On Friday, Taiwan Semiconductor Manufacturing Co (NYSE:TSM) unveiled its first advanced chip fabrication plant in Arizona, marking a significant milestone in U.S.-based semiconductor production.

The facility, covering 3.5 million square feet on a 1,100-acre site, represents Taiwan Semiconductor's commitment to bolstering domestic chip manufacturing. Apple Inc (NASDAQ:AAPL) is its largest customer.

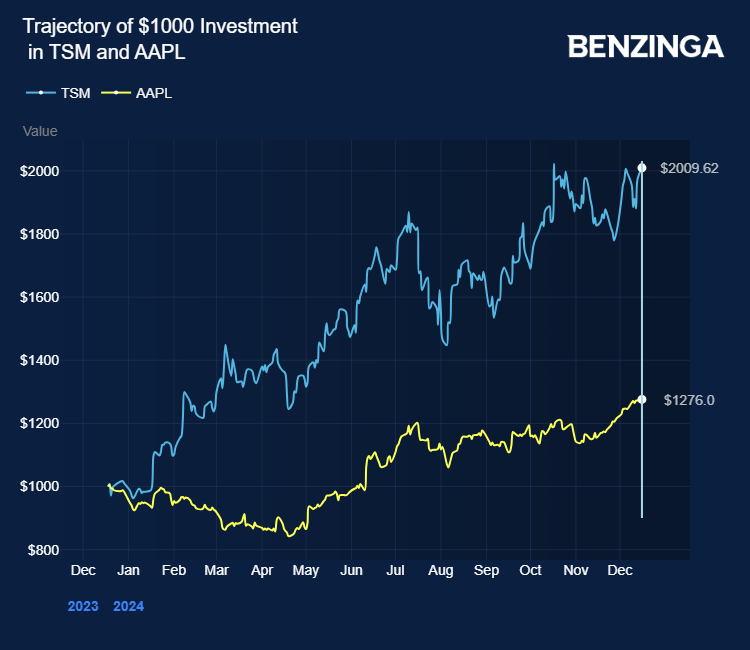

Initially projected at $12 billion, the project has grown to $20 billion, and production has been delayed to 2025. Taiwan Semiconductor stock is trading upwards on Monday.

Currently in pilot production, the fab manufactures sample wafers for customer verification, CNBC reports.

Currently in pilot production, the fab manufactures sample wafers for customer verification, CNBC reports.

Taiwan Semiconductor plans to build two additional fabs on the site by the end of the decade, bringing the total investment to $65 billion.

Rick Cassidy, chairman of Taiwan Semiconductor, highlighted to CNBC the challenges of navigating U.S. regulations, labor laws, and construction processes but expressed confidence that the project is nearly back on its original schedule.

Once operational, the Arizona plant will produce 4-nanometer chips at a rate of 20,000 wafers per month.

The Arizona fab is part of a broader strategy to diversify chip production outside Taiwan, ensuring supply chain resilience amid geopolitical tensions and natural disasters.

Nvidia Corp (NASDAQ:NVDA) is weighing the production of the front-end process of Blackwell AI chips at Taiwan Semiconductor's Arizona plant.

Currently, 92% of the world's most advanced chips are made in Taiwan, prompting Taiwan Semiconductor to ship the aforementioned Blackwell chips back to Taiwan for packaging.

The company aims to employ 6,000 workers for its three planned fabs in Arizona. Taiwan Semiconductor has also implemented water recycling initiatives to manage the 4.7 million gallons required daily for operations, reducing consumption to 1 million through sustainable practices.

Running the first Arizona fab requires significant power—2.85 gigawatt-hours per day, equivalent to the usage of 100,000 homes.

Taiwan Semiconductor is offsetting this demand by purchasing renewable energy credits and utilizing on-site solar energy.

International Data Corp expects Taiwan Semiconductor to control a 67% share of the global foundry market in 2025, backed by AI applications and crypto-mining technologies.

Taiwan Semiconductor posted third-quarter revenue of $23.50 billion, up 39%, surpassing guidance and estimates, driven by strong demand for 3nm and 5nm technologies. Needham analyst Charles Shi highlighted Apple's significant contribution to the robust 3nm performance.

Price Action: TSM stock is up 1.67% at $204.29 premarket at last check Monday.

週五,臺灣半導體制造有限公司(紐約證券交易所代碼:TSM)在亞利桑那州推出了其第一家先進的芯片製造工廠,這標誌着美國半導體生產的一個重要里程碑。

該工廠佔地1,100英畝,佔地350萬平方英尺,代表了臺灣半導體對加強國內芯片製造的承諾。蘋果公司(納斯達克股票代碼:AAPL)是其最大的客戶。

該項目最初預計爲120億美元,現已發展到200億美元,生產已推遲到2025年。週一,臺灣半導體股價上漲。

據CNBC報道,該晶圓廠目前正在試生產,生產樣品晶圓以供客戶驗證。

據CNBC報道,該晶圓廠目前正在試生產,生產樣品晶圓以供客戶驗證。

臺灣半導體計劃在本世紀末在該場地上再建造兩個晶圓廠,使總投資達到650億美元。

臺灣半導體董事長裏克·卡西迪向CNBC強調了駕馭美國法規、勞動法和施工流程所面臨的挑戰,但他表示相信該項目已接近原定計劃。

投產後,亞利桑那州的工廠將以每月20,000塊晶圓的速度生產4納米芯片。

亞利桑那州的晶圓廠是實現臺灣以外地區芯片生產多元化的更廣泛戰略的一部分,該戰略旨在確保供應鏈在地緣政治緊張局勢和自然災害中的彈性。

英偉達公司(納斯達克股票代碼:NVDA)正在權衡臺灣半導體亞利桑那州工廠布萊克韋爾人工智能芯片前端工藝的生產。

目前,世界上最先進的芯片中有92%是在臺灣製造的,這促使臺灣半導體將上述Blackwell芯片運回臺灣進行封裝。

該公司的目標是爲計劃在亞利桑那州建造的三個晶圓廠僱用6,000名員工。臺灣半導體還實施了水資源回收計劃,以管理每天運營所需的470萬加侖,通過可持續的做法將消耗量減少到100萬。

運營亞利桑那州的第一座晶圓廠需要大量的電力——每天 2.85 千兆瓦時,相當於 100,000 個家庭的使用量。

臺灣半導體正在通過購買可再生能源積分和利用現場太陽能來抵消這一需求。

國際數據公司預計,在人工智能應用和加密採礦技術的支持下,臺灣半導體將在2025年控制全球代工市場67%的份額。

受對3納米和5納米技術的強勁需求推動,臺灣半導體公佈的第三季度收入爲235.0億美元,增長39%,超過預期和預期。尼德姆分析師查爾斯·施強調了蘋果對強勁的3納米性能的重大貢獻。

價格走勢:週一最後一次盤前檢查時,tSM股價上漲1.67%,至204.29美元。

據CNBC報道,該晶圓廠目前正在試生產,生產樣品晶圓以供客戶驗證。

據CNBC報道,該晶圓廠目前正在試生產,生產樣品晶圓以供客戶驗證。

Currently in pilot production, the fab manufactures sample wafers for customer verification, CNBC reports.

Currently in pilot production, the fab manufactures sample wafers for customer verification, CNBC reports.