Amazon.com Inc. (NASDAQ:AMZN) faces renewed scrutiny over its warehouse safety practices following a Senate investigation that claims the e-commerce giant manipulated injury data and prioritized speed over worker safety, allegations the company strongly disputes.

What Happened: A 160-page report released on Sunday by Sen. Bernie Sanders (I-Vt.), chair of the Senate Committee on Health, Education, Labor and Pensions, found Amazon warehouses recorded 30% more injuries than the industry average in 2023, with workers nearly twice as likely to be injured compared to other warehouse employees.

"Amazon's self-assessment is disturbingly inaccurate and that the company operates uniquely dangerous warehouses—knowingly allowing unsafe conditions that injure workers and failing to fix those unsafe conditions if doing so could hurt the company's bottom line," the report said.

The investigation claims Amazon's productivity quotas force workers to "move in unsafe ways" and repeat movements thousands of times per shift, leading to musculoskeletal disorders. The report also alleges the company "actively discourages" injured workers from seeking outside medical care.

The investigation claims Amazon's productivity quotas force workers to "move in unsafe ways" and repeat movements thousands of times per shift, leading to musculoskeletal disorders. The report also alleges the company "actively discourages" injured workers from seeking outside medical care.

Amazon sharply rejected these findings in a detailed response, stating the investigation "wasn't a fact-finding mission, but rather an attempt to collect information and twist it to support a false narrative." The company reports it reduced its recordable incident rate by 28% and lost time incident rate by 75% between 2019 and 2023.

Why It Matters: The company defended its safety benchmarking practices, noting its transportation-focused facilities recorded a recordable incident rate of 6.3 in 2023, below the industry average of 9.7. Amazon emphasized that increasing delivery speeds has coincided with decreasing injury rates across its network.

"Our safety record continues to improve," Amazon stated, highlighting investments in ergonomic enhancements and climate-controlled facilities. The company maintains that its performance expectations are "reasonable and achievable," based on actual team accomplishments.

Price Action: Amazon stock closed at $232.93 on Monday, up 2.40% for the day, with a slight after-hours drop. Year-to-date, the stock has risen 55.36%.

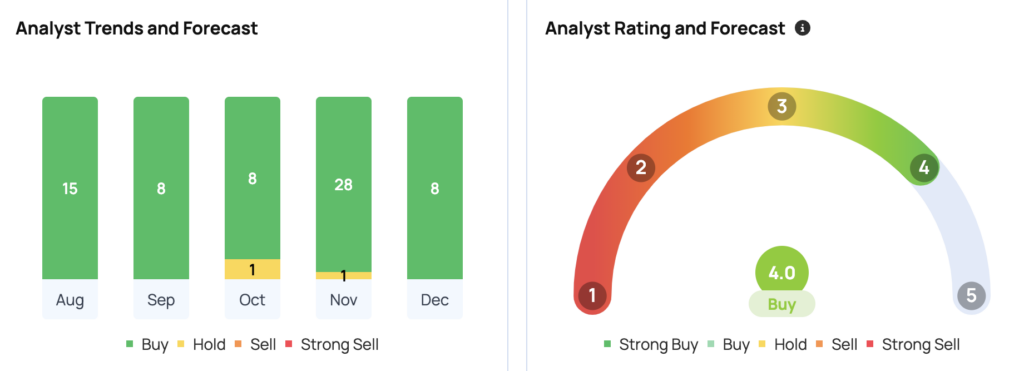

With a market cap of $2.45 trillion and a price-to-earnings ratio of 48.60, Amazon's RSI is 72. The consensus price target is $244.36, with a high of $285 from JMP Securities and a low of $197 from Wells Fargo. The average target of $273.33 suggests a 17.51% upside, according to data from Benzinga Pro.

亞馬遜公司(納斯達克股票代碼:AMZN)因其倉庫安全做法面臨新的審查,此前參議院的一項調查聲稱這家電子商務巨頭操縱了傷害數據,將速度置於員工安全之上,該公司強烈反對這一指控。

發生了什麼:參議院衛生、教育、勞工和養老金委員會主席伯尼·桑德斯(I-Vt.)週日發佈的一份長達160頁的報告發現,2023年,亞馬遜倉庫記錄的受傷人數比行業平均水平多30%,工人受傷的可能性是其他倉庫員工的近兩倍。

報告說:「令人不安的是,亞馬遜的自我評估不準確,而且該公司經營的倉庫特別危險——故意允許不安全的條件對員工造成傷害,如果這樣做可能會損害公司的利潤,則未能修復這些不安全的狀況。」

調查稱,亞馬遜的生產力配額迫使員工 「以不安全的方式移動」,並且每次輪班重複動作數千次,從而導致肌肉骨骼疾病。該報告還稱,該公司 「積極阻止」 受傷的工人尋求外部醫療服務。

調查稱,亞馬遜的生產力配額迫使員工 「以不安全的方式移動」,並且每次輪班重複動作數千次,從而導致肌肉骨骼疾病。該報告還稱,該公司 「積極阻止」 受傷的工人尋求外部醫療服務。

亞馬遜在詳細回應中強烈拒絕了這些調查結果,稱調查 「不是一項實況調查任務,而是試圖收集信息並將其歪曲以支持虛假的敘述。」該公司報告稱,在2019年至2023年期間,其可記錄的事故率降低了28%,損失工時事件率降低了75%。

爲何重要:該公司爲其安全基準測試做法辯護,指出其以交通爲重點的設施在2023年記錄的可記錄事故率爲6.3,低於行業平均水平的9.7。亞馬遜強調,交付速度的提高與其網絡中受傷率的下降同時發生。

亞馬遜表示:「我們的安全記錄持續改善,」 他重點介紹了對人體工程學改進和氣候控制設施的投資。該公司堅持認爲,根據團隊的實際成績,其績效預期 「合理且可以實現」。

價格走勢:亞馬遜股價週一收於232.93美元,當天上漲2.40%,盤後略有下跌。今年迄今爲止,該股已上漲55.36%。

亞馬遜的市值爲2.45萬億美元,市盈率爲48.60,RSI爲72。共識目標股價爲244.36美元,JMP證券的最高價爲285美元,富國銀行的低點爲197美元。根據Benzinga Pro的數據,平均目標爲273.33美元,表明上漲幅度爲17.51%。

調查稱,亞馬遜的生產力配額迫使員工 「以不安全的方式移動」,並且每次輪班重複動作數千次,從而導致肌肉骨骼疾病。該報告還稱,該公司 「積極阻止」 受傷的工人尋求外部醫療服務。

調查稱,亞馬遜的生產力配額迫使員工 「以不安全的方式移動」,並且每次輪班重複動作數千次,從而導致肌肉骨骼疾病。該報告還稱,該公司 「積極阻止」 受傷的工人尋求外部醫療服務。

The investigation claims Amazon's productivity quotas force workers to "move in unsafe ways" and repeat movements thousands of times per shift, leading to musculoskeletal disorders. The report also alleges the company "actively discourages" injured workers from seeking outside medical care.

The investigation claims Amazon's productivity quotas force workers to "move in unsafe ways" and repeat movements thousands of times per shift, leading to musculoskeletal disorders. The report also alleges the company "actively discourages" injured workers from seeking outside medical care.