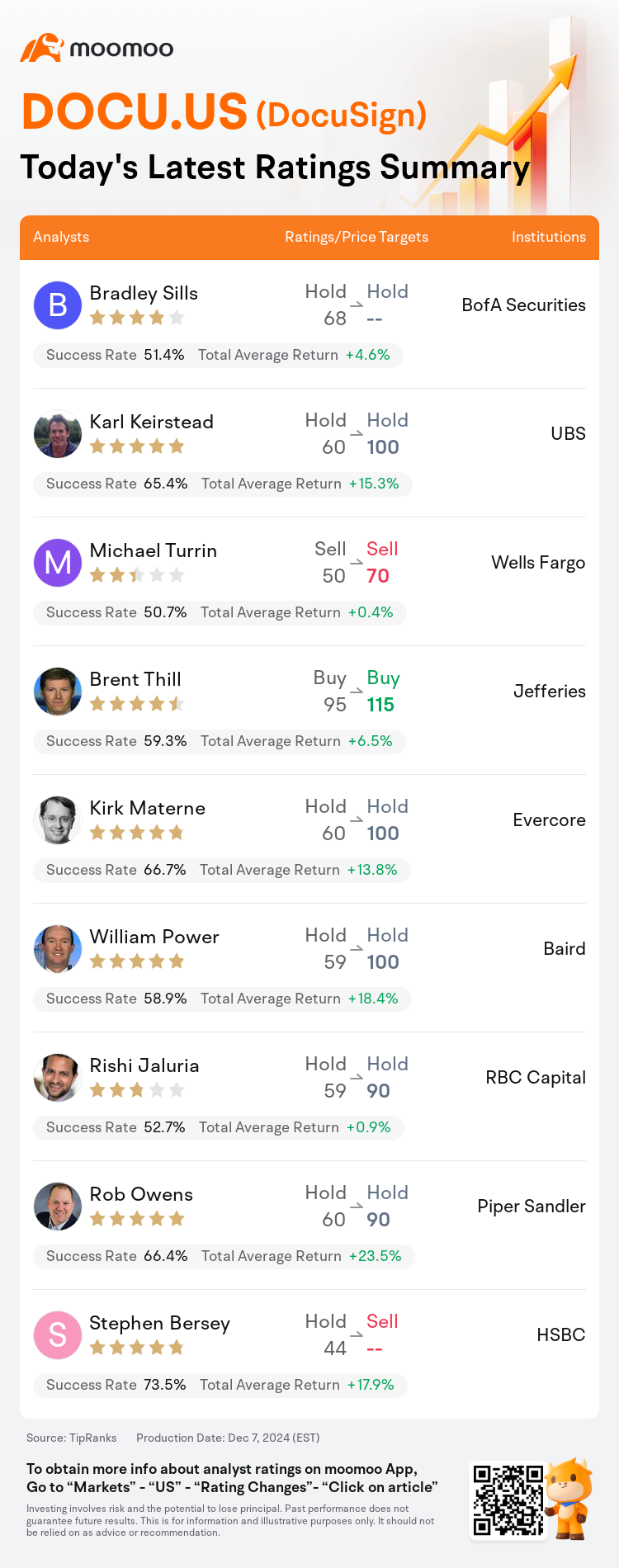

On Dec 07, major Wall Street analysts update their ratings for $DocuSign (DOCU.US)$, with price targets ranging from $70 to $115.

BofA Securities analyst Bradley Sills maintains with a hold rating.

UBS analyst Karl Keirstead maintains with a hold rating, and adjusts the target price from $60 to $100.

Wells Fargo analyst Michael Turrin maintains with a sell rating, and adjusts the target price from $50 to $70.

Wells Fargo analyst Michael Turrin maintains with a sell rating, and adjusts the target price from $50 to $70.

Jefferies analyst Brent Thill maintains with a buy rating, and adjusts the target price from $95 to $115.

Evercore analyst Kirk Materne maintains with a hold rating, and adjusts the target price from $60 to $100.

Furthermore, according to the comprehensive report, the opinions of $DocuSign (DOCU.US)$'s main analysts recently are as follows:

DocuSign is successfully implementing its strategic plan, evidenced by 'several encouraging trends' that contributed to outperformance in the third quarter and surpassed expectations for fourth-quarter billings. Fundamentally, metrics and commentary indicated stabilization or improvement. However, significant share outperformance and stock prices in the mid-$90s after hours indicate that a positive future trajectory is already accounted for in the current share prices.

DocuSign showed a stronger performance after two quarters of mixed results, emphasizing this quarter with a notable billings surplus and the CEO expressing confidence in a return to over 10% growth. It was reported that the core business is stabilizing, with improvements noted in the operating environment, and previous concerns about 'deal timing' and challenging economic conditions were no longer mentioned.

DocuSign delivered a very strong Q3 showing a 'beat-and-raise' performance across all areas, which included a notable increase in billings and a re-acceleration of subscription revenue. The various growth signals from the company continue to inspire confidence.

DocuSign reported a strong quarter that surpassed expectations, marked by an acceleration in billings. Though there is improvement in the core business, the potential for significant acceleration depends on the development of DocuSign's IAM platform, which is still in its early stages.

DocuSign reported results that were notably strong, highlighted by billings that exceeded expectations as renewals stabilized and volumes improved.

Here are the latest investment ratings and price targets for $DocuSign (DOCU.US)$ from 9 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間12月7日,多家華爾街大行更新了$DocuSign (DOCU.US)$的評級,目標價介於70美元至115美元。

美銀證券分析師Bradley Sills維持持有評級。

瑞士銀行分析師Karl Keirstead維持持有評級,並將目標價從60美元上調至100美元。

富國集團分析師Michael Turrin維持賣出評級,並將目標價從50美元上調至70美元。

富國集團分析師Michael Turrin維持賣出評級,並將目標價從50美元上調至70美元。

富瑞集團分析師Brent Thill維持買入評級,並將目標價從95美元上調至115美元。

Evercore分析師Kirk Materne維持持有評級,並將目標價從60美元上調至100美元。

此外,綜合報道,$DocuSign (DOCU.US)$近期主要分析師觀點如下:

docusign成功地實施了其戰略計劃,憑藉'幾個令人鼓舞的趨勢'的證據,促成了第三季度的表現超出預期,並超過了對第四季度賬單的預期。從根本上看,指標和評論表明穩定或改善。然而,顯著的分享表現和盤後股價在90美元中間顯示出,未來的積極發展已在當前的股價中體現。

在經歷了兩個季度的混合結果後,docusign的表現更爲強勁,強調本季度有顯著的賬單盈餘,CEO表達了對恢復10%以上增長的信懇智能。報道稱,核心業務正在穩定,營業環境有所改善,之前關於'交易時機'和艱難經濟條件的擔憂不再被提及。

docusign在第三季度交出了一份非常強勁的成績單,展示了'超預期和提高'的表現,涵蓋所有板塊,包括賬單的顯著增加和訂閱營業收入的重新加速。公司各項增長信號繼續激發信懇智能。

docusign報告了一季度強勁的業績,超出了預期,以賬單的加速爲標誌。儘管核心業務有所改善,但顯著加速的潛力取決於docusign的iam平台的發展,而該平台仍處於早期階段。

docusign報告的業績顯著強勁,賬單超過預期,續訂穩定,交易量改善,這些都成爲亮點。

以下爲今日9位分析師對$DocuSign (DOCU.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

富國集團分析師Michael Turrin維持賣出評級,並將目標價從50美元上調至70美元。

富國集團分析師Michael Turrin維持賣出評級,並將目標價從50美元上調至70美元。

Wells Fargo analyst Michael Turrin maintains with a sell rating, and adjusts the target price from $50 to $70.

Wells Fargo analyst Michael Turrin maintains with a sell rating, and adjusts the target price from $50 to $70.