We Like These Underlying Return On Capital Trends At Shanghai Film (SHSE:601595)

We Like These Underlying Return On Capital Trends At Shanghai Film (SHSE:601595)

What are the early trends we should look for to identify a stock that could multiply in value over the long term? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. With that in mind, we've noticed some promising trends at Shanghai Film (SHSE:601595) so let's look a bit deeper.

我們應該關注哪些早期趨勢,以識別可能在長期內價值倍增的股票?首先,我們希望識別資本回報率(ROCE)的增長,然後是不斷增加的資本使用基礎。最終,這表明這是一個以越來越高的回報率再投資利潤的業務。考慮到這一點,我們注意到上海電影(SHSE:601595)出現了一些積極的趨勢,讓我們深入了解一下。

What Is Return On Capital Employed (ROCE)?

我們對 Enphase Energy 的資本僱用回報率的看法:正如我們上面看到的,Enphase Energy 的資本回報率沒有提高,但它正在重新投資於業務。投資者必須認爲未來會有更好的前景,因爲股票表現良好,使持股五年以上的股東獲得了 690% 的收益。最終,如果基本趨勢持續存在,我們不會對它成爲一隻多頭股持有期很久很有信心。

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Shanghai Film, this is the formula:

如果您以前沒有使用ROCE,它衡量的是公司從其業務中使用的資本產生的「回報」(稅前利潤)。要計算上海電影的這一指標,公式爲:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

資本利用率 = 利息和稅前利潤(EBIT) ÷ (總資產 - 流動負債)

0.02 = CN¥44m ÷ (CN¥2.7b - CN¥498m) (Based on the trailing twelve months to September 2024).

0.02 = CN¥4400萬 ÷ (CN¥27億 - CN¥498m) (基於截至2024年9月的過去12個月)。

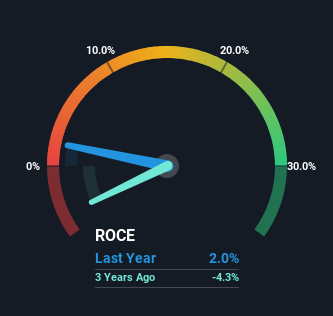

So, Shanghai Film has an ROCE of 2.0%. In absolute terms, that's a low return and it also under-performs the Entertainment industry average of 5.3%.

因此,上海電影的資本回報率爲2.0%。絕對值來說,這是一個較低的回報,而且也低於5.3%的娛樂行業平均水平。

Above you can see how the current ROCE for Shanghai Film compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Shanghai Film .

在上面,你可以看到上海電影當前的資本回報率與其之前的資本回報率的對比,但從過去的數據中我們能夠了解到的信息有限。如果你想了解分析師對未來的預測,應該查看我們針對上海電影的免費分析師報告。

So How Is Shanghai Film's ROCE Trending?

那麼上海電影的資本回報率趨勢如何呢?

We're delighted to see that Shanghai Film is reaping rewards from its investments and has now broken into profitability. The company was generating losses five years ago, but has managed to turn it around and as we saw earlier is now earning 2.0%, which is always encouraging. Interestingly, the capital employed by the business has remained relatively flat, so these higher returns are either from prior investments paying off or increased efficiencies. So while we're happy that the business is more efficient, just keep in mind that could mean that going forward the business is lacking areas to invest internally for growth. So if you're looking for high growth, you'll want to see a business's capital employed also increasing.

我們很高興看到上海電影的投資獲得回報,並且已經實現盈利。五年前公司還在虧損,但現在已經扭轉局勢,正如我們之前看到的,現在盈利2.0%,這總是令人鼓舞的。有趣的是,業務使用的資本基本保持不變,因此這些更高的回報要麼是來自於以往投資的收益,要麼是效率的提高。所以,雖然我們很高興看到企業的效率提高,但請記住,這可能意味着企業在未來缺乏內部投資的增長領域。因此,如果你在尋找高增長,想要看到企業使用的資本也在增加。

In Conclusion...

最後,同等資本下回報率較低的趨勢通常不是我們關注創業板股票的最佳信號。由於這些發展進行良好,因此投資者不太可能表現友好。自五年前以來,該股下跌了32%。除非這些指標朝着更積極的軌跡轉變,否則我們將繼續尋找其他股票。

To sum it up, Shanghai Film is collecting higher returns from the same amount of capital, and that's impressive. And a remarkable 130% total return over the last five years tells us that investors are expecting more good things to come in the future. Therefore, we think it would be worth your time to check if these trends are going to continue.

總而言之,上海電影在同樣的資本下獲得了更高的回報,這令人印象深刻。在過去五年間,驚人的130%的總回報告訴我們,投資者期待未來會有更多好事發生。因此,我們認爲檢查這些趨勢是否會持續是值得你花時間的。

One more thing to note, we've identified 1 warning sign with Shanghai Film and understanding it should be part of your investment process.

還有一點要注意,我們已經發現與上海電影相關的一個警告信號,理解這一點應成爲你投資過程的一部分。

While Shanghai Film isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

雖然上海電影沒有獲得最高的回報,但請查看這份免費列表,其中包含獲得高股本回報且資產負債表穩健的公司。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

0.02 = CN¥44m ÷ (CN¥2.7b - CN¥498m)

0.02 = CN¥44m ÷ (CN¥2.7b - CN¥498m)