Unpacking the Latest Options Trading Trends in Amgen

Unpacking the Latest Options Trading Trends in Amgen

Investors with a lot of money to spend have taken a bullish stance on Amgen (NASDAQ:AMGN).

擁有大量資金的投資者對安進(納斯達克:AMGN)持看好態度。

And retail traders should know.

零售交易者應該了解這一點。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我們今天注意到這一點,當交易出現在我們在Benzinga跟蹤的公共可用期權歷史記錄中時。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with AMGN, it often means somebody knows something is about to happen.

我們不知道這些是機構還是僅僅是富有的個人。但當AMGN發生如此重大事件時,通常意味着有人知道即將發生的事情。

So how do we know what these investors just did?

那麼我們怎麼知道這些投資者剛剛做了什麼呢?

Today, Benzinga's options scanner spotted 11 uncommon options trades for Amgen.

今天,Benzinga的期權掃描儀發現了11筆安進的期權異動。

This isn't normal.

這並不正常。

The overall sentiment of these big-money traders is split between 45% bullish and 36%, bearish.

這些大資金交易者的整體情緒在45%的看好和36%的看淡之間分歧。

Out of all of the special options we uncovered, 6 are puts, for a total amount of $372,685, and 5 are calls, for a total amount of $171,796.

在我們發現的所有特殊期權中,有6個是看跌期權,總金額爲372,685美元,5個是看漲期權,總金額爲171,796美元。

What's The Price Target?

價格目標是什麼?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $220.0 and $282.5 for Amgen, spanning the last three months.

經過對成交量和未平倉合約的評估,很明顯主要市場動向在於安進的價格區間在220.0美元到282.5美元之間,涵蓋了過去三個月。

Insights into Volume & Open Interest

成交量和持倉量分析

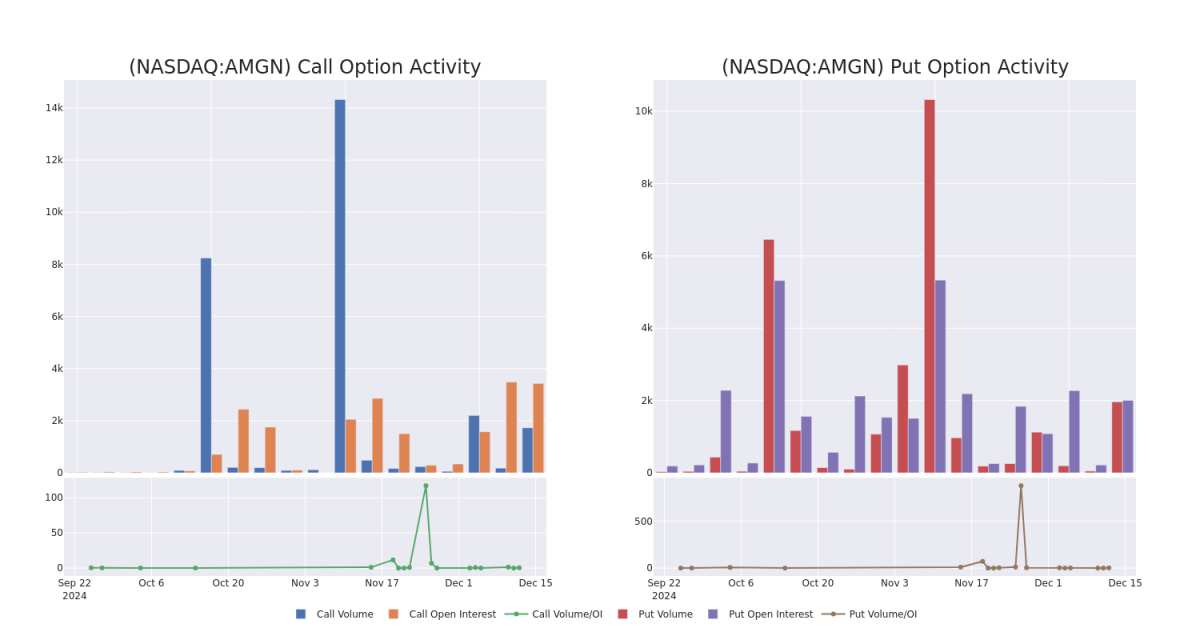

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Amgen's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Amgen's substantial trades, within a strike price spectrum from $220.0 to $282.5 over the preceding 30 days.

評估成交量和未平倉合約是期權交易中的一個戰略步驟。這些指標揭示了安進的期權在指定行使價格下的流動性和投資者興趣。接下來的數據將展示過去30天中與安進大量交易相關的看漲和看跌期權的成交量和未平倉合約的波動,行使價格範圍爲220.0美元到282.5美元。

Amgen Call and Put Volume: 30-Day Overview

安進看漲和看跌成交量:30天概述

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMGN | PUT | SWEEP | BULLISH | 12/20/24 | $4.05 | $3.85 | $3.85 | $270.00 | $152.0K | 1.3K | 822 |

| AMGN | PUT | SWEEP | BULLISH | 12/20/24 | $4.3 | $3.95 | $3.95 | $270.00 | $54.9K | 1.3K | 148 |

| AMGN | PUT | SWEEP | NEUTRAL | 12/20/24 | $3.1 | $2.86 | $2.98 | $267.50 | $50.4K | 625 | 170 |

| AMGN | PUT | SWEEP | NEUTRAL | 12/20/24 | $3.75 | $2.69 | $2.94 | $267.50 | $45.0K | 625 | 180 |

| AMGN | PUT | SWEEP | BULLISH | 12/20/24 | $4.25 | $3.85 | $3.85 | $270.00 | $43.8K | 1.3K | 427 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMGN | 看跌 | 掃單 | 看好 | 12/20/24 | $4.05 | $3.85 | $3.85 | $270.00 | $152.0K | 1.3K | 822 |

| AMGN | 看跌 | 掃單 | 看好 | 12/20/24 | $4.3 | $3.95 | $3.95 | $270.00 | $54.9K | 1.3K | 148 |

| AMGN | 看跌 | 掃單 | 中立 | 12/20/24 | $3.1 | $2.86 | $2.98 | $267.50 | $50.4K | 625 | 170 |

| AMGN | 看跌 | 掃單 | 中立 | 12/20/24 | $3.75 | $2.69 | $2.94 | $267.50 | $45.0K | 625 | 180 |

| AMGN | 看跌 | 掃單 | 看好 | 12/20/24 | $4.25 | $3.85 | $3.85 | $270.00 | $43.8K | 1.3K | 427 |

About Amgen

關於安進

Amgen is a leader in biotechnology-based human therapeutics. Flagship drugs include red blood cell boosters Epogen and Aranesp, immune system boosters Neupogen and Neulasta, and Enbrel and Otezla for inflammatory diseases. Amgen introduced its first cancer therapeutic, Vectibix, in 2006 and markets bone-strengthening drug Prolia/Xgeva (approved 2010) and Evenity (2019). The acquisition of Onyx bolstered the firm's therapeutic oncology portfolio with Kyprolis. Recent launches include Repatha (cholesterol-lowering), Aimovig (migraine), Lumakras (lung cancer), and Tezspire (asthma). The 2023 Horizon acquisition brings several rare-disease drugs, including thyroid eye disease drug Tepezza. Amgen also has a growing biosimilar portfolio.

安進是生物技術基礎的人類治療藥物領域的領導者。旗艦產品包括紅細胞增強劑Epogen和Aranesp,免疫系統增強劑Neupogen和Neulasta,以及用於炎症疾病的Enbrel和Otezla。安進於2006年推出其首個癌症治療藥物Vectibix,並且市場上還有加強骨骼的藥物Prolia/Xgeva(批准於2010年)和Evenity(2019年)。收購Onyx增強了公司的腫瘤治療組合,包括Kyprolis。近期推出的藥物包括Repatha(降膽固醇)、Aimovig(治療偏頭痛)、Lumakras(肺癌)和Tezspire(哮喘)。2023年的Horizon收購帶來了幾款罕見疾病藥物,包括甲狀腺眼病藥物Tepezza。安進還在不斷擴展其生物類似藥組合。

Following our analysis of the options activities associated with Amgen, we pivot to a closer look at the company's own performance.

根據我們對安進相關期權活動的分析,我們轉向更詳細地觀察公司的自身表現。

Amgen's Current Market Status

Amgen的當前市場狀況

- Currently trading with a volume of 1,698,248, the AMGN's price is down by -0.17%, now at $272.95.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 54 days.

- 目前成交量爲1,698,248,安進的價格下跌了-0.17%,當前爲$272.95。

- RSI讀數表明該股票當前可能接近超賣。

- 預計收益發布將在54天后。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:聰明資金正在行動

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期權異動板塊在市場發生變化之前發現潛在的市場動向。看看大資金在你喜歡的股票上採取了什麼倉位。點擊這裏獲取訪問權限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅僅交易股票相比,期權是一種風險較高的資產,但它們具有更高的盈利潛力。嚴肅的期權交易者通過日常學習、逐步進出交易、關注多個因子以及密切關注市場來管理這種風險。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with AMGN, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with AMGN, it often means somebody knows something is about to happen.