SoundHound AI Soars Over 700%: Short Squeeze Potential Has Traders Talking

SoundHound AI Soars Over 700%: Short Squeeze Potential Has Traders Talking

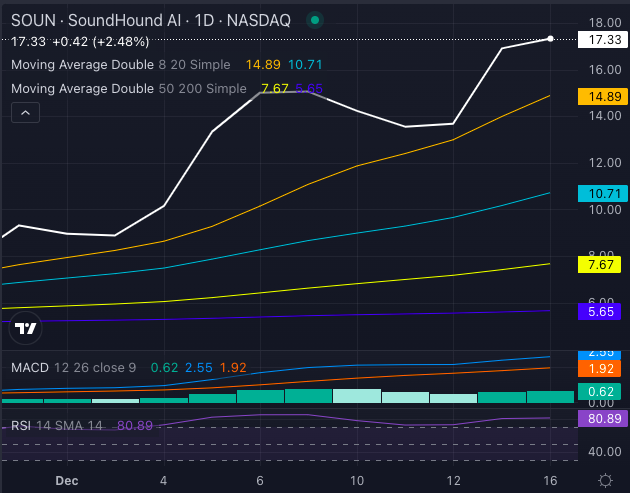

SoundHound AI Inc (NASDAQ:SOUN) stock skyrocketed 713% this year and 173% this month.

SoundHound人工智能公司 (納斯達克:SOUN) 的股票今年上漲了713%,這個月上漲了173%。

The company, which specializes in voice AI technology, is trading at an all-time — and 52-week high — of $17.29 on Friday.

這家專注於語音人工智能技術的公司,週五的股票交易價格達到了歷史最高和52周高點,達到17.29美元。

Chart created using Benzinga Pro

圖表使用Benzinga Pro創建

SOUN stock's technical signals are flashing green across the board. Trading well above its eight, 20 and 50-day simple moving averages, SoundHound is in strongly bullish territory.

SOUN股票的技術信號全面呈現綠色。其交易價格遠高於8天、20天和50天的簡單移動平均線,SoundHound正處於強勁看好領域。

Key indicators like its relative strength index (RSI) of 80.89 may point to an overbought status, but they've done little to slow its momentum. Even the moving average convergence divergence (MACD) indicator at 2.55 screams Bullish.

相對強弱指數(RSI)爲80.89等關鍵因子可能指向超買狀態,但對其動能幾乎沒有影響。即使是2.55的移動平均收斂發散(MACD)指示器也在大聲叫看好。

Read Also: What's Going On With SoundHound AI Stock?

另請閱讀:SoundHound人工智能股票發生了什麼?

What's Fueling The Frenzy?

是什麼推動了這場熱潮?

SoundHound's rise from a low of $1.62 earlier this year underscores the wave of AI excitement. Nvidia Corp's (NASDAQ:NVDA) multimillion-dollar investment earlier this year lent credibility to SoundHound's voice AI tech, while analysts now expect revenue to grow nearly 97% annually.

SoundHound今年早些時候的最低點1.62美元的回升突顯了人工智能激動人心的浪潮。英偉達CORP(NASDAQ:NVDA)今年早些時候的數百萬美元投資爲SoundHound的語音人工智能技術增添了可信度,而分析師現在預計營業收入將年增長近97%。

The company's partnerships in automotive, fast food, and consumer electronics have further cemented its place as a niche leader.

該公司在汽車、快餐和消費電子-半導體領域的合作伙伴關係進一步鞏固了其作爲利基領導者的地位。

Is A Short Squeeze In The Cards?

短期擠壓在考慮中嗎?

Adding fuel to the fire, 24.4% of the stock's float is shorted, positioning it perfectly for a short squeeze. Retail investors, particularly on social media platforms, have latched onto the potential for explosive gains, creating a feedback loop of buying pressure.

更糟的是,24.4%的股票浮動被做空,這使其完美地爲短期擠壓做好了準備。零售投資者,尤其是在社交媒體平台上的投資者,已經抓住了潛在爆炸性收益的機會,形成了購買壓力的反饋循環。

With its cutting-edge voice AI tech and strong market fit, the stock might still have room to grow—but overbought signals suggest investors should proceed with caution.

憑藉其先進的語音人工智能技術和強大的市場契合度,該股票仍可能有上升空間——但超買信號表明投資者應該謹慎行事。

- Taiwan Semiconductor CEO Highlights AI-Powered Drones, Next-Gen Robots As Growth Drivers

- 台積電首席執行官強調人工智能驅動的無人機和下一代機器人作爲增長驅動力

Image: Shutterstock

圖片:shutterstock

SOUN stock's technical signals are flashing green across the board. Trading well above its eight, 20 and 50-day simple moving averages, SoundHound is in strongly bullish territory.

SOUN stock's technical signals are flashing green across the board. Trading well above its eight, 20 and 50-day simple moving averages, SoundHound is in strongly bullish territory.