$1000 Invested In Motorola Solns 10 Years Ago Would Be Worth This Much Today

$1000 Invested In Motorola Solns 10 Years Ago Would Be Worth This Much Today

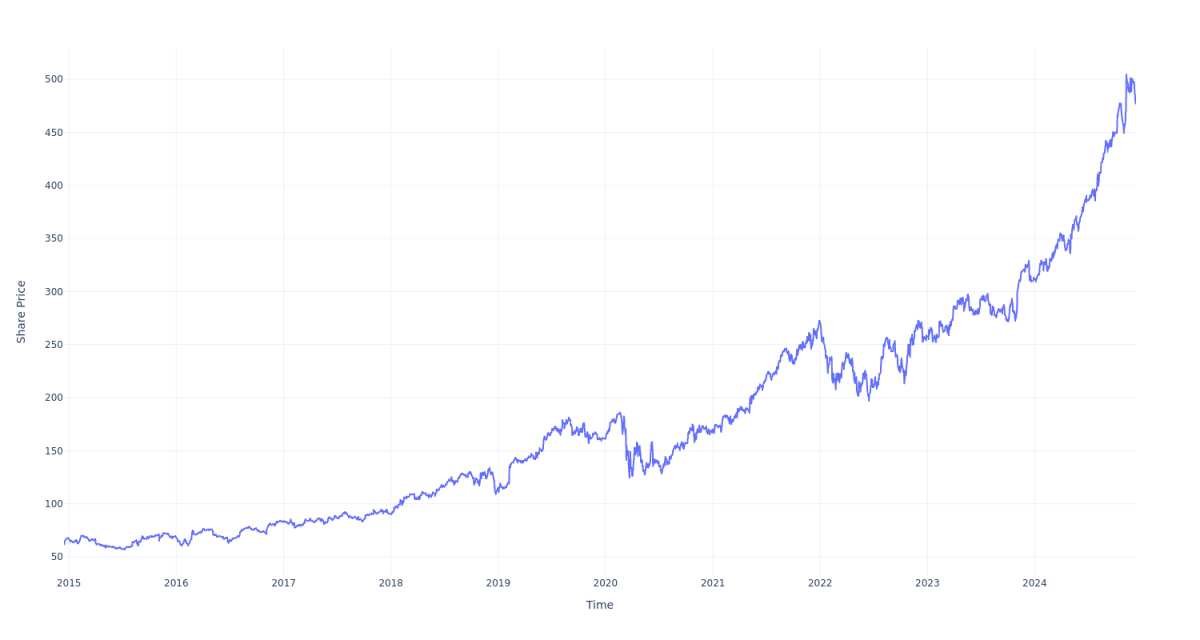

Motorola Solns (NYSE:MSI) has outperformed the market over the past 10 years by 10.85% on an annualized basis producing an average annual return of 22.72%. Currently, Motorola Solns has a market capitalization of $79.90 billion.

摩托羅拉索爾恩斯(紐約證券交易所代碼:MSI)在過去10年中按年計算的表現比市場高出10.85%,平均年回報率爲22.72%。目前,摩托羅拉Solns的市值爲799.0億美元。

Buying $1000 In MSI: If an investor had bought $1000 of MSI stock 10 years ago, it would be worth $7,722.66 today based on a price of $478.11 for MSI at the time of writing.

購買1000美元的微星股票:如果投資者在10年前購買了1000美元的微星股票,那麼根據撰寫本文時微星478.11美元的價格計算,今天的價值將達到7,722.66美元。

Motorola Solns's Performance Over Last 10 Years

摩托羅拉 Solns 過去 10 年的表現

Finally -- what's the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

最後 —— 這一切有什麼意義?從本文中得出的關鍵見解是注意複合回報在一段時間內可以爲您的現金增長帶來多大的差異。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自動化內容引擎生成,並由編輯審閱。