Behind the Scenes of Goldman Sachs Gr's Latest Options Trends

Behind the Scenes of Goldman Sachs Gr's Latest Options Trends

Whales with a lot of money to spend have taken a noticeably bullish stance on Goldman Sachs Gr.

有大量資金的投資者對高盛集團採取了明顯的看好態度。

Looking at options history for Goldman Sachs Gr (NYSE:GS) we detected 20 trades.

通過查看高盛集團(紐交所:GS)的期權歷史,我們發現了20筆交易。

If we consider the specifics of each trade, it is accurate to state that 60% of the investors opened trades with bullish expectations and 35% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,60%的投資者以看漲的預期開盤交易,35%則是看淡的預期。

From the overall spotted trades, 14 are puts, for a total amount of $879,540 and 6, calls, for a total amount of $609,710.

在所有發現的交易中,14筆是看跌期權,總金額爲879,540美元,6筆是看漲期權,總金額爲609,710美元。

Predicted Price Range

預測價格區間

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $530.0 to $650.0 for Goldman Sachs Gr over the recent three months.

根據交易活動,重要投資者近期三個月的目標價區間爲530.0美元至650.0美元,針對高盛集團。

Insights into Volume & Open Interest

成交量和持倉量分析

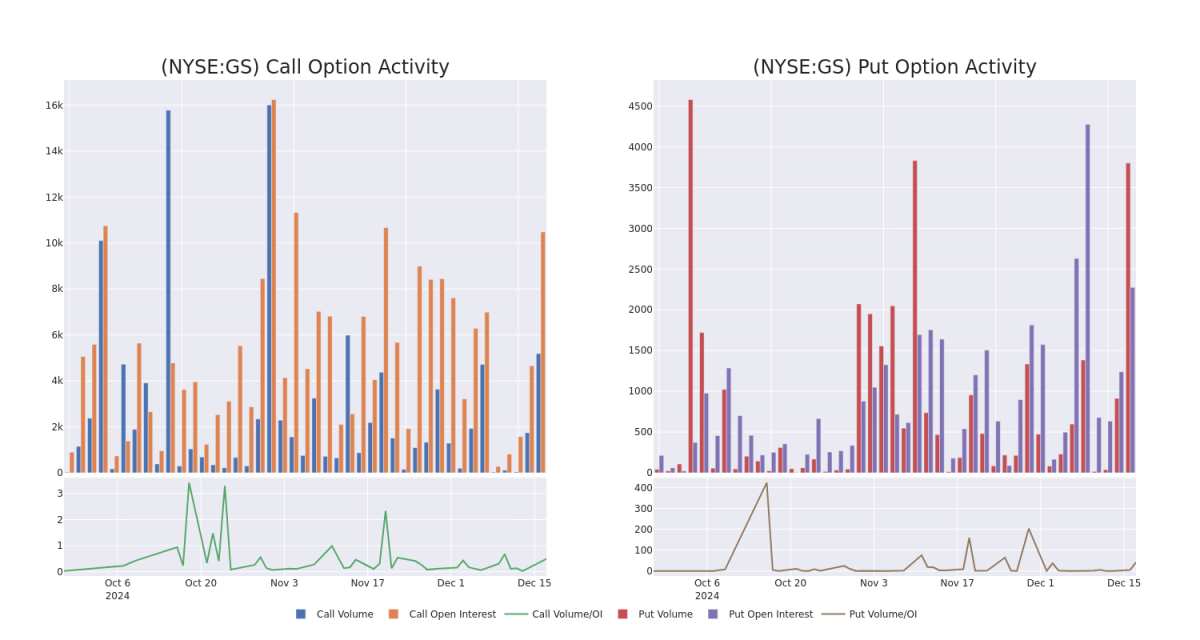

In today's trading context, the average open interest for options of Goldman Sachs Gr stands at 215.25, with a total volume reaching 1,030.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Goldman Sachs Gr, situated within the strike price corridor from $530.0 to $650.0, throughout the last 30 days.

在今天的交易環境中,高盛集團的期權平均未平倉合約數爲215.25,總成交量達到1,030.00。附帶圖表描繪了高盛集團高價值交易中看漲和看跌期權的成交量和未平倉合約數在過去30天內在530.0美元至650.0美元的行權價格區間內的發展。

Goldman Sachs Gr Call and Put Volume: 30-Day Overview

高盛公司看漲和看跌期權成交量:30天總覽

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GS | CALL | SWEEP | BULLISH | 01/03/25 | $8.35 | $7.85 | $8.35 | $585.00 | $208.7K | 26 | 251 |

| GS | CALL | SWEEP | BULLISH | 02/21/25 | $18.55 | $18.0 | $18.51 | $600.00 | $184.8K | 219 | 103 |

| GS | PUT | TRADE | BULLISH | 12/20/24 | $73.0 | $72.7 | $72.7 | $650.00 | $145.4K | 0 | 0 |

| GS | CALL | SWEEP | BULLISH | 04/17/25 | $28.25 | $27.85 | $28.25 | $600.00 | $107.3K | 300 | 42 |

| GS | PUT | SWEEP | BULLISH | 03/21/25 | $29.15 | $28.75 | $28.75 | $580.00 | $100.6K | 194 | 153 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 高盛 | 看漲 | 掃單 | 看好 | 01/03/25 | $8.35 | $7.85 | $8.35 | $585.00 | 208.7K美元 | 26 | 251 |

| 高盛 | 看漲 | 掃單 | 看好 | 02/21/25 | $18.55 | $18.0 | $18.51 | $600.00 | $184.8K | 219 | 103 |

| 高盛 | 看跌 | 交易 | 看好 | 12/20/24 | $73.0 | $72.7 | $72.7 | $650.00 | 145.4K美元 | 0 | 0 |

| 高盛 | 看漲 | 掃單 | 看好 | 04/17/25 | $28.25 | $27.85 | $28.25 | $600.00 | 107.3K美元 | 300 | 42 |

| 高盛 | 看跌 | 掃單 | 看好 | 03/21/25 | $29.15 | $28.75 | $28.75 | $580.00 | $100.6K | 194 | 153 |

About Goldman Sachs Gr

高盛集團簡介

Goldman Sachs is a leading global investment banking and asset management firm. Approximately 20% of its revenue comes from investment banking, 45% from trading, 20% from asset management and 15% from wealth management and retail financial services. Around 60% of the company's net revenue is generated in the Americas, 15% in Asia, and 25% in Europe, the Middle East, and Africa.

高盛是一家領先的全球投資銀行和資產管理公司。大約20%的營業收入來自投資銀行業務,45%來自交易,20%來自資產管理,15%來自财富管理和零售金融服務。該公司約60%的淨營業收入來自美洲,15%來自亞洲,25%來自歐洲、中東和非洲。

Goldman Sachs Gr's Current Market Status

高盛集團的當前市場狀況

- With a volume of 437,583, the price of GS is up 0.12% at $575.38.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 28 days.

- 隨着成交量達到437,583,GS的價格上漲了0.12%,現爲$575.38。

- 相對強弱指數因子暗示底層股票目前在超買和超賣之間處於中立狀態。

- 下一個業績預計將在28天后發佈。

Expert Opinions on Goldman Sachs Gr

高盛的專家意見

In the last month, 4 experts released ratings on this stock with an average target price of $607.25.

在過去一個月中,4位專家對這隻股票發佈了評級,平均目標價爲607.25美元。

Turn $1000 into $1270 in just 20 days?

在短短20天內將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Keefe, Bruyette & Woods has decided to maintain their Outperform rating on Goldman Sachs Gr, which currently sits at a price target of $686. * In a cautious move, an analyst from HSBC downgraded its rating to Hold, setting a price target of $608. * Consistent in their evaluation, an analyst from Citigroup keeps a Neutral rating on Goldman Sachs Gr with a target price of $585. * An analyst from JP Morgan has decided to maintain their Overweight rating on Goldman Sachs Gr, which currently sits at a price target of $550.

20年的專業期權交易員揭示了他的一行圖表技巧,顯示何時買入和賣出。複製他的交易,平均每20天獲得27%的利潤。點擊這裏獲取訪問權限。* 一位來自Keefe, Bruyette & Woods的分析師決定維持對高盛的跑贏大盤評級,目前的目標價爲686美元。* 在謹慎的舉動中,一位來自匯豐的分析師將其評級下調至持有,目標價設定爲608美元。* 一位來自花旗集團的分析師在對高盛保持中立評級的情況下,目標價爲585美元。* 一位來自摩根大通的分析師決定維持對高盛的增持評級,目前目標價爲550美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅僅交易股票相比,期權是一種風險較高的資產,但它們具有更高的盈利潛力。嚴肅的期權交易者通過日常學習、逐步進出交易、關注多個因子以及密切關注市場來管理這種風險。

From the overall spotted trades, 14 are puts, for a total amount of $879,540 and 6, calls, for a total amount of $609,710.

From the overall spotted trades, 14 are puts, for a total amount of $879,540 and 6, calls, for a total amount of $609,710.