Why It Might Not Make Sense To Buy Chow Tai Fook Jewellery Group Limited (HKG:1929) For Its Upcoming Dividend

Why It Might Not Make Sense To Buy Chow Tai Fook Jewellery Group Limited (HKG:1929) For Its Upcoming Dividend

Chow Tai Fook Jewellery Group Limited (HKG:1929) is about to trade ex-dividend in the next four days. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Meaning, you will need to purchase Chow Tai Fook Jewellery Group's shares before the 10th of December to receive the dividend, which will be paid on the 24th of December.

周大福珠寶集團有限公司 (HKG:1929) 將在接下來的四天內開始除息。除息日是在公司記錄日期之前的一個工作日,記錄日期是公司確定哪些股東有權獲得分紅的日期。除息日是一個重要的日期,因爲在此日期或之後購買股票可能意味着由於結算延遲,無法在記錄日期顯示。因此,您需要在12月10日之前購買周大福珠寶集團的股票,以便獲得將在12月24日支付的分紅。

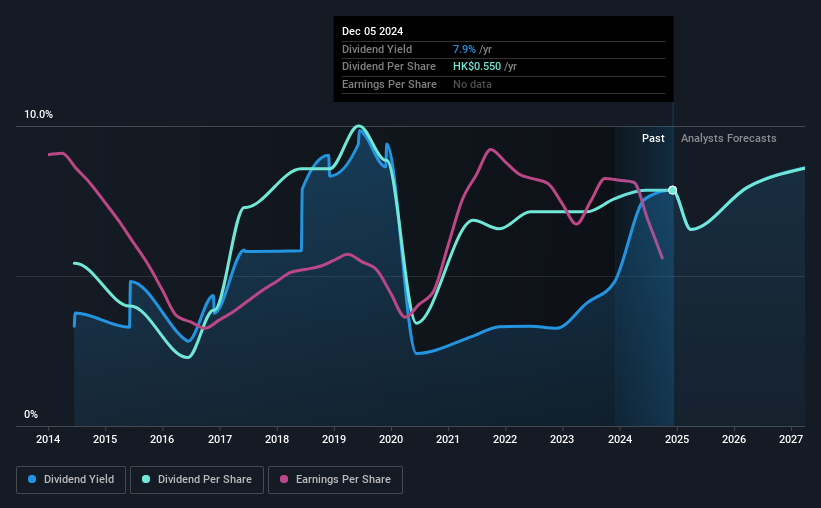

The company's next dividend payment will be HK$0.20 per share, on the back of last year when the company paid a total of HK$0.55 to shareholders. Looking at the last 12 months of distributions, Chow Tai Fook Jewellery Group has a trailing yield of approximately 7.9% on its current stock price of HK$6.99. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to check whether the dividend payments are covered, and if earnings are growing.

該公司下一個分紅支付將爲每股港幣0.20,基於去年該公司向股東支付的總額爲港幣0.55。觀察過去12個月的分配,周大福珠寶集團的當前股價爲港幣6.99,收益率約爲7.9%。分紅是許多股東的重要收入來源,但公司的健康狀況對維持這些分紅至關重要。因此,我們需要檢查分紅支付是否得到保障,以及盈利是否在增長。

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Chow Tai Fook Jewellery Group distributed an unsustainably high 112% of its profit as dividends to shareholders last year. Without more sustainable payment behaviour, the dividend looks precarious. A useful secondary check can be to evaluate whether Chow Tai Fook Jewellery Group generated enough free cash flow to afford its dividend. It paid out 88% of its free cash flow as dividends, which is within usual limits but will limit the company's ability to lift the dividend if there's no growth.

分紅通常來自公司的收入,因此如果公司支付的分紅超過其收入,分紅通常面臨被削減的更高風險。周大福珠寶集團去年向股東分配的分紅佔其利潤的112%,這個比例不可持續。如果沒有更可持續的支付行爲,分紅情況看起來就很不穩固。一個有用的輔助檢查是評估周大福珠寶集團是否生成足夠的自由現金流來支付其分紅。它將88%的自由現金流用於分紅,這在正常範圍內,但如果沒有增長將限制公司提高分紅的能力。

It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and Chow Tai Fook Jewellery Group fortunately did generate enough cash to fund its dividend. If executives were to continue paying more in dividends than the company reported in profits, we'd view this as a warning sign. Very few companies are able to sustainably pay dividends larger than their reported earnings.

看到分紅未由利潤覆蓋令人失望,但從分紅可持續性的角度來看,現金更爲重要,幸運的是周大福珠寶集團生成了足夠的現金來資助其分紅。如果高管繼續支付的分紅超過公司報告的利潤,我們會將此視爲一個警告信號。很少有公司能夠持續支付超過其報告利潤的分紅。

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

點擊此處查看公司的支付比率以及未來分紅的分析師預期。

Have Earnings And Dividends Been Growing?

收益和股息一直在增長嗎?

Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. It's not encouraging to see that Chow Tai Fook Jewellery Group's earnings are effectively flat over the past five years. It's better than seeing them drop, certainly, but over the long term, all of the best dividend stocks are able to meaningfully grow their earnings per share.

收益平穩的股票仍然可以吸引分紅派息,但在分紅的可持續性方面,採取更爲保守的策略並要求更大的安全邊際是很重要的。如果業務進入低迷狀態並削減分紅,公司可能會看到其價值急劇下降。看到周大福珠寶集團在過去五年裏的收益基本持平並不令人鼓舞。比起收益下降,這當然要好得多,但從長遠來看,所有優秀的分紅股票都能夠顯著增長其每股收益。

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Chow Tai Fook Jewellery Group has delivered an average of 3.8% per year annual increase in its dividend, based on the past 10 years of dividend payments.

衡量一個公司分紅前景的另一個關鍵方法是測量其歷史分紅增長率。根據過去10年的分紅支付,周大福珠寶集團的分紅平均每年增長3.8%。

Final Takeaway

最後的結論

Has Chow Tai Fook Jewellery Group got what it takes to maintain its dividend payments? Earnings per share have been flat in recent times, which is, we suppose, better than seeing them shrink. Plus, Chow Tai Fook Jewellery Group's paying out a high percentage of its earnings and more than half its cash flow. Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

周大福珠寶集團能否維持其分紅派息?每股收益近期持平,這比看到它們縮水要好。再加上,周大福珠寶集團支付的分紅派息佔其收益的高比例,並且超過了一半的自由現金流。總體來看,這似乎並不是適合長揸投資者的最佳分紅派息股票。

So if you're still interested in Chow Tai Fook Jewellery Group despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. To help with this, we've discovered 3 warning signs for Chow Tai Fook Jewellery Group that you should be aware of before investing in their shares.

因此,如果您仍然對周大福珠寶集團感興趣,儘管其分紅派息質量不佳,您應該充分了解面對該股票的一些風險。爲了幫助您,我們發現了周大福珠寶集團的3個警告信號,您在投資其股票之前應該了解這些警告。

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

一個常見的投資錯誤是購買你看到的第一個有趣的股票。在這裏,您可以找到高股息股票的完整列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and Chow Tai Fook Jewellery Group fortunately did generate enough cash to fund its dividend. If executives were to continue paying more in dividends than the company reported in profits, we'd view this as a warning sign. Very few companies are able to sustainably pay dividends larger than their reported earnings.

It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and Chow Tai Fook Jewellery Group fortunately did generate enough cash to fund its dividend. If executives were to continue paying more in dividends than the company reported in profits, we'd view this as a warning sign. Very few companies are able to sustainably pay dividends larger than their reported earnings.