If EPS Growth Is Important To You, Shannon Semiconductor TechnologyLtd (SZSE:300475) Presents An Opportunity

If EPS Growth Is Important To You, Shannon Semiconductor TechnologyLtd (SZSE:300475) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

許多投資者,尤其是那些缺乏經驗的投資者,常常會買入那些有良好故事的公司股票,即使這些公司處於虧損狀態。但正如彼得·林奇在《華爾街傳奇》中所說,'長線投資幾乎從不盈利。' 虧損的公司總是在與時間賽跑,以達到財務可持續性,因此投資這些公司的投資者可能承擔了超過他們應有的風險。

In contrast to all that, many investors prefer to focus on companies like Shannon Semiconductor TechnologyLtd (SZSE:300475), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

與所有板塊相比,許多投資者更傾向於關注像香農半導體科技有限公司(SZSE:300475)這樣的公司,它不僅有營業收入,還有利潤。雖然利潤並不是投資時唯一需要考慮的指標,但值得關注那些能夠持續產生利潤的企業。

How Quickly Is Shannon Semiconductor TechnologyLtd Increasing Earnings Per Share?

香農半導體科技有限公司的每股收益增長速度有多快?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Shannon Semiconductor TechnologyLtd's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 45%. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

一般來說,每股收益(EPS)增長的公司,其股票價格也應呈現類似的趨勢。因此,經驗豐富的投資者在進行投資研究時,密切關注公司每股收益是有道理的。香農半導體科技有限公司的股東們有很多值得高興的事情,因爲他們過去3年的每股收益年增長率爲45%。如此快速的增長可能會是短暫的,但這足以引起謹慎選股者的興趣。

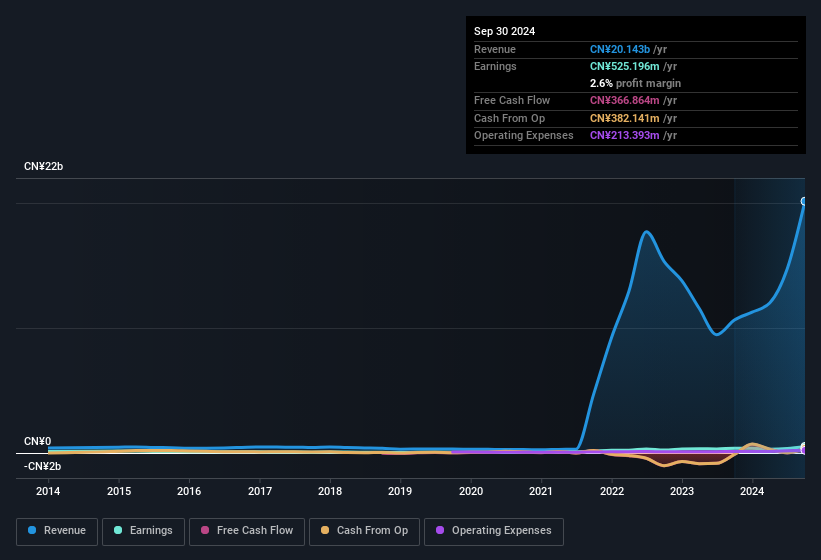

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Shannon Semiconductor TechnologyLtd remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 89% to CN¥20b. That's encouraging news for the company!

核實一家公司的增長方式之一是查看它的營業收入和息稅前利潤(EBIT)利潤率如何變化。香農半導體科技有限公司的EBIT利潤率在過去一年中變化不大,然而公司應該欣喜地報告在此期間營業收入增長了89%,達到了200億人民幣。這對公司來說是個令人振奮的消息!

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

在下面的圖表中,您可以看到公司隨時間增長的收益和收入。點擊圖表查看確切數字。

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Shannon Semiconductor TechnologyLtd.

當然,訣竅在於找到那些未來表現最佳的股票,而不是過去表現好的股票。你當然可以根據過去的表現來形成你的觀點,但你也可能想查看關於香農半導體科技有限公司的專業分析師每股收益預測的互動圖表。

Are Shannon Semiconductor TechnologyLtd Insiders Aligned With All Shareholders?

香農半導體科技有限公司的內部人士與所有股東是否一致?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Shannon Semiconductor TechnologyLtd followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. We note that their impressive stake in the company is worth CN¥1.8b. This totals to 14% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

如果內部人士也擁有公司的股份,這應給投資者帶來安全感,促進他們的利益一致。香農半導體科技有限公司的追隨者將感到寬慰,因爲內部人士擁有大量資本,使他們的最佳利益與廣大的股東群體保持一致。我們注意到,他們在公司的顯著股份價值達CN¥18億。這佔公司股份的14%。足以引導管理層的決策過程走向最能帶給股東利益的方向。因此,這裏有機會投資於一家管理層有切實激勵的公司。

Should You Add Shannon Semiconductor TechnologyLtd To Your Watchlist?

你應該將香農半導體科技有限公司添加到你的自選嗎?

Shannon Semiconductor TechnologyLtd's earnings per share have been soaring, with growth rates sky high. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So based on this quick analysis, we do think it's worth considering Shannon Semiconductor TechnologyLtd for a spot on your watchlist. You still need to take note of risks, for example - Shannon Semiconductor TechnologyLtd has 2 warning signs we think you should be aware of.

香農半導體科技有限公司的每股收益正在飆升,增長率高得驚人。這種每股收益的增長確實引人注目,而大量的內部持股只會進一步激發我們的興趣。希望是,這種強勁增長標誌着業務經濟的根本改善。因此,根據這個快速分析,我們確實認爲值得將香農半導體科技有限公司考慮納入你的自選。你仍然需要注意風險,例如 - 香農半導體科技有限公司有 2 個我們認爲你應該注意的警示信號。

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Chinese companies which have demonstrated growth backed by significant insider holdings.

購買那些沒有盈利增長並且沒有內部人士購買股票的股票總有成功的可能。但是,對於那些將這些重要指標視爲關鍵的投資者,我們鼓勵你查看那些具備這些特徵的公司。你可以訪問一個定製的中國公司名單,這些公司已經證明了其在顯著內部持股支持下的增長。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

請注意,本文討論的內部交易是指在相關管轄區內可報告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有反饋?對內容有疑慮?請直接與我們聯繫。或者,發送電子郵件至 editorial-team (at) simplywallst.com。

這篇來自Simply Wall ST的文章是一般性的。我們根據歷史數據和分析師預測提供評論,採用無偏見的方法,我們的文章並不旨在提供財務建議。它不構成對任何股票的買入或賣出建議,也未考慮到您的目標或財務狀況。我們旨在爲您提供以基本數據驅動的長期分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall ST在提到的任何股票中均沒有持倉。

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Shannon Semiconductor TechnologyLtd remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 89% to CN¥20b. That's encouraging news for the company!

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Shannon Semiconductor TechnologyLtd remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 89% to CN¥20b. That's encouraging news for the company!