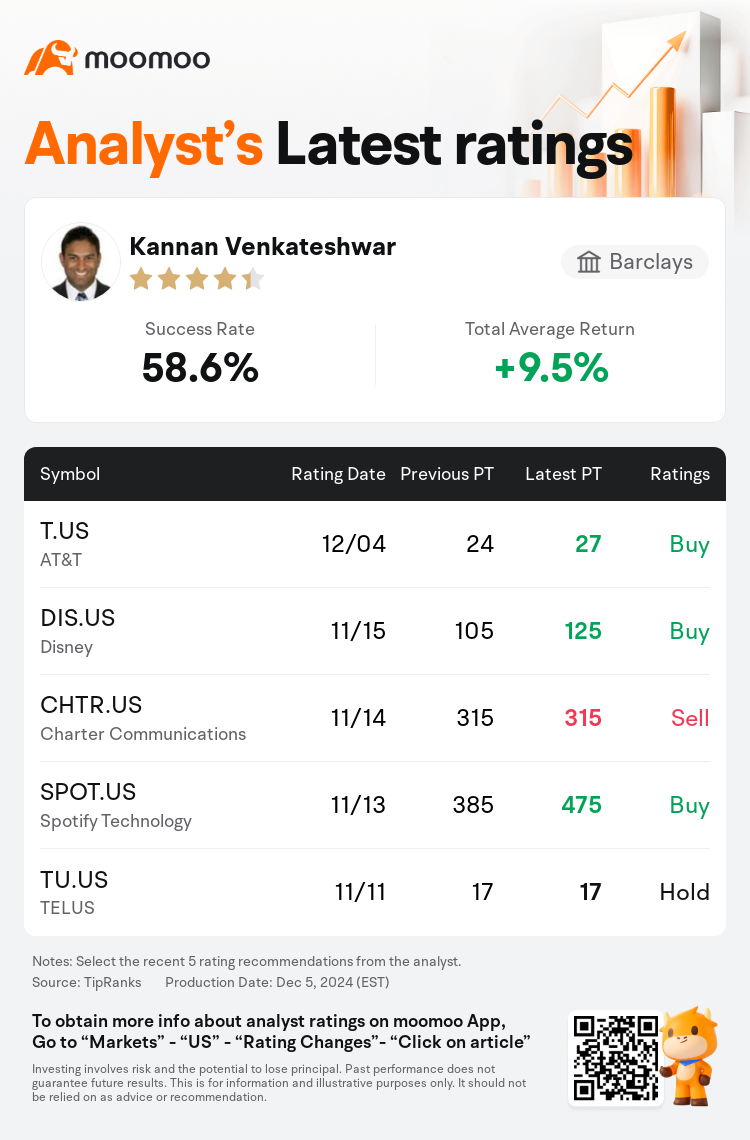

Barclays analyst Kannan Venkateshwar maintains $AT&T (T.US)$ with a buy rating, and adjusts the target price from $24 to $27.

According to TipRanks data, the analyst has a success rate of 58.6% and a total average return of 9.5% over the past year.

Furthermore, according to the comprehensive report, the opinions of $AT&T (T.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $AT&T (T.US)$'s main analysts recently are as follows:

Following a recent investor day, it is believed that AT&T is well positioned to meet its revenue, EBITDA, and free cash flow growth objectives, which are facilitating shareholder returns. The company's current strategy, focusing on connectivity, builds upon the approach initiated in 2021, emphasizing wireless and broadband connectivity.

Following a recent investor day, it is reported that the company has improved its multi-year service revenue and EBITDA guidance, anticipating a normalized free cash flow of $18B by 2027. The anticipated growth in broadband and mobility market share, coupled with EBITDA margin expansion, is expected to contribute to accelerating earnings and free cash flow per share growth, which is perceived as attractive at the current share levels.

AT&T shared a positive update on its multi-year financial outlook during the analyst meeting, while emphasizing its commitment to an organic investment and growth strategy. The combination of expected annual service revenue growth paired with accelerated EBITDA growth is seen as a potential catalyst for improved valuation. Additionally, the expanded fiber deployment strategy that aims to increase home coverage is considered to be favorable compared to previous projections and general consensus.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

巴克萊銀行分析師Kannan Venkateshwar維持$AT&T (T.US)$買入評級,並將目標價從24美元上調至27美元。

根據TipRanks數據顯示,該分析師近一年總勝率為58.6%,總平均回報率為9.5%。

此外,綜合報道,$AT&T (T.US)$近期主要分析師觀點如下:

此外,綜合報道,$AT&T (T.US)$近期主要分析師觀點如下:

在最近的一次投資者日活動中,人們相信AT&T有良好的基礎來實現其營業收入、EBITDA和自由現金流的增長目標,這將推動股東回報。公司的當前策略專注於連接,建立在2021年啓動的基礎上,強調無線和寬帶連接。

在最近的一次投資者日活動後,報道指出公司提高了其多年的服務營業收入和EBITDA指導,預計到2027年自由現金流將達到180億美元。預計寬帶和移動市場份額的增長,加上EBITDA利潤率的擴展,預計將促進每股收益和自由現金流的加速增長,這在當前的股價水平上被視爲具有吸引力。

在分析師會議上,AT&T分享了其多年的財務前景的積極更新,同時強調了其對有機投資和增長策略的承諾。預計年度服務營業收入增長與加速的EBITDA增長結合在一起,被視爲改善估值的潛在催化劑。此外,擴展的光纖部署策略旨在增加家庭覆蓋率,相較之前的預測和普遍共識被認爲更爲有利。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$AT&T (T.US)$近期主要分析師觀點如下:

此外,綜合報道,$AT&T (T.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of