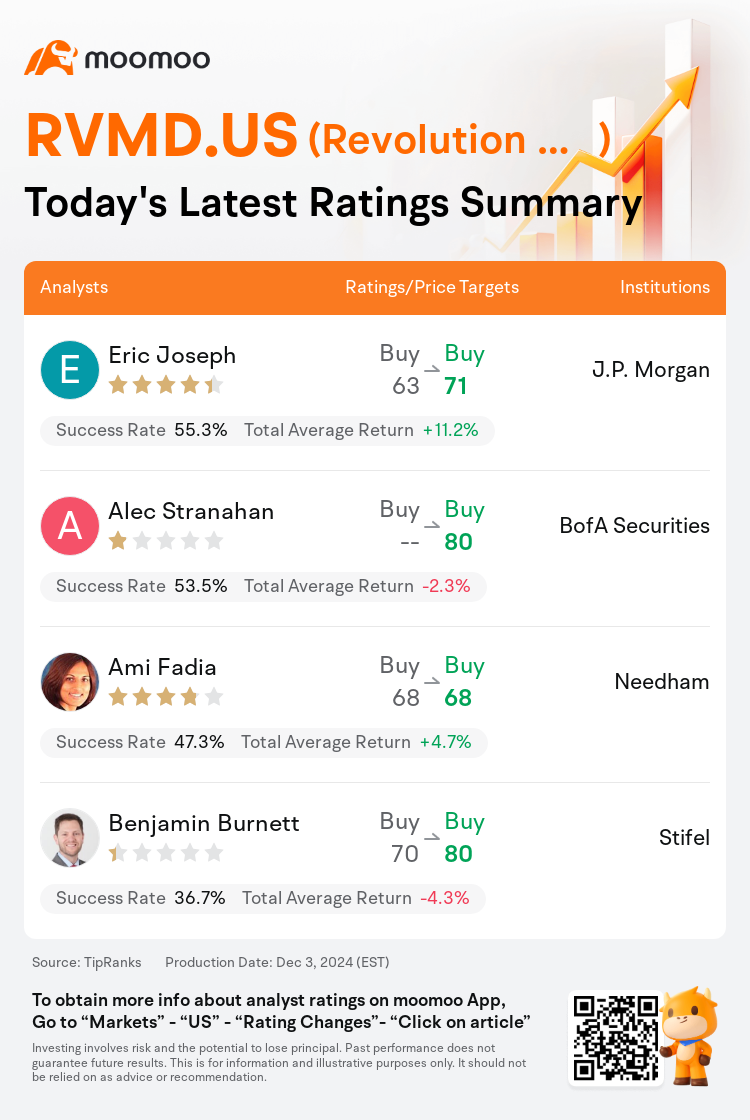

On Dec 03, major Wall Street analysts update their ratings for $Revolution Medicines (RVMD.US)$, with price targets ranging from $68 to $80.

J.P. Morgan analyst Eric Joseph maintains with a buy rating, and adjusts the target price from $63 to $71.

BofA Securities analyst Alec Stranahan maintains with a buy rating, and sets the target price at $80.

Needham analyst Ami Fadia maintains with a buy rating, and maintains the target price at $68.

Needham analyst Ami Fadia maintains with a buy rating, and maintains the target price at $68.

Stifel analyst Benjamin Burnett maintains with a buy rating, and adjusts the target price from $70 to $80.

Furthermore, according to the comprehensive report, the opinions of $Revolution Medicines (RVMD.US)$'s main analysts recently are as follows:

Following a recent update on data across the RAS(ON) pipeline, analysts have revised their model to accommodate heightened success prospects, particularly in the second-line and first-line NSCLC treatments with RMC-6236. This adjustment aligns with positive developments in Phase 1 evaluations, which suggest a reduction in risk as the company advances towards pivotal Phase 3 trials in 2L NSCLC, slated to start in Q1, alongside anticipated trials in a 1L setting employing doublet/triplet regimens.

The raised evaluation of Revolution Medicines' shares is based on improved success assumption for its treatments in second-line non-small cell lung cancer. This follows the company's update on its clinical data concerning the RAS inhibitor pipeline, which has been assessed as generally positive, helping to further mitigate the risks associated with its clinical development strategies in PDAC, NSCLC, and CRC.

The recent study outcomes indicated that the expected dose of 300mg RMC-6236 wasn't as effective or tolerable when used with pembro, contributing to a less robust stock response. However, results from the 200mg dose demonstrated considerable effectiveness, suggesting an additive effect alongside pembro, which could potentially exceed the standard of care in first-line NSCLC treatments. The combination's safety profile concerning liver toxicity appears favorable, though the limited duration of the follow-up could raise concerns. Despite the necessity to reduce dosages in NSCLC contexts, the observed efficacy supports the pursuit of significant opportunities in first-line NSCLC treatments. Market sensitivity to deviations from expected results has heightened investor caution.

Here are the latest investment ratings and price targets for $Revolution Medicines (RVMD.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

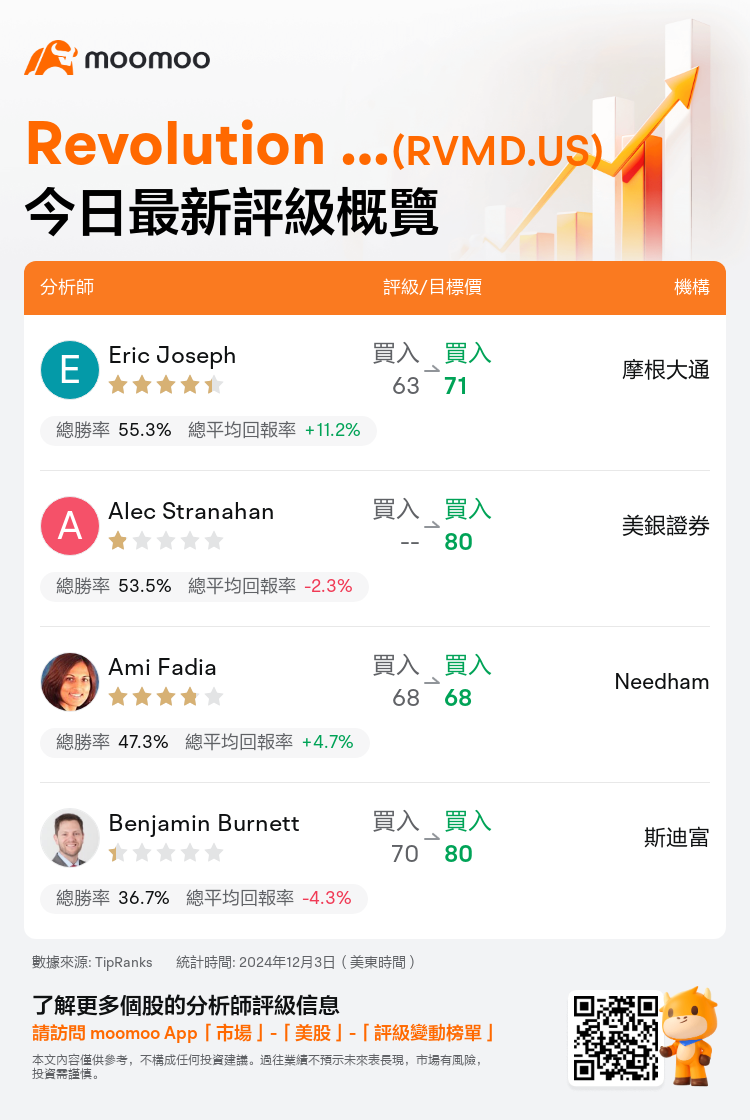

美東時間12月3日,多家華爾街大行更新了$Revolution Medicines (RVMD.US)$的評級,目標價介於68美元至80美元。

摩根大通分析師Eric Joseph維持買入評級,並將目標價從63美元上調至71美元。

美銀證券分析師Alec Stranahan維持買入評級,目標價80美元。

Needham分析師Ami Fadia維持買入評級,維持目標價68美元。

Needham分析師Ami Fadia維持買入評級,維持目標價68美元。

斯迪富分析師Benjamin Burnett維持買入評級,並將目標價從70美元上調至80美元。

此外,綜合報道,$Revolution Medicines (RVMD.US)$近期主要分析師觀點如下:

在最近關於RAS(ON)管道數據的更新後,分析師們修訂了他們的模型以適應成功前景的提升,特別是在使用RMC-6236進行的二線和一線非小細胞肺癌(NSCLC)治療中。這一調整與一期評估中的積極進展相一致,這表明隨着公司向將在第一季度開始的二線NSCLC的關鍵第三階段試驗推進,風險有所降低,同時預計還將在一線設置中進行雙藥/三藥方案的試驗。

對revolution medicines股票的評估上調基於對其在二線非小細胞肺癌治療的成功假設的改善。這是在公司更新其RAS抑制劑管道的臨床數據後做出的評估,該數據總體被認爲是積極的,進一步幫助緩解了與其在胰腺導管腺癌(PDAC)、非小細胞肺癌(NSCLC)和結直腸癌(CRC)的臨床開發戰略相關的風險。

最近的研究結果表明,預計的300mg RMC-6236劑量在與pembro聯合使用時效果不如預期,耐受性也較差,導致股票反應不夠強勁。然而,200mg劑量的結果展示了顯著的有效性,表明與pembro聯合使用可能產生附加效果,超越一線NSCLC治療的標準護理。該組合在肝臟毒性方面的安全性看來是有利的,儘管隨訪的時間有限可能引發擔憂。儘管在NSCLC環境中需要減少劑量,觀察到的有效性支持在一線NSCLC治療中追求重大機會。市場對偏離預期結果的敏感性加劇了投資者的謹慎。

以下爲今日4位分析師對$Revolution Medicines (RVMD.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

Needham分析師Ami Fadia維持買入評級,維持目標價68美元。

Needham分析師Ami Fadia維持買入評級,維持目標價68美元。

Needham analyst Ami Fadia maintains with a buy rating, and maintains the target price at $68.

Needham analyst Ami Fadia maintains with a buy rating, and maintains the target price at $68.