Price Over Earnings Overview: Dick's Sporting Goods

Price Over Earnings Overview: Dick's Sporting Goods

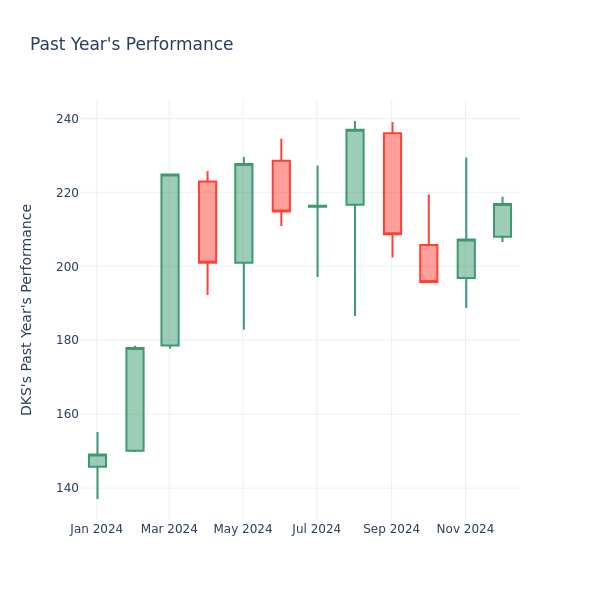

In the current session, the stock is trading at $209.72, after a 0.48% increase. Over the past month, Dick's Sporting Goods Inc. (NYSE:DKS) stock increased by 6.92%, and in the past year, by 56.20%. With performance like this, long-term shareholders are optimistic but others are more likely to look into the price-to-earnings ratio to see if the stock might be overvalued.

在當前的交易時段,股票交易價格爲209.72美元,上漲了0.48%。在過去一個月,迪克體育用品公司(紐交所:DKS)股票上漲了6.92%,而在過去一年,上漲了56.20%。這樣的表現讓長期股東充滿信心,但其他投資者更可能關注市盈率,以判斷該股票是否被高估。

A Look at Dick's Sporting Goods P/E Relative to Its Competitors

迪克體育用品的市盈率與其競爭對手的比較

The P/E ratio measures the current share price to the company's EPS. It is used by long-term investors to analyze the company's current performance against it's past earnings, historical data and aggregate market data for the industry or the indices, such as S&P 500. A higher P/E indicates that investors expect the company to perform better in the future, and the stock is probably overvalued, but not necessarily. It also could indicate that investors are willing to pay a higher share price currently, because they expect the company to perform better in the upcoming quarters. This leads investors to also remain optimistic about rising dividends in the future.

市盈率衡量公司的每股收益與當前股價的比例。長期投資者使用該比率分析公司當前業績與其過去收益、歷史數據和行業或指數的市場數據進行比較,如標普500。更高的市盈率表明投資者預計公司未來表現將更好,股票可能被高估,但不一定如此。它還可以表明,投資者當前願意支付更高的股票價格,因爲他們預計公司在未來季度內表現更好。這使投資者也對未來的分紅保持樂觀。

Dick's Sporting Goods has a lower P/E than the aggregate P/E of 19.08 of the Specialty Retail industry. Ideally, one might believe that the stock might perform worse than its peers, but it's also probable that the stock is undervalued.

迪克體育用品的市盈率低於專業零售行業19.08的總市盈率。理想情況下,人們可能會認爲該股票的表現會遜色於同行,但也有可能這隻股票被低估。

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company's market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company's financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

總結一下,市盈率是投資者評估公司市場表現的有價值工具,但使用時應謹慎。低市盈率可能表明公司被低估,但也可能暗示着增長前景疲弱或財務不穩定。此外,市盈率僅是投資者在做出投資決策時應考慮的衆多指標之一,應結合其他財務比率、行業趨勢和定性因素進行評估。通過全面分析公司的財務健康狀況,投資者可以做出更有可能帶來成功結果的明智決策。

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company's market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company's market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry