Wall Street's Most Accurate Analysts Spotlight On 3 Utilities Stocks Delivering High-Dividend Yields

Wall Street's Most Accurate Analysts Spotlight On 3 Utilities Stocks Delivering High-Dividend Yields

華爾街最準確的分析師重點關注3只公用事業股,獲得高股息收益。

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

在市場動盪和不確定時期,許多投資者會選擇高股息股票。這些公司通常具有高自由現金流,並以高股息回報股東。

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Benzinga的讀者可以通過訪問分析師股票評級頁面來查看他們最喜歡的股票的最新分析師看法。交易者可以在Benzinga龐大的分析師評級數據庫中進行排序,包括按分析師的準確性。

Below are the ratings of the most accurate analysts for three high-yielding stocks in the utilities sector.

以下是公用事業板塊三個高股息股票最準確的分析師的評級。

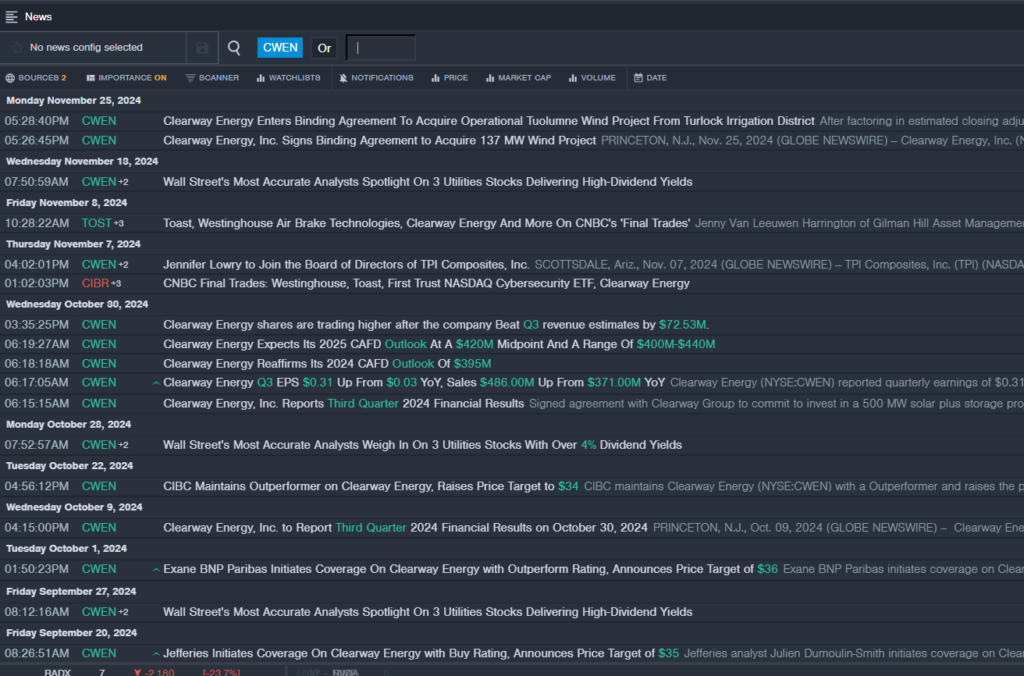

Clearway Energy, Inc. (NYSE:CWEN)

Clearway Energy公司(紐交所股票代碼:CWEN)

- Dividend Yield: 5.94%

- Jefferies analyst Julien Dumoulin-Smith initiated coverage on the stock with a Buy rating and a price target of $35 on Sept. 20. This analyst has an accuracy rate of 65%.

- Morgan Stanley analyst Robert Kad upgraded the stock from Equal-Weight to Overweight and raised the price target from $25 to $36 on July 31. This analyst has an accuracy rate of 80%.

- Recent News: On Nov. 25, Clearway Energy entered into binding agreement to acquire Operational Tuolumne Wind Project from Turlock Irrigation District.

- Benzinga Pro's real-time newsfeed alerted to latest CWEN news

- 股息收益率:5.94%

- 傑富瑞分析師Julien Dumoulin-Smith於9月20日以買入評級和35美元的目標價啓動了對該股票的 coverage。這位分析師的準確率爲65%。

- 摩根士丹利分析師Robert Kad將該股票評級從持平上調至超配,並將目標價從25美元提高至36美元,時間爲7月31日。這位分析師的準確率爲80%。

- 最新資訊:11月25日,Clearway Energy與Turlock Irrigation District達成了收購Operational Tuolumne Wind Project的具有約束力的協議。

- Benzinga Pro的實時資訊提醒了最新的CWEN新聞

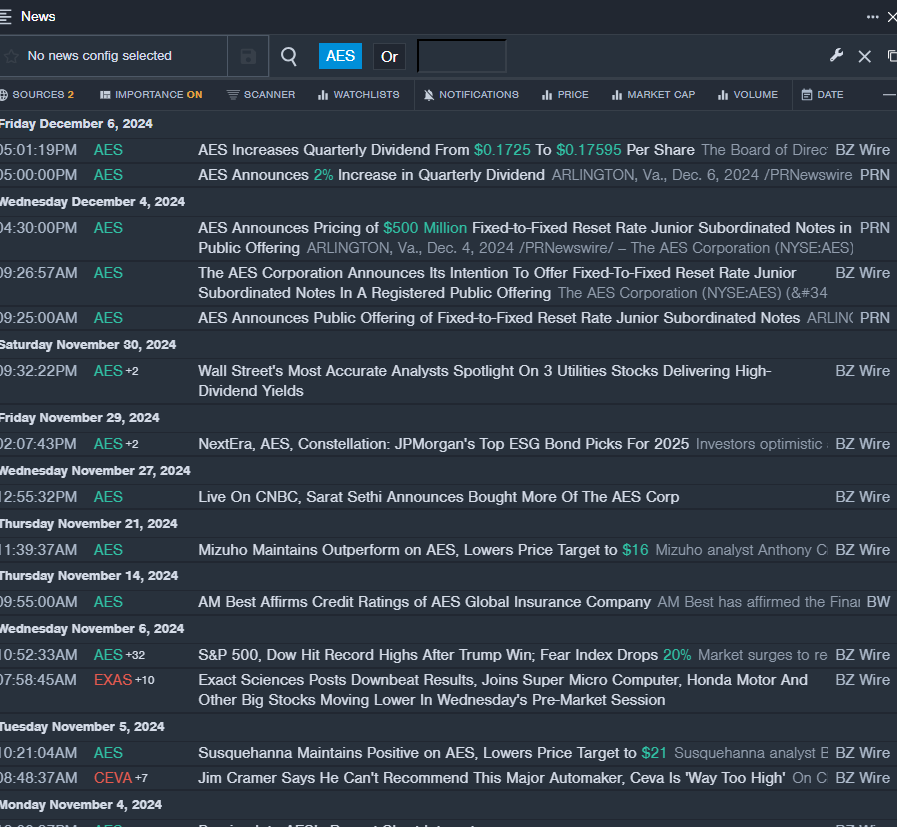

The AES Corporation (NYSE:AES)

The AES Corporation (NYSE:AES)

- Dividend Yield: 5.07%

- Mizuho analyst Anthony Crowdell maintained an Outperform rating and cut the price target from $24 to $16 on Nov. 21. This analyst has an accuracy rate of 64%.

- Barclays analyst Nicholas Campanella maintained an Overweight rating and raised the price target from $22 to $23 on Oct. 21. This analyst has an accuracy rate of 66%.

- Recent News: On Dec. 6, AES announced a 2% increase in quarterly dividend.

- Benzinga Pro's real-time newsfeed alerted to latest AES news

- 股息收益率:5.07%

- 瑞穗分析師Anthony Crowdell維持了跑贏大盤的評級,並在11月21日將目標價格從24美元下調至16美元。該分析師的準確率爲64%。

- 巴克萊銀行分析師Nicholas Campanella維持了增持評級,並在10月21日將目標價格從22萬億美元上調至23美元。該分析師的準確率爲66%。

- 最新資訊:在12月6日,AES宣佈季度股息增加2%。

- Benzinga Pro的實時資訊提醒了最新的AES新聞

Eversource Energy (NYSE:ES)

Eversource Energy (紐交所:ES)

- Dividend Yield: 4.75%

- Jefferies analyst Paul Zimbardo initiated coverage on the stock with an Underperform rating and a price target of $52 on Dec. 3. This analyst has an accuracy rate of 77%.

- Barclays analyst Eric Beaumont maintained an Equal-Weight rating and raised the price target from $69 to $72 on Oct. 15. This analyst has an accuracy rate of 70%.

- Recent News: On Nov. 4, Eversource Energy posted upbeat quarterly earnings.

- Benzinga Pro's charting tool helped identify the trend in ES stock.

- 股息收益率:4.75%

- 傑富瑞分析師保羅·津巴爾多於12月3日對該股票發起了覆蓋,給予了低於大盤的評級,目標價爲52美元。該分析師的準確率爲77%。

- 巴克萊銀行分析師埃裏克·博蒙特維持了中性評級,並將目標價從69萬億提高至72美元,日期爲10月15日。該分析師的準確率爲70%。

- 最新資訊:11月4日,Eversource Energy公佈了樂觀的季度收益。

- Benzinga Pro的圖表工具幫助識別了ES股票的趨勢。

Read More:

閱讀更多:

- S&P 500, Nasdaq Retreat From Record Highs As Nvidia Declines Over Chinese Antitrust Concerns: Fear & Greed Index Remains In 'Neutral' Zone

- S&P 500、納斯達克從歷史高點回落,因英偉達因中國反壟斷擔憂而下跌:恐懼與貪婪指數保持在「中立」區間。