DraftKings's Options: A Look at What the Big Money Is Thinking

DraftKings's Options: A Look at What the Big Money Is Thinking

Whales with a lot of money to spend have taken a noticeably bullish stance on DraftKings.

Looking at options history for DraftKings (NASDAQ:DKNG) we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 44% of the investors opened trades with bullish expectations and 44% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $283,106 and 4, calls, for a total amount of $202,619.

From the overall spotted trades, 5 are puts, for a total amount of $283,106 and 4, calls, for a total amount of $202,619.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $39.0 and $50.0 for DraftKings, spanning the last three months.

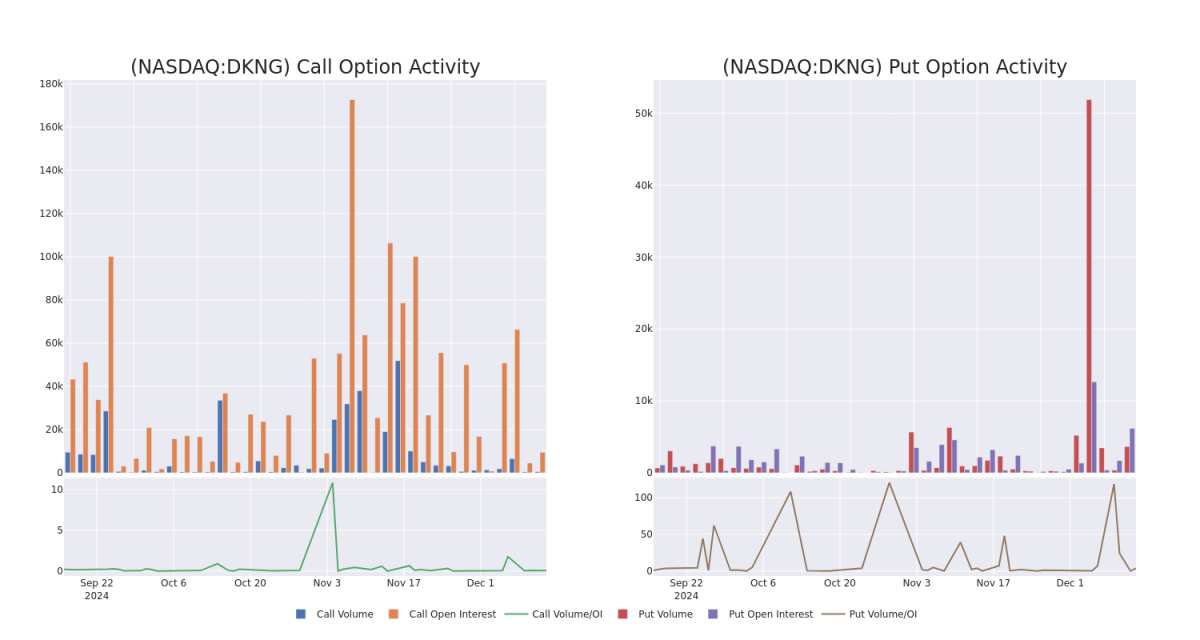

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in DraftKings's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to DraftKings's substantial trades, within a strike price spectrum from $39.0 to $50.0 over the preceding 30 days.

DraftKings Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DKNG | PUT | TRADE | BEARISH | 12/20/24 | $1.25 | $1.0 | $1.15 | $40.50 | $123.7K | 556 | 1.6K |

| DKNG | CALL | SWEEP | BEARISH | 05/16/25 | $5.0 | $4.9 | $4.9 | $42.00 | $93.1K | 240 | 190 |

| DKNG | PUT | SWEEP | BULLISH | 03/21/25 | $10.05 | $9.95 | $9.95 | $50.00 | $56.7K | 487 | 57 |

| DKNG | CALL | TRADE | BULLISH | 01/16/26 | $5.0 | $4.8 | $5.0 | $50.00 | $50.0K | 5.2K | 107 |

| DKNG | PUT | SWEEP | BEARISH | 12/20/24 | $1.25 | $1.13 | $1.25 | $41.00 | $39.8K | 2.6K | 842 |

About DraftKings

DraftKings got its start in 2012 as an innovator in daily fantasy sports. Then, following a Supreme Court ruling in 2018 that allowed states to legalize online sports wagering, the company expanded into online sports and casino gambling, where it generally holds the number two or three revenue share position across states in which it competes. DraftKings is now live with online or retail sports betting in about 30 states and iGaming in seven states, with both products available to around 40% of Canada's population. The company also operates a non-fungible token commissioned-based marketplace and develops and licenses online gaming products.

In light of the recent options history for DraftKings, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of DraftKings

- Currently trading with a volume of 2,021,612, the DKNG's price is down by -2.04%, now at $40.62.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 62 days.

What The Experts Say On DraftKings

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $53.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for DraftKings, targeting a price of $53.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest DraftKings options trades with real-time alerts from Benzinga Pro.