What the Options Market Tells Us About IBM

What the Options Market Tells Us About IBM

Whales with a lot of money to spend have taken a noticeably bullish stance on IBM.

有大量資金的鯨魚對IBM表現出了顯著的看好態度。

Looking at options history for IBM (NYSE:IBM) we detected 14 trades.

查看IBM(紐交所:IBM)的期權歷史,我們檢測到了14筆交易。

If we consider the specifics of each trade, it is accurate to state that 42% of the investors opened trades with bullish expectations and 42% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,42%的投資者以看漲預期開立了交易,42%則持看淡態度。

From the overall spotted trades, 2 are puts, for a total amount of $130,410 and 12, calls, for a total amount of $375,154.

在觀察到的所有交易中,有2筆是看跌期權,總金額爲130,410美元,12筆是看漲期權,總金額爲375,154美元。

Predicted Price Range

預測價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $170.0 and $250.0 for IBM, spanning the last three months.

在評估了交易量和未平倉合約後,明顯可以看出,主要市場參與者關注於IBM的價格區間在170.0美元到250.0美元之間,持續了過去三個月。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

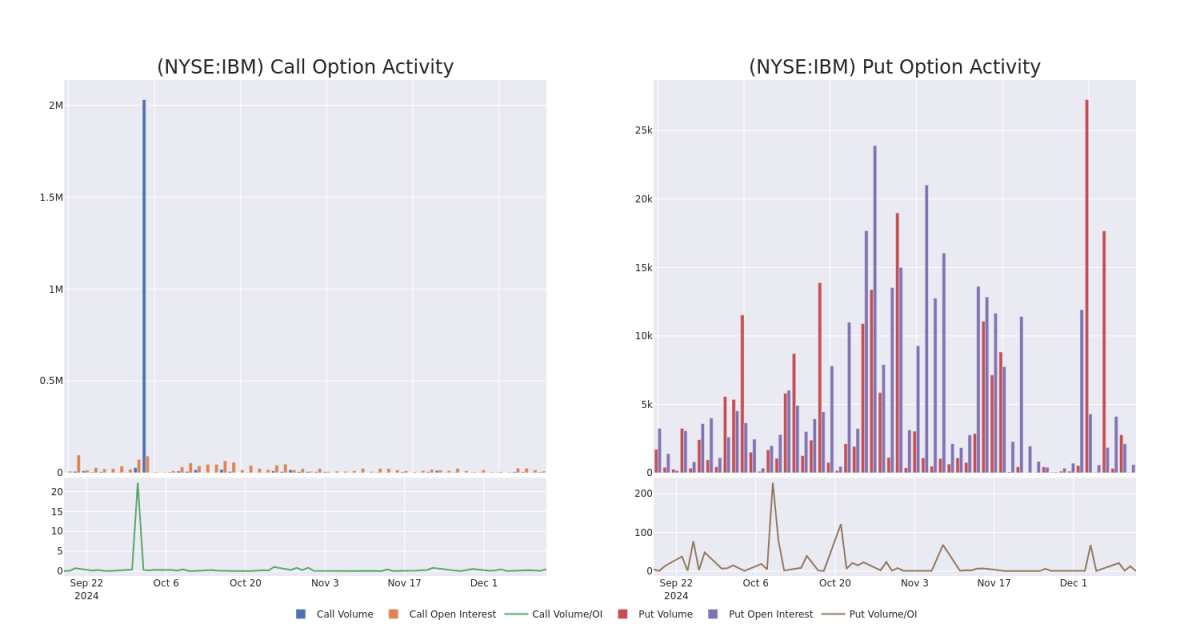

In today's trading context, the average open interest for options of IBM stands at 1211.0, with a total volume reaching 4,352.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in IBM, situated within the strike price corridor from $170.0 to $250.0, throughout the last 30 days.

在今天的交易環境中,IBM期權的平均未平倉合約爲1211.0,總成交量達到4,352.00。附帶的圖表描繪了在過去30天內IBM高價值交易的看漲和看跌期權的成交量和未平倉合約的變化,位於170.0美元到250.0美元的行權價格區間內。

IBM Option Volume And Open Interest Over Last 30 Days

IBM過去30天的期權成交量和持倉量

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IBM | PUT | SWEEP | BEARISH | 02/21/25 | $12.6 | $12.55 | $12.6 | $235.00 | $89.4K | 390 | 4 |

| IBM | CALL | TRADE | NEUTRAL | 01/16/26 | $70.1 | $68.1 | $69.06 | $170.00 | $48.3K | 516 | 7 |

| IBM | PUT | SWEEP | BULLISH | 06/20/25 | $16.2 | $15.75 | $15.75 | $230.00 | $40.9K | 208 | 28 |

| IBM | CALL | SWEEP | BEARISH | 12/27/24 | $3.5 | $3.3 | $3.3 | $235.00 | $33.3K | 167 | 611 |

| IBM | CALL | SWEEP | NEUTRAL | 12/27/24 | $3.3 | $3.3 | $3.3 | $235.00 | $33.0K | 167 | 711 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IBM | 看跌 | 掃單 | 看淡 | 02/21/25 | $12.6 | $12.55 | $12.6 | $235.00 | $89.4K | 390 | 4 |

| IBM | 看漲 | 交易 | 中立 | 01/16/26 | $70.1 | $68.1 | $69.06 | $170.00 | $48.3K | 516 | 7 |

| IBM | 看跌 | 掃單 | 看好 | 06/20/25 | $16.2 | $15.75 | $15.75 | $230.00 | $40.9K | 208 | 28 |

| IBM | 看漲 | 掃單 | 看淡 | 12/27/24 | $3.5 | $3.3 | $3.3 | $235.00 | $33.3K | 167 | 611 |

| IBM | 看漲 | 掃單 | 中立 | 12/27/24 | $3.3 | $3.3 | $3.3 | $235.00 | 33.0K美元 | 167 | 711 |

About IBM

關於IBM

IBM looks to be a part of every aspect of an enterprise's IT needs. The company primarily sells software, IT services, consulting, and hardware. IBM operates in 175 countries and employs approximately 350,000 people. The company has a robust roster of 80,000 business partners to service 5,200 clients, which includes 95% of all Fortune 500. While IBM is a B2B company, IBM's outward impact is substantial. For example, IBM manages 90% of all credit card transactions globally and is responsible for 50% of all wireless connections in the world.

IBM似乎參與企業IT需求的每一個方面。該公司主要銷售軟件、IT服務、諮詢和硬件。IBM在175個國家運營,員工約爲350,000人。該公司擁有80,000個強大的業務合作伙伴,爲5,200個客戶提供服務,包括95%的《財富》500強。儘管IBM是一家B20億公司,IBM的外部影響力是巨大的。例如,IBM管理全球90%的信用卡交易,並負責全球50%的無線連接。

In light of the recent options history for IBM, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考慮到IBM最近的期權歷史,現在適合專注於公司本身。我們旨在探討其當前的表現。

Current Position of IBM

IBM的當前位置

- With a volume of 1,830,962, the price of IBM is up 1.31% at $233.13.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 41 days.

- 當前交易量爲1,830,962,IBM的價格上漲1.31%,達到$233.13。

- RSI因子提示基準股可能被高估。

- 下一個業績預計在41天后發佈。

Turn $1000 into $1270 in just 20 days?

在短短20天內將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

一位擁有20年經驗的期權交易員揭示了他的單行圖表技巧,幫助判斷何時買入和賣出。複製他的交易,這些交易每20天平均獲得27%的利潤。點擊這裏獲取訪問權限。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest IBM options trades with real-time alerts from Benzinga Pro.

期權交易帶來更高的風險和潛在的回報。聰明的交易者通過不斷自我教育、調整策略、監測多個因子並密切關注市場動態來管理這些風險。通過Benzinga Pro的實時警報,保持對最新IBm期權交易的了解。

From the overall spotted trades, 2 are puts, for a total amount of $130,410 and 12, calls, for a total amount of $375,154.

From the overall spotted trades, 2 are puts, for a total amount of $130,410 and 12, calls, for a total amount of $375,154.