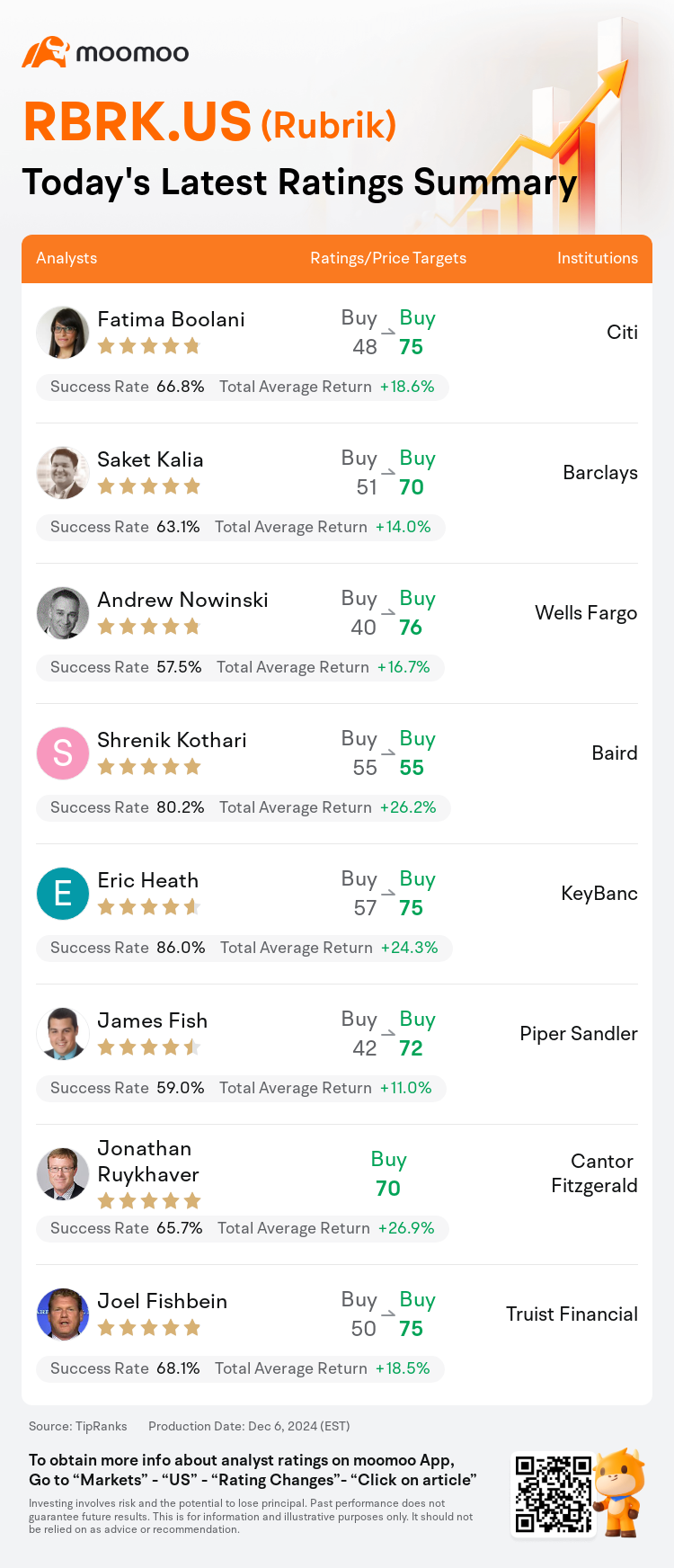

On Dec 06, major Wall Street analysts update their ratings for $Rubrik (RBRK.US)$, with price targets ranging from $55 to $76.

Citi analyst Fatima Boolani maintains with a buy rating, and adjusts the target price from $48 to $75.

Barclays analyst Saket Kalia maintains with a buy rating, and adjusts the target price from $51 to $70.

Wells Fargo analyst Andrew Nowinski maintains with a buy rating, and adjusts the target price from $40 to $76.

Wells Fargo analyst Andrew Nowinski maintains with a buy rating, and adjusts the target price from $40 to $76.

Baird analyst Shrenik Kothari maintains with a buy rating, and maintains the target price at $55.

KeyBanc analyst Eric Heath maintains with a buy rating, and adjusts the target price from $57 to $75.

Furthermore, according to the comprehensive report, the opinions of $Rubrik (RBRK.US)$'s main analysts recently are as follows:

Rubrik delivered an exceptional Q3 report, characterized by commendable performance throughout the organization. There's widespread momentum within the company, and numerous avenues remain for enhancing margins. This robust scenario reinforces the confidence in a strong fiscal year guidance.

Rubrik has reported an enhancement in subscription annual recurring revenue, primarily propelled by a significant increase in cloud ARR. This growth is crucial as it is expected to drive a greater contribution to ARR, potentially leading to a breakeven financial position in the coming year.

The company surpassed fiscal Q3 consensus estimates significantly and indicated an upward adjustment to the Q4 guidance. This performance displays a company exhibiting uncommon business momentum that should sustain uncommon growth for the foreseeable future.

Rubrik delivered an exceptional Q3 performance, surpassing the $1B Annual Recurring Revenue milestone, which was driven by strong adoption of Rubrik Security Cloud.

Rubrik demonstrated further robust performance in its quarterly results, surpassing expectations on annual recurring revenue and margins. Analysts maintain a positive outlook on Rubrik's dominance in backup and recovery and its growing data security platform. There is substantial opportunity for market share gains in the $11B backup and recovery industry, particularly through its unique emphasis on cyber resilience. Additionally, the rising frequency and intensity of ransomware attacks are prompting enterprises to transition away from older solutions that hold over 40% of the market share.

Here are the latest investment ratings and price targets for $Rubrik (RBRK.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

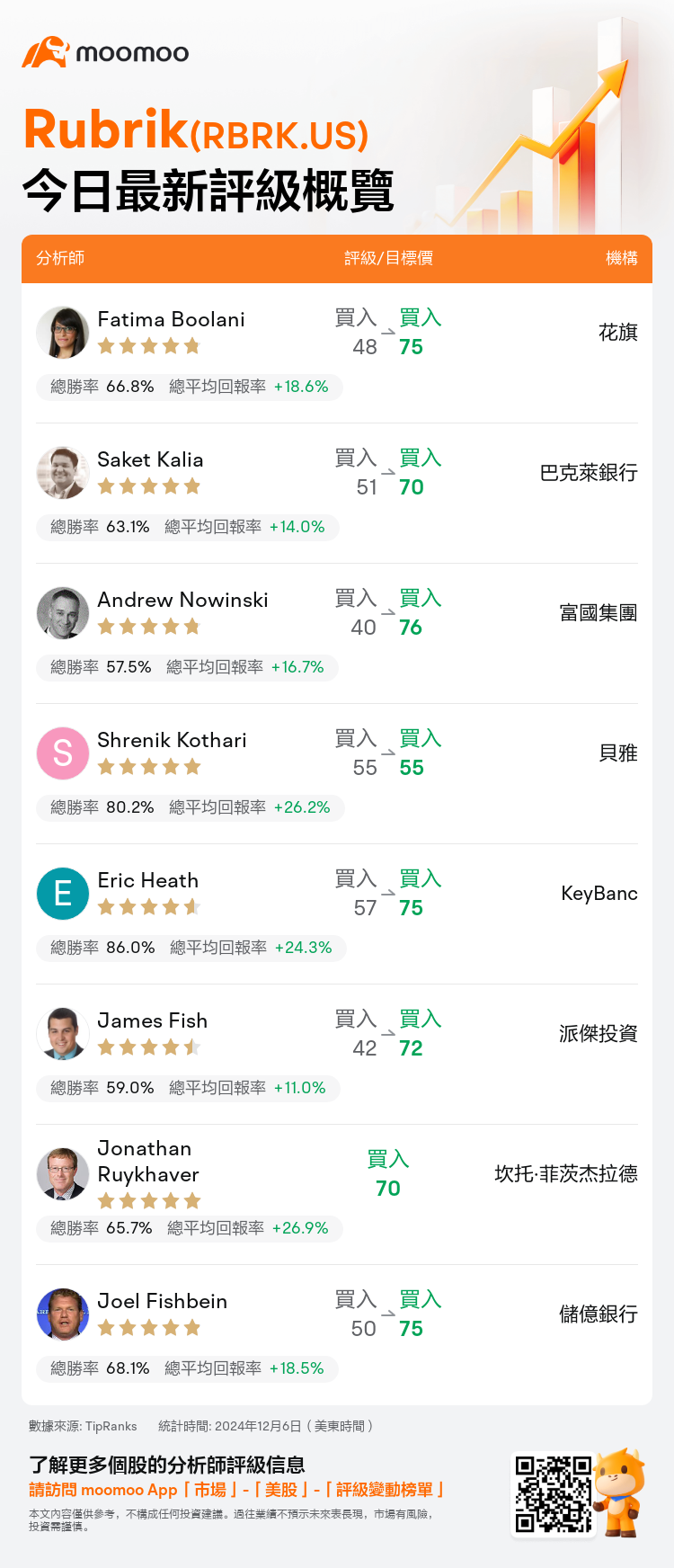

美東時間12月6日,多家華爾街大行更新了$Rubrik (RBRK.US)$的評級,目標價介於55美元至76美元。

花旗分析師Fatima Boolani維持買入評級,並將目標價從48美元上調至75美元。

巴克萊銀行分析師Saket Kalia維持買入評級,並將目標價從51美元上調至70美元。

富國集團分析師Andrew Nowinski維持買入評級,並將目標價從40美元上調至76美元。

富國集團分析師Andrew Nowinski維持買入評級,並將目標價從40美元上調至76美元。

貝雅分析師Shrenik Kothari維持買入評級,維持目標價55美元。

KeyBanc分析師Eric Heath維持買入評級,並將目標價從57美元上調至75美元。

此外,綜合報道,$Rubrik (RBRK.US)$近期主要分析師觀點如下:

Rubrik提交了出色的第三季度報告,表現可圈可點。公司內部普遍存在增長勢頭,仍然有許多途徑可以提升利潤率。這一穩健的情景加強了對強勁財年指引的信心。

Rubrik的訂閱年度循環營收有所提升,主要推動力來自雲ARR的大幅增長。這種增長至關重要,因爲預計將爲ARR做出更大貢獻,可能導致在未來一年實現盈虧平衡的財務狀況。

公司顯著超額實現了第三財季的共識預期,並說明第四財季指引有望上調。這一表現顯示了公司展現出非凡的業務勢頭,應該能在可預見的未來持續非凡的增長。

Rubrik交出出色的第三季度表現,超越了10億美元的年度循環營收里程碑,這得益於Rubrik Security Cloud的強勁採用。

Rubrik在季度業績方面表現出色,超額實現了年度循環營收和利潤率的預期。分析師對Rubrik在備份和恢復領域的主導地位以及不斷增長的數據安全平台保持積極展望。在110億美元備份和恢復行業中,Rubrik有着實質性獲得市場份額的機會,特別是通過其獨特的強調網絡防護。此外,勒索軟件攻擊的頻率和強度不斷上升,促使企業轉向擺脫市場份額超過40%的舊解決方案。

以下爲今日8位分析師對$Rubrik (RBRK.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

富國集團分析師Andrew Nowinski維持買入評級,並將目標價從40美元上調至76美元。

富國集團分析師Andrew Nowinski維持買入評級,並將目標價從40美元上調至76美元。

Wells Fargo analyst Andrew Nowinski maintains with a buy rating, and adjusts the target price from $40 to $76.

Wells Fargo analyst Andrew Nowinski maintains with a buy rating, and adjusts the target price from $40 to $76.