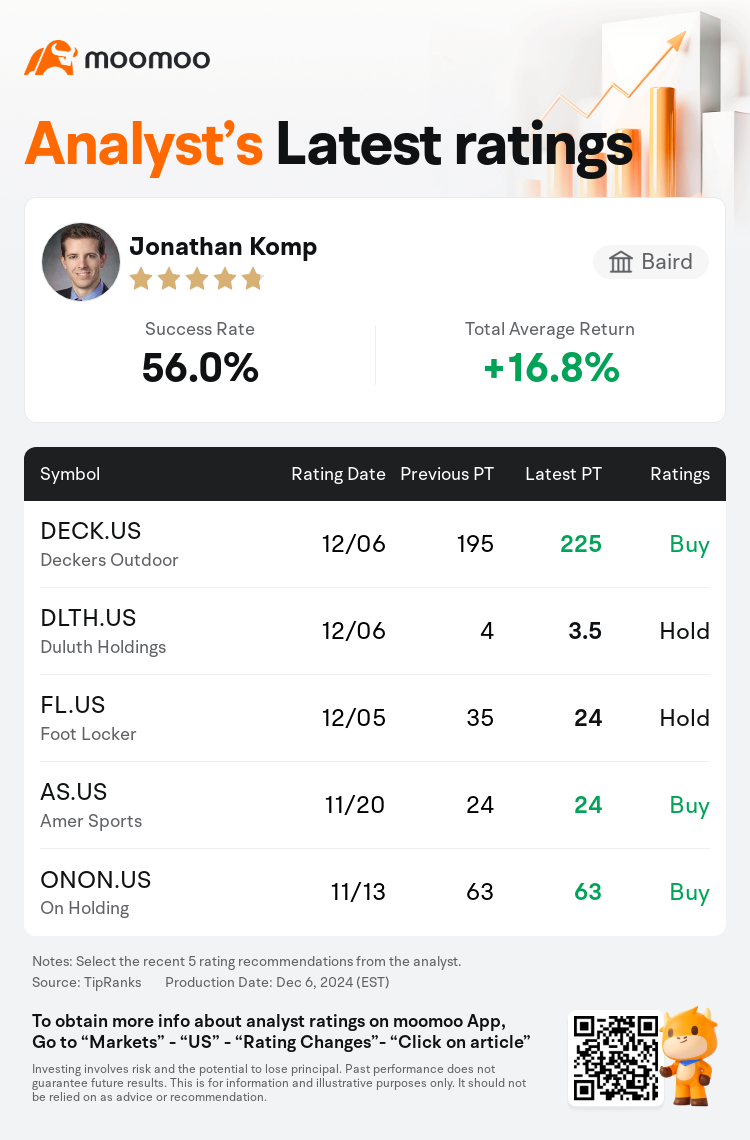

Baird analyst Jonathan Komp maintains $Deckers Outdoor (DECK.US)$ with a buy rating, and adjusts the target price from $195 to $225.

According to TipRanks data, the analyst has a success rate of 56.0% and a total average return of 16.8% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Deckers Outdoor (DECK.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Deckers Outdoor (DECK.US)$'s main analysts recently are as follows:

The company recently held a product-focused meeting with senior executives and brand leaders, which was not aimed at short-term outcomes but maintained a continued bullish tone about the business. Key opportunities spanning innovation, international markets, and direct-to-consumer strategies were highlighted during this meeting.

Following recent observations at FFANY Market Week, encouragement was derived from Deckers Outdoor's new initiatives, including effective distribution management, enhanced customer acquisition strategies, and prioritization of innovation. Additionally, excitement continues to build around the revamped launches of the Bondi and Clifton models under the HOKA brand, prominently featured at an event hosted by Deckers.

During a recent product open house attended by company management, it was evident that there is a palpable confidence in the future performance of the brands, bolstered by significant product launches planned for 2025 and subsequent brand-building efforts aimed at sustaining growth. The outlook is positive with expectations of continued earnings growth as the brands expand.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

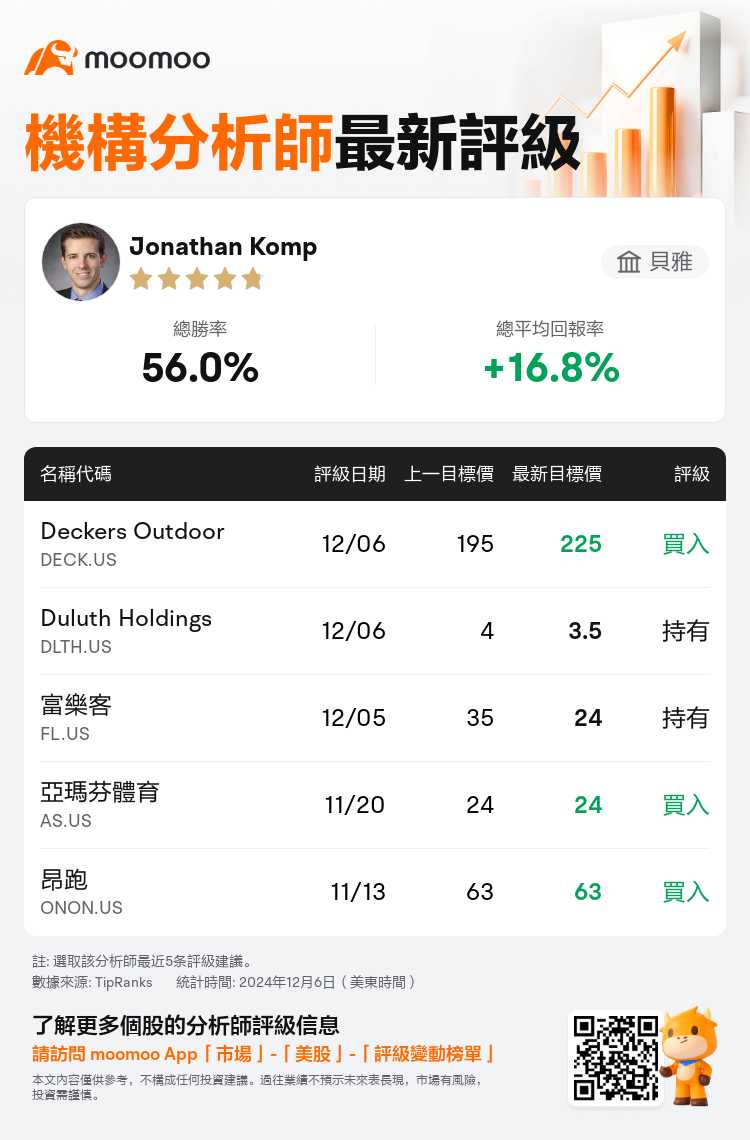

貝雅分析師Jonathan Komp維持$Deckers Outdoor (DECK.US)$買入評級,並將目標價從195美元上調至225美元。

根據TipRanks數據顯示,該分析師近一年總勝率為56.0%,總平均回報率為16.8%。

此外,綜合報道,$Deckers Outdoor (DECK.US)$近期主要分析師觀點如下:

此外,綜合報道,$Deckers Outdoor (DECK.US)$近期主要分析師觀點如下:

該公司最近與高級管理人員和品牌領導者舉行了一次以產品爲重點的會議,會議不旨在實現短期結果,而是保持了對業務的持續看好的態度。在此次會議中,強調了跨越創新、國際市場和直接面向消費者策略的關鍵機遇。

在最近的FFANY市場周觀察後,從deckers outdoor的新舉措中獲得了鼓舞,包括有效的分銷管理、提升客戶獲取策略及優先考慮創新。此外,圍繞HOKA品牌下Bondi和Clifton系列的重新發布的興奮感也在持續提升,這些產品在deckers舉辦的一次活動中得到了特色展示。

在最近一次公司管理層參加的產品開放日上,可以明顯感受到對品牌未來表現的信懇智能,這源於計劃於2025年推出的重大產品以及隨後旨在維持增長的品牌建設努力。展望積極,預計隨着品牌的擴展,將繼續實現盈利增長。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Deckers Outdoor (DECK.US)$近期主要分析師觀點如下:

此外,綜合報道,$Deckers Outdoor (DECK.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of