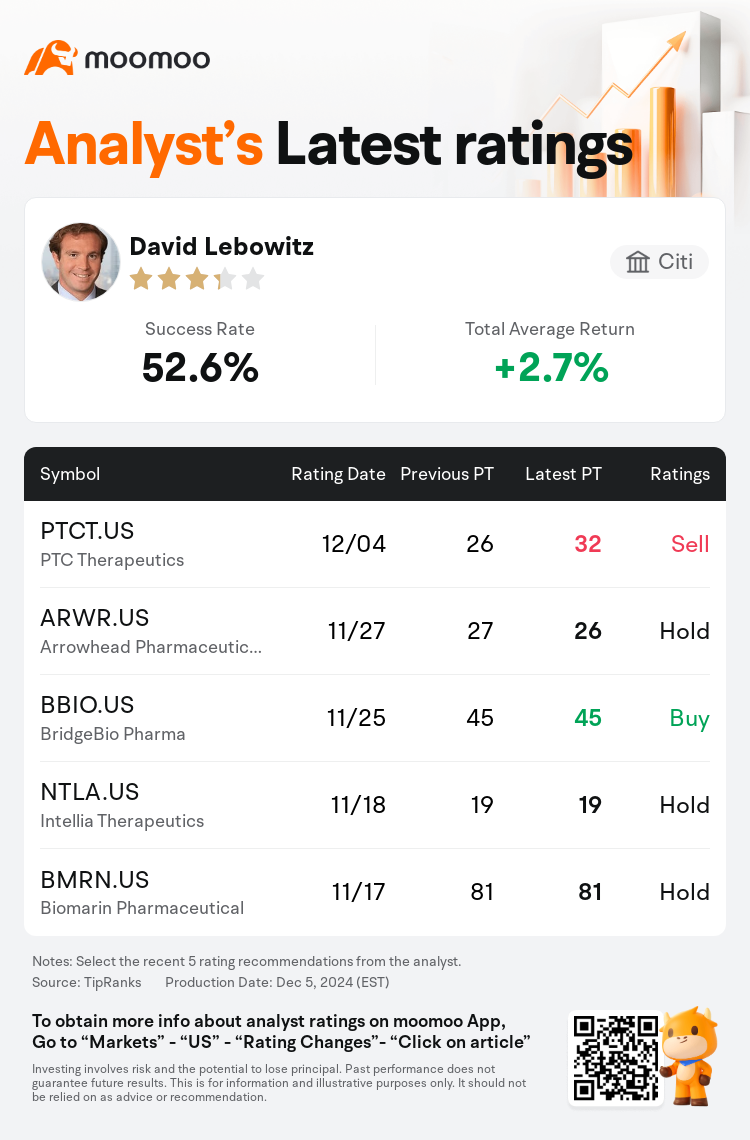

Citi analyst David Lebowitz maintains $PTC Therapeutics (PTCT.US)$ with a sell rating, and adjusts the target price from $26 to $32.

According to TipRanks data, the analyst has a success rate of 52.6% and a total average return of 2.7% over the past year.

Furthermore, according to the comprehensive report, the opinions of $PTC Therapeutics (PTCT.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $PTC Therapeutics (PTCT.US)$'s main analysts recently are as follows:

The update to the company's model reflects the Novartis collaboration, which significantly enhances the liquidity position of the company, now estimated at $2 billion. The collaboration concerning PTC518 is highlighted as bringing significant pharmaceutical industry support and substantial immediate financial benefits.

PTC Therapeutics recently announced a comprehensive global licensing and collaboration agreement with Novartis for its Huntington's Disease program, PTC518. This agreement provides PTC Therapeutics with a significant immediate cash boost and the potential for future earnings through various development, regulatory, and sales milestones. Analysts view this deal favorably, noting that it not only offers PTC substantial financial benefits but also maintains advantageous economic terms and presents a significant opportunity for success. Furthermore, PTC Therapeutics is regarded as a promising player in the rare disease sector, anticipated to present several key catalysts over the forthcoming year.

It is noted with optimism that the recent exclusive strategic license agreement for the global development of PTC518 in Huntington's disease may reduce the immediate financial requirements for the company. Furthermore, as the company continues to seek regulatory agreement on an accelerated approval pathway following an encouraging phase 2 update in June, there remains anticipation around forthcoming elaborations on future development strategies which are perceived as still requiring risk mitigation.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

花旗分析師David Lebowitz維持$PTC Therapeutics (PTCT.US)$賣出評級,並將目標價從26美元上調至32美元。

根據TipRanks數據顯示,該分析師近一年總勝率為52.6%,總平均回報率為2.7%。

此外,綜合報道,$PTC Therapeutics (PTCT.US)$近期主要分析師觀點如下:

此外,綜合報道,$PTC Therapeutics (PTCT.US)$近期主要分析師觀點如下:

對公司模型的更新反映了與諾華的合作,這顯著增強了公司的流動性,目前估計爲20億美元。關於PTC518的合作被強調爲帶來了顯著的藥品行業支持和可觀的即時財務收益。

ptc therapeutics最近宣佈與諾華在亨廷頓氏病項目PTC518上達成了一項全面的全球許可和合作協議。該協議爲ptc therapeutics提供了顯著的即時現金注入,並通過多個開發、監管和銷售里程碑爲未來收益提供了潛力。分析師對這一交易持積極態度,指出它不僅爲ptc帶來了實質性的財務利益,而且保持了有利的經濟條款,並提供了成功的重大機會。此外,ptc therapeutics被視爲罕見疾病板塊中的一名有前景的參與者,預計在未來一年將發佈若干關鍵催化劑。

樂觀地認爲,最近關於PTC518在亨廷頓氏病全球開發的獨家戰略許可協議可能會減少公司的即時財務需求。此外,隨着公司繼續尋求在6月鼓舞人心的第二階段更新後關於加速審批路徑的監管協議,對於未來發展策略的進一步闡述仍然抱有期待,雖然這些策略被認爲仍需進行風險緩解。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$PTC Therapeutics (PTCT.US)$近期主要分析師觀點如下:

此外,綜合報道,$PTC Therapeutics (PTCT.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of