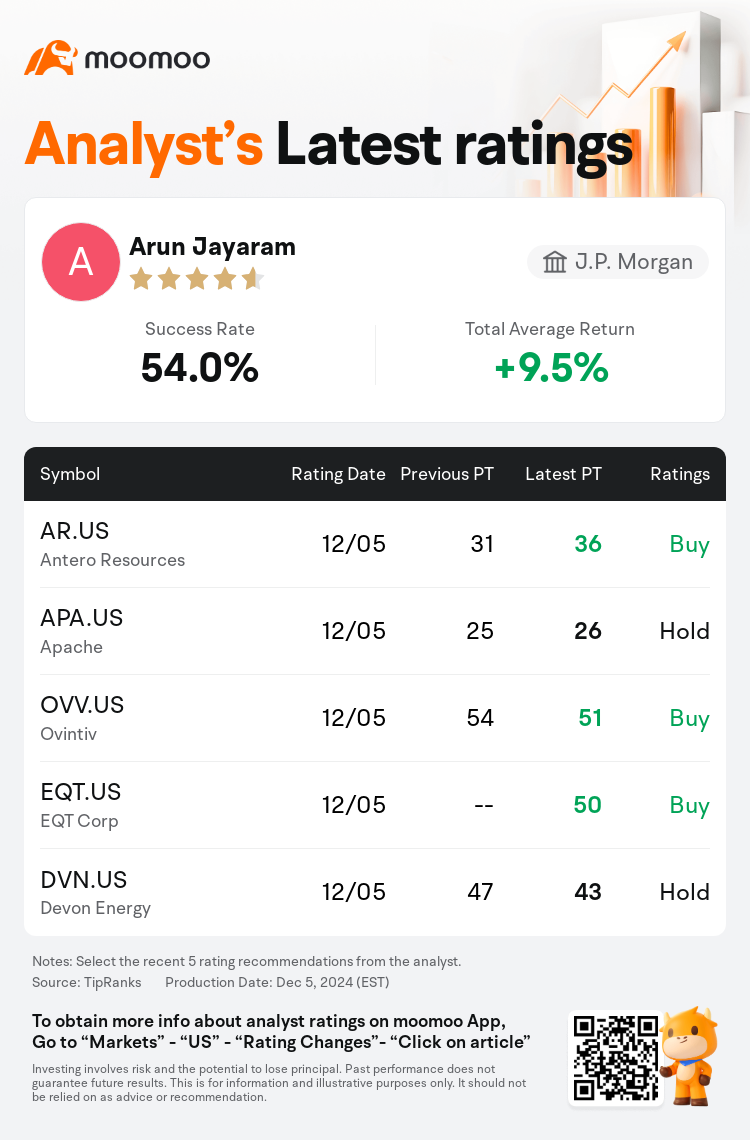

J.P. Morgan analyst Arun Jayaram maintains $EQT Corp (EQT.US)$ with a buy rating, and sets the target price at $50.

According to TipRanks data, the analyst has a success rate of 54.0% and a total average return of 9.5% over the past year.

Furthermore, according to the comprehensive report, the opinions of $EQT Corp (EQT.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $EQT Corp (EQT.US)$'s main analysts recently are as follows:

In 2025, natural gas producers are anticipated to gain from three major secular demand trends, including the expansion of substantial liquefied natural gas export capacities, increased power demand from electrification, and the transition from coal to gas. Updates to exploration and production models through 2030 bolster the view that long-term gas prices will likely need to stay above $3.50 per MMBtu. This adjustment in prices is expected to encourage increased supply from the Haynesville and other higher-cost gas regions. A shift to a more defensive stance is expected going into 2025 as the oil market may transition from balanced conditions in 2024 to a surplus scenario due to supply increments.

EQT Corporation shares are described as a core long-term natural gas holding. They are expected to trade in line with peers due to their relative valuation. Recent maneuvers to monetize a portion of midstream ownership are seen as accelerators for debt reduction and increases in shareholder returns.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

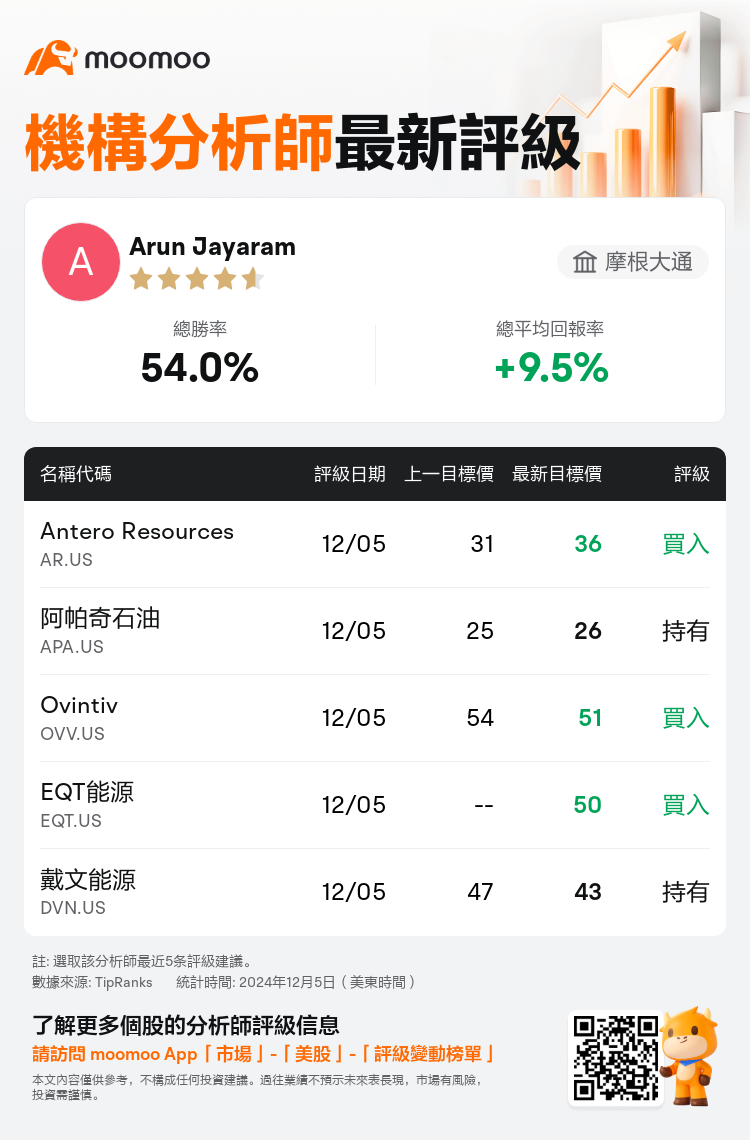

摩根大通分析師Arun Jayaram維持$EQT能源 (EQT.US)$買入評級,目標價50美元。

根據TipRanks數據顯示,該分析師近一年總勝率為54.0%,總平均回報率為9.5%。

此外,綜合報道,$EQT能源 (EQT.US)$近期主要分析師觀點如下:

此外,綜合報道,$EQT能源 (EQT.US)$近期主要分析師觀點如下:

到2025年, 天然氣生產商有望從三大長期需求趨勢中獲益,包括擴大大量液化天然氣出口能力、來自電氣化的增加電力需求,以及從煤炭向燃料幣的過渡。 到2030年,對勘探和生產模式的更新加強了觀點,即長期燃料幣價格可能需要保持在每MMBtu 3.50美元以上。 預計價格調整將鼓勵海恩斯維爾和其他較高成本燃料幣地區增加供應。 預計到2025年進入更爲保守的立場,因爲石油市場可能會由於供應遞增而從2024年的平衡狀態轉變爲盈餘景象。

EQt Corporation股票被描述爲核心長期天然氣持有股。由於其相對估值,預計它們將與同行交易。 最近用於變現部分中游所有權的操作被視爲降低債務和增加股東回報的加速器。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$EQT能源 (EQT.US)$近期主要分析師觀點如下:

此外,綜合報道,$EQT能源 (EQT.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of