Recent 5.1% Pullback Isn't Enough to Hurt Long-term JiangSu WuZhong Pharmaceutical Development (SHSE:600200) Shareholders, They're Still up 100% Over 5 Years

Recent 5.1% Pullback Isn't Enough to Hurt Long-term JiangSu WuZhong Pharmaceutical Development (SHSE:600200) Shareholders, They're Still up 100% Over 5 Years

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. To wit, the JiangSu WuZhong Pharmaceutical Development share price has climbed 100% in five years, easily topping the market return of 19% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 15%.

While the stock has fallen 5.1% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

JiangSu WuZhong Pharmaceutical Development wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years JiangSu WuZhong Pharmaceutical Development saw its revenue grow at 3.4% per year. Put simply, that growth rate fails to impress. The modest growth is probably broadly reflected in the share price, which is up 15%, per year over 5 years. The business could be one worth watching but we generally prefer faster revenue growth.

In the last 5 years JiangSu WuZhong Pharmaceutical Development saw its revenue grow at 3.4% per year. Put simply, that growth rate fails to impress. The modest growth is probably broadly reflected in the share price, which is up 15%, per year over 5 years. The business could be one worth watching but we generally prefer faster revenue growth.

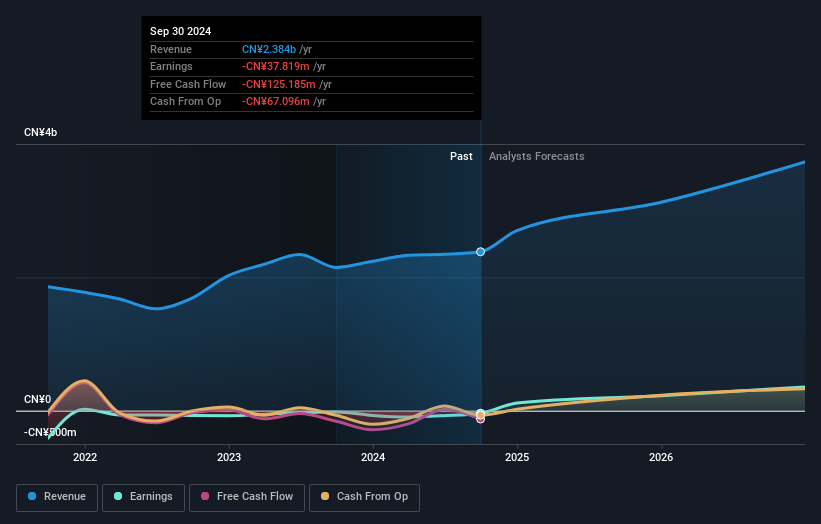

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on JiangSu WuZhong Pharmaceutical Development's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that JiangSu WuZhong Pharmaceutical Development shareholders have received a total shareholder return of 15% over one year. Having said that, the five-year TSR of 15% a year, is even better. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.