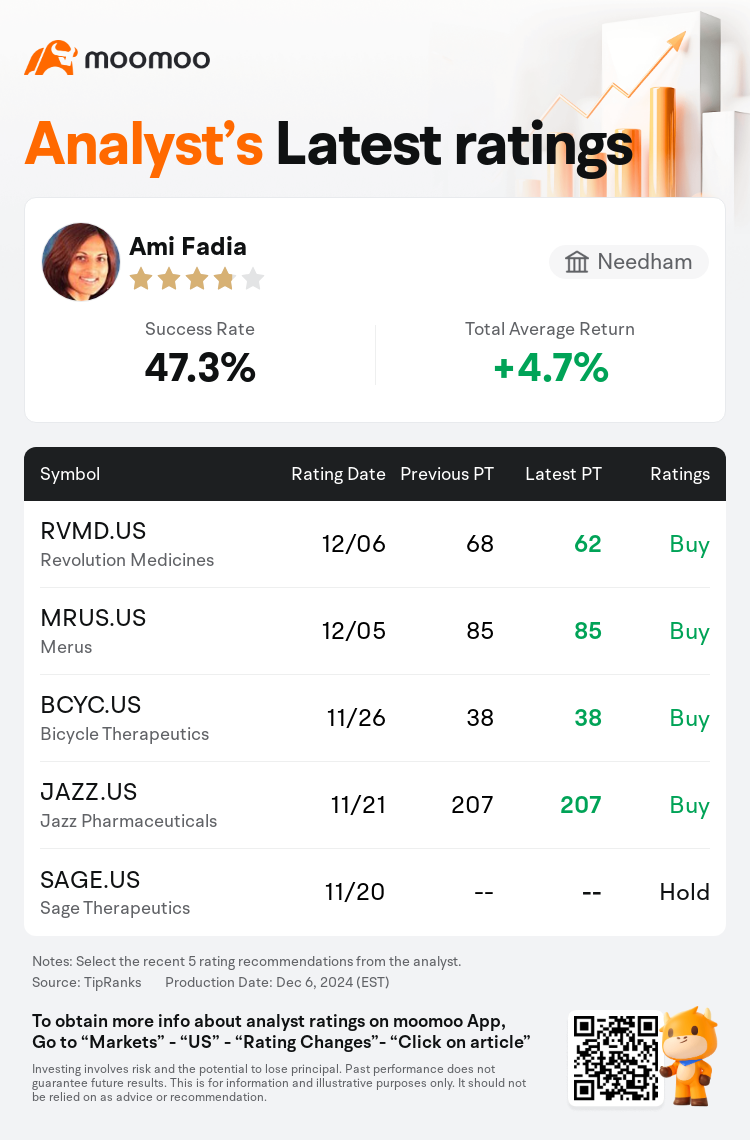

Needham analyst Ami Fadia maintains $Revolution Medicines (RVMD.US)$ with a buy rating, and adjusts the target price from $68 to $62.

According to TipRanks data, the analyst has a success rate of 47.3% and a total average return of 4.7% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Revolution Medicines (RVMD.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Revolution Medicines (RVMD.US)$'s main analysts recently are as follows:

The firm adjusted its valuation model following Revolution Medicines' completion of an upsized public offering totaling $862.5M in common stock. The firm still perceives significant potential in Revolution Medicines' RAS-ON platform, highlighting the prospect of combining two RAS-ON drugs or using them in conjunction with other treatments.

Revolution Medicines initiated a stock offering of roughly 19M common shares and about 2.17M in pre-funded warrants priced at $46 per share, thereby raising total gross proceeds of $862.5M. This strategic financial move came on the heels of new positive clinical data for RMC-6236 in treating non-small cell lung cancer, which demonstrated a promising 38% overall response rate and a median progression-free survival of 9.8 months in third-line RAS-mutant NSCLC patients. Analysts continue to believe that RAS(ON) inhibitors will significantly alter the standard of care across several RAS-mutant solid tumors, including non-small cell lung cancer and pancreatic ductal adenocarcinoma, suggesting that the recent market adjustments present a favorable buying opportunity for investors in Revolution Medicines.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

Needham分析師Ami Fadia維持$Revolution Medicines (RVMD.US)$買入評級,並將目標價從68美元下調至62美元。

根據TipRanks數據顯示,該分析師近一年總勝率為47.3%,總平均回報率為4.7%。

此外,綜合報道,$Revolution Medicines (RVMD.US)$近期主要分析師觀點如下:

此外,綜合報道,$Revolution Medicines (RVMD.US)$近期主要分析師觀點如下:

該公司在小基站-5g完成總額爲86250萬美元的普通股份公開發行之後調整了其估值模型。該公司仍然認爲在revolution medicines的RAS-ON平台中存在重大潛力,強調了結合兩種RAS-ON藥物或與其他治療方法聯合使用的前景。

revolution medicines發起了一項大約1900萬普通股和約217萬預資劵的股票發行,發行價爲46美元每股,從而籌集了總計86250萬美元的總權利淨收益。這一戰略性財務舉措是基於對RMC-6236在治療非小細胞肺癌方面的新積極臨床數據,該數據顯示在三線RAS突變NSCLC患者中,RMC-6236表現出令人期待的38%總體反應率和中位無病進展生存時間高達9.8個月。分析師繼續認爲RAS(ON)抑制劑將顯著改變幾種RAS突變的固體腫瘤的標準治療方法,包括非小細胞肺癌和胰腺導管腺癌,暗示最近的市場調整爲revolution medicines的投資者提供了有利的買入機會。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Revolution Medicines (RVMD.US)$近期主要分析師觀點如下:

此外,綜合報道,$Revolution Medicines (RVMD.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of