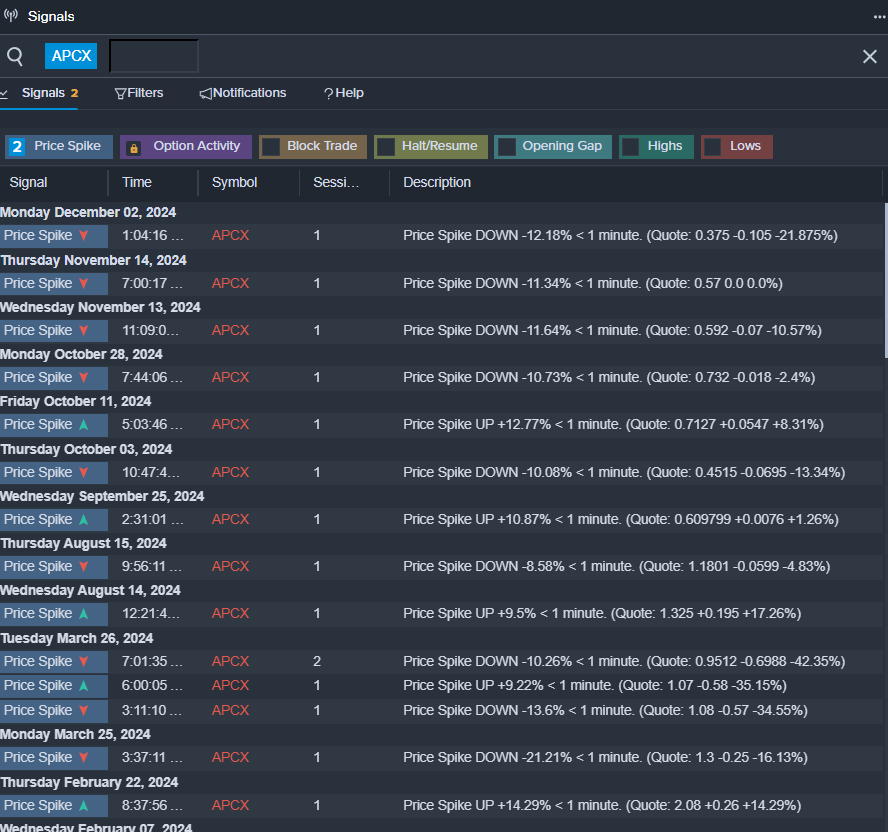

- On Nov. 15, AppTech Payments reported a quarterly loss of 8 cents per share, which missed the analyst consensus estimate of a loss of 6 cents per share. "Our Q3 results reflect our focused approach to refining digital payment solutions and advancing strategic platform development to serve key sectors better," said Luke D'Angelo, Chairman and CEO of AppTech. The company's stock fell around 37% over the past month and has a 52-week low of $0.38.

- RSI Value: 25.34

- APCX Price Action: Shares of AppTech Payments fell 12.5% to close at $0.42 on Monday.

- Benzinga Pro's signals feature notified of a potential breakout in APCX shares.

- 11月15日,AppTech Payments公佈的季度每股虧損爲8美分,未達到分析師普遍預期的每股虧損6美分。AppTech董事長兼首席執行官Luke D'Angelo表示:「我們的第三季度業績反映了我們專注於完善數字支付解決方案和推進戰略平台開發以更好地服務關鍵領域的方法。」該公司的股票在過去一個月中下跌了約37%,爲52周低點0.38美元。

- RSI 值:25.34

- APCX價格走勢:週一,AppTech Payments的股價下跌12.5%,收於0.42美元。

- Benzinga Pro的信號功能被告知APCX股票可能出現突破。

Read This Next:

接下來閱讀這篇文章:

- This Analyst With 85% Accuracy Rate Sees More Than 8% Upside In CrowdStrike – Here Are 5 Stock Picks For November From Wall Street's Most Accurate Analysts

- 這位準確率爲85%的分析師認爲CrowdStrike的上行空間超過8%——以下是華爾街最準確的分析師在11月份精選的5只股票