- 要聞

- 投資者對西維斯健康公司(紐交所:CVS)持觀望態度

Investors Holding Back On CVS Health Corporation (NYSE:CVS)

Investors Holding Back On CVS Health Corporation (NYSE:CVS)

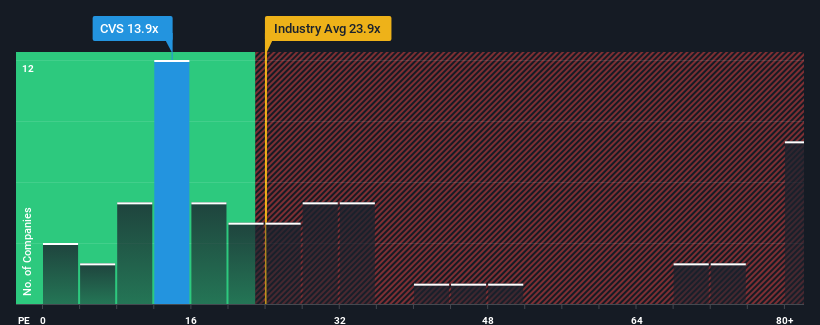

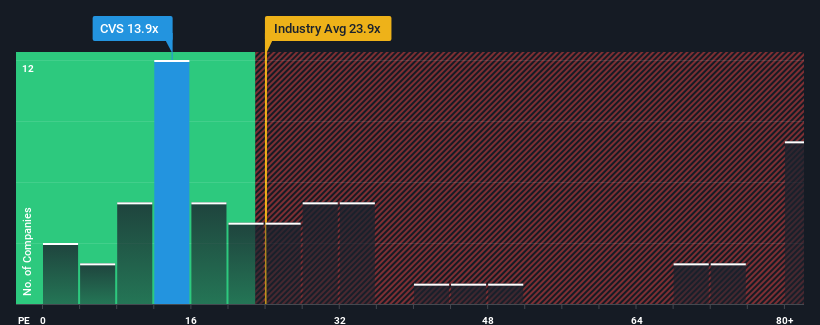

With a price-to-earnings (or "P/E") ratio of 13.9x CVS Health Corporation (NYSE:CVS) may be sending bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 20x and even P/E's higher than 36x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

CVS Health hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as CVS Health's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 41% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 31% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Retrospectively, the last year delivered a frustrating 41% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 31% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 19% each year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 11% per year, which is noticeably less attractive.

With this information, we find it odd that CVS Health is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On CVS Health's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that CVS Health currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 3 warning signs for CVS Health (1 is concerning!) that we have uncovered.

Of course, you might also be able to find a better stock than CVS Health. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

CVS健康公司(紐交所:CVS)的市盈率爲13.9倍,可能正在發出積極信號,因爲幾乎一半的美國公司市盈率超過20倍,甚至超過36倍的市盈率也並不飛凡。然而,市盈率低可能是有原因的,需要進一步調查以判斷是否合理。

最近CVS健康的表現不佳,由於其收益下降,與其他公司相比顯得不夠理想,而其他公司平均上有一定的增長。似乎許多人預計這種低迷的收益表現將持續,這抑制了市盈率。如果你仍然喜歡這家公司,你會希望情況不是這樣,以便你可以在它不受歡迎時買入一些股票。

增長是否符合低市盈率?

你對CVS健康的市盈率如此之低會感到真正舒適的唯一情況是公司的增長速度有望落後於市場。

回顧過去一年,公司利潤下降了令人沮喪的41%。這意味着它在更長的時間內也經歷了收益的下降,因爲每股收益在過去三年中總共下降了31%。因此,股東們對中期的收益增長率感到沮喪。

回顧過去一年,公司利潤下降了令人沮喪的41%。這意味着它在更長的時間內也經歷了收益的下降,因爲每股收益在過去三年中總共下降了31%。因此,股東們對中期的收益增長率感到沮喪。

展望未來,分析師對公司的預測顯示,收益在未來三年每年應該增長19%。與此同時,市場的其餘部分預計每年只會擴張11%,這顯然吸引力較低。

根據這些信息,我們發現西維斯健康的市盈率低於市場。這顯然讓一些股東對預測感到懷疑,接受了顯著較低的賣出價格。

西維斯健康市盈率的底線

雖然市盈率不應是您是否購買股票的決定性因素,但它是企業盈利預期的比較良好的指標。

我們已經確定,西維斯健康的市盈率目前遠低於預期,因爲其預測增長高於更廣泛的市場。當我們看到強勁的收益前景和快於市場的增長時,我們假設潛在風險可能對市盈率施加了重大壓力。看來許多人確實在預期收益的不穩定,因爲這些條件通常應該會推動股價上漲。

在您採取下一步之前,您應該了解我們發現的西維斯健康的三個警告信號(其中一個令人擔憂!)。

當然,您也可以找到比西維斯健康更好的股票。因此,您可能希望查看這份免費收集的其他公司,它們的市盈率合理且收益增長強勁。

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Moomoo Securities Australia Limited提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Moomoo Securities Australia Limited, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

風險及免責聲明

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Moomoo Securities Australia Limited提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Moomoo Securities Australia Limited, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用瀏覽器的分享功能,分享給你的好友吧