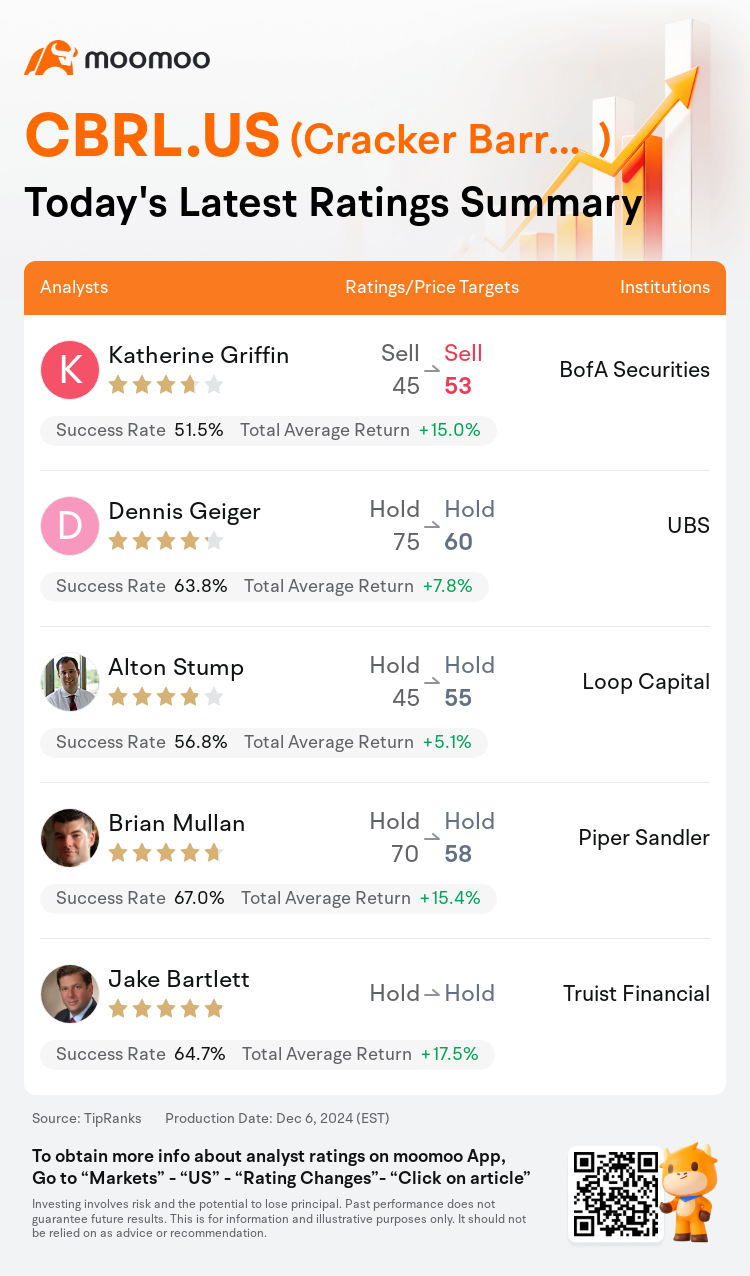

On Dec 06, major Wall Street analysts update their ratings for $Cracker Barrel Old Country Store Inc (CBRL.US)$, with price targets ranging from $53 to $60.

BofA Securities analyst Katherine Griffin maintains with a sell rating, and adjusts the target price from $45 to $53.

UBS analyst Dennis Geiger maintains with a hold rating, and adjusts the target price from $75 to $60.

Loop Capital analyst Alton Stump maintains with a hold rating, and adjusts the target price from $45 to $55.

Loop Capital analyst Alton Stump maintains with a hold rating, and adjusts the target price from $45 to $55.

Piper Sandler analyst Brian Mullan maintains with a hold rating, and adjusts the target price from $70 to $58.

Truist Financial analyst Jake Bartlett maintains with a hold rating.

Furthermore, according to the comprehensive report, the opinions of $Cracker Barrel Old Country Store Inc (CBRL.US)$'s main analysts recently are as follows:

Cracker Barrel's store-level execution has shown improvement, potentially indicating early successes in the strategic turnaround. Analysts note that the primary driver for the Q1 traffic performance appears to be favorable industry trends. While an expansion in restaurant-level margin is anticipated by FY25, forecasts for FY25 EPS have been adjusted downwards due to anticipated increases in G&A and interest expenses.

Cracker Barrel's Q1 call highlighted improving sales trends in a challenging macroeconomic environment, while reaffirming FY25 guidance and indicating continued progress against strategic plans. FY25 guidance is seen as achievable, underscored by same store sales outperformance relative to industry trends and traffic improvement. Although Thanksgiving results in Q2 were positive, traffic pressures are expected to persist in the near term due to ongoing macroeconomic headwinds. Management anticipates significant improvements in results to commence in 2H26 with an acceleration into FY27.

Cracker Barrel's first quarter performance was noted as solid, bolstered by a 2.9% increase in comparable sales despite a 1.6% dip in retail comparable sales. The company attributed this positive trajectory to sustained improvements in customer traffic during dinner time, marking the fourth consecutive quarter of such trends contributing to robust same-store sales growth.

Here are the latest investment ratings and price targets for $Cracker Barrel Old Country Store Inc (CBRL.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

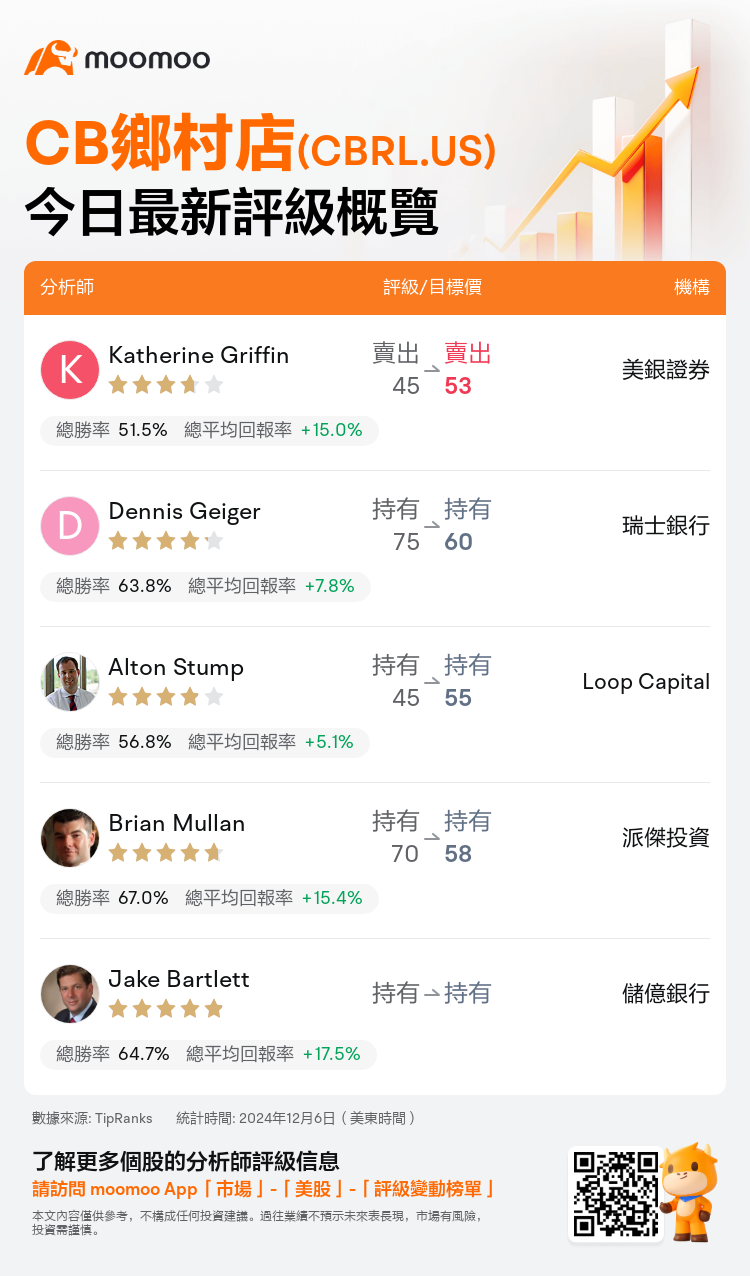

美東時間12月6日,多家華爾街大行更新了$CB鄉村店 (CBRL.US)$的評級,目標價介於53美元至60美元。

美銀證券分析師Katherine Griffin維持賣出評級,並將目標價從45美元上調至53美元。

瑞士銀行分析師Dennis Geiger維持持有評級,並將目標價從75美元下調至60美元。

Loop Capital分析師Alton Stump維持持有評級,並將目標價從45美元上調至55美元。

Loop Capital分析師Alton Stump維持持有評級,並將目標價從45美元上調至55美元。

派傑投資分析師Brian Mullan維持持有評級,並將目標價從70美元下調至58美元。

儲億銀行分析師Jake Bartlett維持持有評級。

此外,綜合報道,$CB鄉村店 (CBRL.US)$近期主要分析師觀點如下:

Cracker Barrel的店鋪執行水平已經顯示出改善,可能表明戰略轉型取得了早期成功。分析師指出,Q1交通表現的主要驅動因素似乎是行業趨勢向好。雖然預計到FY25年餐廳利潤率將有所擴大,但由於預計G&A和利息支出將增加,FY25年EPS的預測已經下調。

Cracker Barrel的Q1看漲突顯在具有挑戰性的宏觀經濟環境中銷售趨勢改善,同時重申FY25年指引並表明在戰略計劃方面持續取得進展。FY25年指引被認爲是可以實現的,強調了相對於行業趨勢和交通改善的同店銷售業績超越。雖然Q2的感恩節結果是積極的,但由於持續存在的宏觀經濟逆風,交通壓力料將在短期內持續存在。管理層預計成績將在2H26年開始顯著改善,並在FY27年加速。

Cracker Barrel的第一季度表現被認爲是穩健的,儘管零售可比銷售下降了1.6%,但同店銷售增長了2.9%。公司將這一積極趨勢歸因於晚餐時間顧客流量的持續改善,這標誌着連續第四個季度出現這種趨勢,有助於同店銷售強勁增長。

以下爲今日5位分析師對$CB鄉村店 (CBRL.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

Loop Capital分析師Alton Stump維持持有評級,並將目標價從45美元上調至55美元。

Loop Capital分析師Alton Stump維持持有評級,並將目標價從45美元上調至55美元。

Loop Capital analyst Alton Stump maintains with a hold rating, and adjusts the target price from $45 to $55.

Loop Capital analyst Alton Stump maintains with a hold rating, and adjusts the target price from $45 to $55.