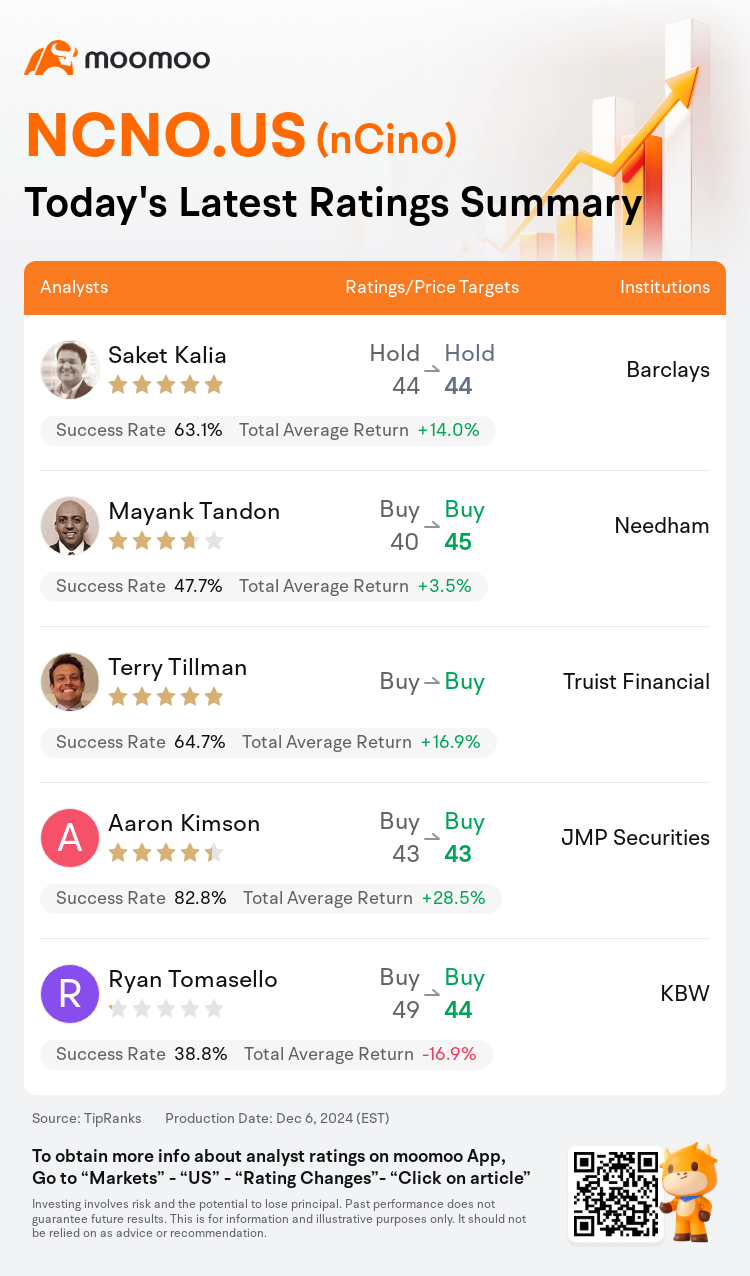

On Dec 06, major Wall Street analysts update their ratings for $nCino (NCNO.US)$, with price targets ranging from $43 to $45.

Barclays analyst Saket Kalia maintains with a hold rating, and maintains the target price at $44.

Needham analyst Mayank Tandon maintains with a buy rating, and adjusts the target price from $40 to $45.

Truist Financial analyst Terry Tillman maintains with a buy rating.

Truist Financial analyst Terry Tillman maintains with a buy rating.

JMP Securities analyst Aaron Kimson maintains with a buy rating, and maintains the target price at $43.

KBW analyst Ryan Tomasello maintains with a buy rating, and adjusts the target price from $49 to $44.

Furthermore, according to the comprehensive report, the opinions of $nCino (NCNO.US)$'s main analysts recently are as follows:

While anticipating a period of organic subscription revenue weakness as an opportunity for a more favorable entry point, and showing interest in adopting a positive stance before potential policy shifts and net interest income inflection, it is suggested that the company's shares are likely 'in the penalty box' until it can demonstrate acceleration. It is viewed that this acceleration is necessary for multiple expansion.

nCino's Q3 results surpassed expectations due to strong subscription revenue growth and effective cost management. The company's sales execution continues to be impressive, evidenced by a 5.3% increase from Q2 and 19.4% year-over-year growth in its Remaining Performance Obligation, fueled by significant achievements in both U.S. and international markets. The challenges in the mortgage sector are seen as temporary, and the recent sell-off in nCino shares is regarded as excessive.

nCino demonstrated robust growth in Q3, although their forecast for Q4 fell short of expectations. The core US markets continue to show strength and there was significant deal activity internationally as expected; however, the mortgage sector is still a mitigating factor, with management recognizing increased churn and a more subdued Q4 recovery outlook as interest rates stay high.

Here are the latest investment ratings and price targets for $nCino (NCNO.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

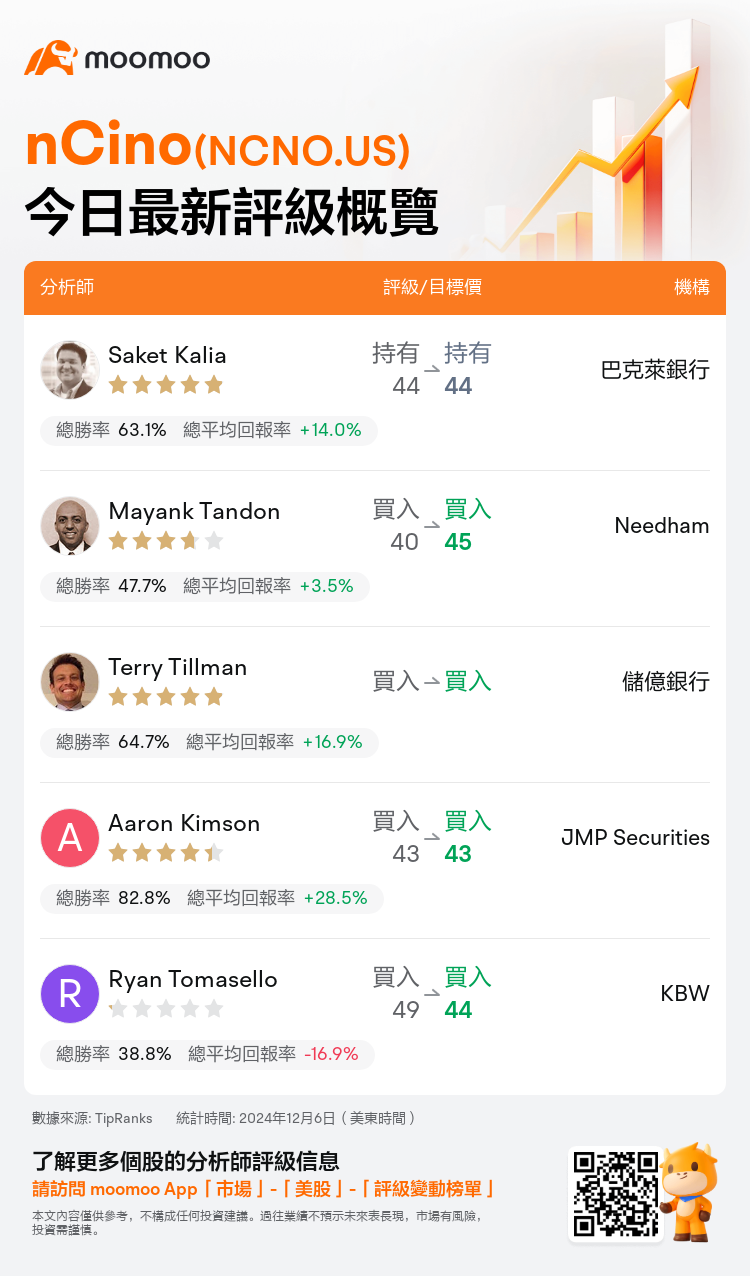

美東時間12月6日,多家華爾街大行更新了$nCino (NCNO.US)$的評級,目標價介於43美元至45美元。

巴克萊銀行分析師Saket Kalia維持持有評級,維持目標價44美元。

Needham分析師Mayank Tandon維持買入評級,並將目標價從40美元上調至45美元。

儲億銀行分析師Terry Tillman維持買入評級。

儲億銀行分析師Terry Tillman維持買入評級。

JMP Securities分析師Aaron Kimson維持買入評級,維持目標價43美元。

KBW分析師Ryan Tomasello維持買入評級,並將目標價從49美元下調至44美元。

此外,綜合報道,$nCino (NCNO.US)$近期主要分析師觀點如下:

在預期有機訂閱營業收入疲軟階段作爲更有利的入場點,並在潛在政策變化和淨利息收入轉折前表現出採取積極立場的興趣時,有人建議該公司的股票可能會被視爲"懲罰區",直到它能夠展示加速增長。這一加速被視爲多元化擴張的必要條件。

ncino的第三季度業績超出預期,得益於強勁的訂閱營業收入增長和有效的成本管理。公司的銷售執行能力依然出色,從第二季度增長了5.3%,年同比增長19.4%,其剩餘業績義務的顯著成就推動了美國和國際市場的顯著發展。抵押貸款板塊的挑戰被視爲暫時的,近期ncino股票的拋售被認爲是過度的。

儘管ncino在第三季度表現出強勁的增長,但他們對第四季度的預測未能達到預期。核心美國市場仍然表現強勁,國際市場也有顯著的交易活動,如預期的那樣;然而,抵押貸款板塊仍然是一個緩和因素,管理層注意到流失率增加,且由於利率保持高位,第四季度的復甦前景較爲溫和。

以下爲今日5位分析師對$nCino (NCNO.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

儲億銀行分析師Terry Tillman維持買入評級。

儲億銀行分析師Terry Tillman維持買入評級。

Truist Financial analyst Terry Tillman maintains with a buy rating.

Truist Financial analyst Terry Tillman maintains with a buy rating.