Huizhou CEE Technology (SZSE:002579 Shareholders Incur Further Losses as Stock Declines 6.8% This Week, Taking Five-year Losses to 27%

Huizhou CEE Technology (SZSE:002579 Shareholders Incur Further Losses as Stock Declines 6.8% This Week, Taking Five-year Losses to 27%

It is a pleasure to report that the Huizhou CEE Technology Inc. (SZSE:002579) is up 39% in the last quarter. But if you look at the last five years the returns have not been good. You would have done a lot better buying an index fund, since the stock has dropped 29% in that half decade.

很高興地報告,惠州中電科技股份有限公司(深圳證券交易所:002579)在上個季度上漲了39%。但是,如果你看看過去的五年,回報並不理想。購買指數基金的表現要好得多,因爲該股在那五年中下跌了29%。

If the past week is anything to go by, investor sentiment for Huizhou CEE Technology isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

如果說過去一週有意義的話,投資者對惠州中電科技的情緒並不樂觀,所以讓我們看看基本面和股價之間是否存在不匹配的情況。

Huizhou CEE Technology isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

惠州中電科技目前尚未盈利,因此大多數分析師會着眼於收入的增長,以了解基礎業務的增長速度。一般而言,沒有利潤的公司預計每年收入將增長,而且速度很快。這是因爲快速的收入增長可以很容易地推斷出來預測利潤,通常規模相當大。

In the last half decade, Huizhou CEE Technology saw its revenue increase by 5.7% per year. That's far from impressive given all the money it is losing. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 5% (annualized) in the same time frame. Investors should consider how bad the losses are, and whether the company can make it to profitability with ease. Shareholders will want the company to approach profitability if it can't grow revenue any faster.

在過去的五年中,惠州中電科技的收入每年增長5.7%。考慮到它損失的所有資金,這遠非令人印象深刻。鑑於這種相當低的收入增長(以及缺乏利潤),該股在同一時間範圍內下跌5%(按年計算)也就不足爲奇了。投資者應考慮損失有多嚴重,以及公司能否輕鬆實現盈利。如果公司無法更快地增加收入,股東們就會希望公司實現盈利。

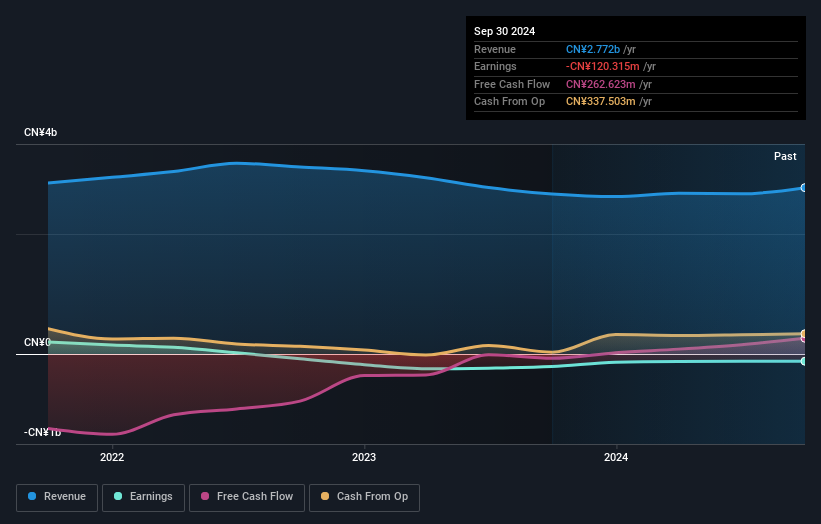

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

你可以在下面看到收入和收入如何隨着時間的推移而變化(點擊圖片發現確切的數值)。

This free interactive report on Huizhou CEE Technology's balance sheet strength is a great place to start, if you want to investigate the stock further.

如果你想進一步調查該股,這份關於惠州中電科技資產負債表實力的免費互動報告是一個很好的起點。

What About The Total Shareholder Return (TSR)?

股東總回報率(TSR)呢?

We've already covered Huizhou CEE Technology's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Huizhou CEE Technology's TSR, which was a 27% drop over the last 5 years, was not as bad as the share price return.

我們已經報道了惠州中電科技的股價走勢,但我們還應該提及其股東總回報率(TSR)。可以說,股東總回報率是更完整的回報計算方法,因爲它考慮了股息的價值(就好像是再投資一樣),以及向股東提供的任何貼現資本的假設價值。其股息支付歷史表明,惠州中電科技的股東總回報率在過去5年中下降了27%,沒有股價回報率那麼糟糕。

A Different Perspective

不同的視角

While the broader market gained around 12% in the last year, Huizhou CEE Technology shareholders lost 0.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 5% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Huizhou CEE Technology .

儘管去年整體市場上漲了約12%,但惠州中電科技的股東卻下跌了0.8%。即使是優質股票的股價有時也會下跌,但我們希望在過於感興趣之前看到企業基本指標的改善。但是,去年的虧損沒有投資者在過去五年中遭受的每年5%的損失那麼嚴重。我們需要看到關鍵指標的持續改善,然後才能激起極大的熱情。我發現將長期股價視爲業務績效的代表非常有趣。但是,要真正獲得見解,我們還需要考慮其他信息。爲此,你應該注意我們在惠州中電科技發現的兩個警告信號。

We will like Huizhou CEE Technology better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

如果我們看到一些重大的內幕收購,我們會更喜歡惠州中電科技。在我們等待的同時,請查看這份被低估的股票(主要是小盤股)的免費清單,這些股票最近有大量的內幕買盤。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

請注意,本文引用的市場回報反映了目前在中國交易所交易的股票的市場加權平均回報率。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?擔心內容嗎?直接聯繫我們。或者,發送電子郵件給編輯組(網址爲)simplywallst.com。

Simply Wall ST 的這篇文章本質上是籠統的。我們僅使用公正的方法提供基於歷史數據和分析師預測的評論,我們的文章並非旨在提供財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不會考慮最新的價格敏感型公司公告或定性材料。華爾街只是沒有持有上述任何股票的頭寸。

In the last half decade, Huizhou CEE Technology saw its revenue increase by 5.7% per year. That's far from impressive given all the money it is losing. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 5% (annualized) in the same time frame. Investors should consider how bad the losses are, and whether the company can make it to profitability with ease. Shareholders will want the company to approach profitability if it can't grow revenue any faster.

In the last half decade, Huizhou CEE Technology saw its revenue increase by 5.7% per year. That's far from impressive given all the money it is losing. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 5% (annualized) in the same time frame. Investors should consider how bad the losses are, and whether the company can make it to profitability with ease. Shareholders will want the company to approach profitability if it can't grow revenue any faster.