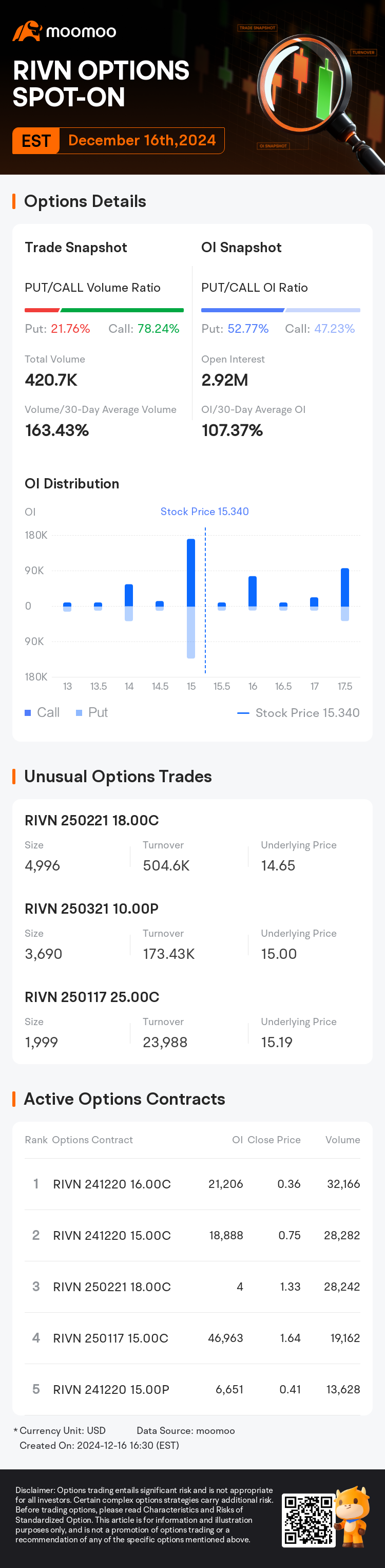

On December 16th ET, $Rivian Automotive (RIVN.US)$ had active options trading, with a total trading volume of 420.7K options for the day, of which put options accounted for 21.76% of the total transactions, and call options accounted for 78.24%.

It shows that as of the close of the day, the open interest of $Rivian Automotive (RIVN.US)$, indicating options positions have not been closed, totaled about 2.92 million contracts, which was 107.37% of the average of the past 30 trading days.

When $Rivian Automotive (RIVN.US)$ was trading at $14.65, the call option with $18.00 of strike price expiring on February 21st,2025 transacted 4,996 contracts. It ranked first among $Rivian Automotive (RIVN.US)$ unusual option trades of the day and reflected $504.6K turnover.

Additionally, in terms of the total trading volume for the day, the most active option contract of $Rivian Automotive (RIVN.US)$ achieved 32,166 volume and closed at $0.36.

Additionally, in terms of the total trading volume for the day, the most active option contract of $Rivian Automotive (RIVN.US)$ achieved 32,166 volume and closed at $0.36.

See below for more details:

Notes:

Select the top 70 stocks based on options volume on trading day.

The article will be published after the options trading hours.

Volume/30-Day Average Volume (OR Total Volume DoD) and OI/30-Day Average OI (OR OI DoD) reflect the changes in overall options activities compared to the past.

The chart shows the cumulative distribution of open interest of all expiration dates per different strike prices. 10 strike prices that are closest to the current underlying price are presented. The chart conveys the market views of the future underlying price.

Options trades with a size of more than 1,000 contracts will be marked as unusual trades.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

美東時間12月16日,$Rivian Automotive (RIVN.US)$期權成交活躍,當日期權總成交量達42.07萬張,其中認沽期權佔總成交量的21.76%,認購期權佔78.24%。

數據顯示,截至當日收盤,$Rivian Automotive (RIVN.US)$未平倉合約(即沒有買賣或行權的期權合約)總計約292.03萬張,與其近30個交易日均值比為107.37%。

值得注意的是,在$Rivian Automotive (RIVN.US)$成交價格為14.65 美元時,出現一筆認購期權的異動大單,其以4,996張的成交量榮登大單榜首,涉資50.46萬美元。該期權的行使價為18.00美元,到期日為2025年2月21日。

另外,從全日成交量來看,$Rivian Automotive (RIVN.US)$當日最活躍的期權合約總計成交3.22萬張,收盤價0.36美元。

另外,從全日成交量來看,$Rivian Automotive (RIVN.US)$當日最活躍的期權合約總計成交3.22萬張,收盤價0.36美元。

詳情請見下文圖表:

提示:

選取全市場當天期權成交量排序的前70只個股。

於交易日美東時間期權交易結束後生成。

總成交量/近30個交易日均值(或成交量環比)、未平倉合約/近30個交易日均值(或未平倉合約環比),這些指標反映個股期權整體活躍較以往的變化。

未平倉合約分布圖顯示了不同行使價下所有到期日未平倉權益的累積分布。圖中列出了與當前標的收盤價格最接近的10個行使價。該圖一定程度上反映了市場對標的未來潛在價格的看法。

成交量大於1000張的期權交易將被標記為異動大單。

異動大單、期權合約成交榜均以成交量排序。

期權交易特點及風險

交易期權前,投資者應先了解其交易特點和風險,詳情請參考Options Disclosure Document(ODD)。

另外,從全日成交量來看,$Rivian Automotive (RIVN.US)$當日最活躍的期權合約總計成交3.22萬張,收盤價0.36美元。

另外,從全日成交量來看,$Rivian Automotive (RIVN.US)$當日最活躍的期權合約總計成交3.22萬張,收盤價0.36美元。

Additionally, in terms of the total trading volume for the day, the most active option contract of

Additionally, in terms of the total trading volume for the day, the most active option contract of