C3.ai Unusual Options Activity For December 18

C3.ai Unusual Options Activity For December 18

Investors with a lot of money to spend have taken a bearish stance on C3.ai (NYSE:AI).

大量資金的投資者對C3.ai(紐交所:AI)採取了看淡的態度。

And retail traders should know.

零售交易者應該了解這一點。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

我們今天注意到,當我們在Benzinga跟蹤的公開可用的期權歷史中出現這些頭寸時。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with AI, it often means somebody knows something is about to happen.

我們不知道這些投資者是機構還是富有的個人。但是,當人工智能領域出現如此重大事件時,往往意味着有人知道即將發生什麼。

Today, Benzinga's options scanner spotted 18 options trades for C3.ai.

今天,Benzinga的期權掃描儀發現了18筆C3.ai的期權交易。

This isn't normal.

這並不正常。

The overall sentiment of these big-money traders is split between 22% bullish and 72%, bearish.

這些大資金交易者的整體情緒在22%看好和72%看淡之間分歧。

Out of all of the options we uncovered, there was 1 put, for a total amount of $105,000, and 17, calls, for a total amount of $973,263.

在我們發現的所有期權中,有1筆看跌期權,總金額爲105,000美元,和17筆看漲期權,總金額爲973,263美元。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $30.0 to $65.0 for C3.ai over the recent three months.

根據交易活動,看來重要投資者在最近三個月內對C3.ai的價格區域設定在30.0美元到65.0美元之間。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

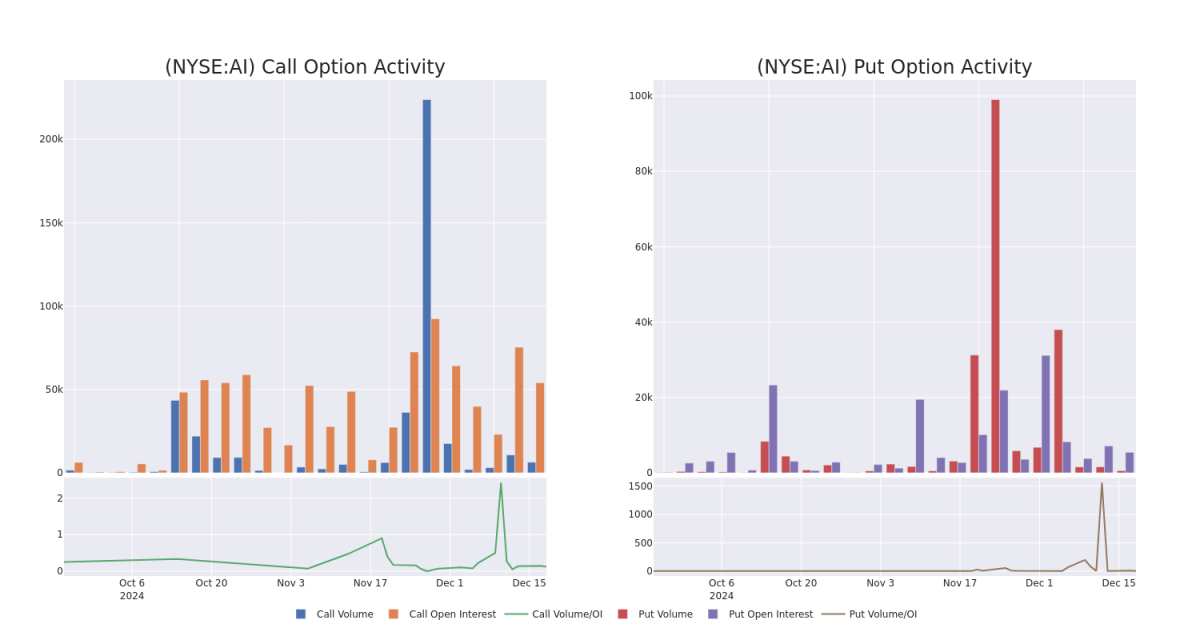

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

觀察成交量和未平倉合約是進行股票盡職調查的一個有見地的方法。

This data can help you track the liquidity and interest for C3.ai's options for a given strike price.

這些數據可以幫助你跟蹤C3.ai在特定行權價的期權流動性和興趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of C3.ai's whale activity within a strike price range from $30.0 to $65.0 in the last 30 days.

在下方,我們可以觀察到過去30天C3.ai的鯨魚活動在30.0美元到65.0美元的行權價區間內,看漲和看跌期權的成交量和持倉量的演變。

C3.ai 30-Day Option Volume & Interest Snapshot

C3.ai 30天期權成交量和持倉快照

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AI | CALL | TRADE | BEARISH | 01/17/25 | $4.4 | $4.3 | $4.3 | $40.00 | $129.0K | 31.0K | 525 |

| AI | PUT | TRADE | BEARISH | 01/17/25 | $2.14 | $2.04 | $2.1 | $40.00 | $105.0K | 5.4K | 574 |

| AI | CALL | TRADE | BULLISH | 04/17/25 | $8.6 | $8.45 | $8.6 | $40.00 | $86.0K | 3.5K | 168 |

| AI | CALL | TRADE | BEARISH | 04/17/25 | $8.4 | $8.15 | $8.23 | $40.00 | $82.3K | 3.5K | 818 |

| AI | CALL | TRADE | BULLISH | 04/17/25 | $8.4 | $7.65 | $8.22 | $40.00 | $82.2K | 3.5K | 368 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 人工智能 | 看漲 | 交易 | 看淡 | 01/17/25 | $4.4 | $4.3 | $4.3 | $40.00 | 129.0K美元 | 31.0K | 525 |

| 人工智能 | 看跌 | 交易 | 看淡 | 01/17/25 | $2.14 | $2.04 | $2.1 | $40.00 | $105.0K | 5.4K | 574 |

| 人工智能 | 看漲 | 交易 | 看好 | 04/17/25 | $8.6 | $8.45 | $8.6 | $40.00 | $86.0K | 3.5K | 168 |

| 人工智能 | 看漲 | 交易 | 看淡 | 04/17/25 | $8.4 | $8.15 | $8.23 | $40.00 | $82.3K | 3.5K | 818 |

| 人工智能 | 看漲 | 交易 | 看好 | 04/17/25 | $8.4 | $7.65 | $8.22 | $40.00 | $82.2K | 3.5K | 368 |

About C3.ai

關於C3.ai

C3.ai Inc is an enterprise artificial intelligence company. The company provides software-as-a-service applications that enable customers to rapidly develop, deploy, and operate large-scale Enterprise AI applications across any infrastructure. It provides solutions under three divisions namely, The C3 AI Platform, which is an end-to-end application development and runtime environment for designing, developing, and deploying AI applications: C3 AI Applications, which is a portfolio of pre-built, extensible, industry-specific, and application-specific Enterprise AI applications: and C3 Generative AI, which combines the utility of large language models. Geographically the company derives revenue from North America, Europe, the Middle East and Africa, Asia Pacific, and the Rest of the World.

C3.ai公司是一家企業人工智能公司。該公司提供的軟件即服務應用程序使客戶能夠快速開發、部署和運營大規模的企業人工智能應用,適用於任何基礎設施。它提供三大部門的解決方案,分別是C3 AI平台,這是一個端到端的應用程序開發和運行環境,用於設計、開發和部署人工智能應用:C3 AI應用程序,這是一個預構建的、可擴展的、行業特定和應用特定的企業人工智能應用組合:以及C3生成性人工智能,它結合了大型語言模型的實用性。從地理位置上看,該公司從北美、歐洲、中東和非洲、亞太地區,以及世界其他地區獲得營業收入。

Having examined the options trading patterns of C3.ai, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在檢查了C3.ai的期權交易模式後,我們的注意力現在直接轉向公司。這一轉變使我們能夠深入了解其目前的市場地位和表現。

Where Is C3.ai Standing Right Now?

C3.ai現在的狀況如何?

- With a trading volume of 3,457,009, the price of AI is up by 2.1%, reaching $43.76.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 70 days from now.

- 隨着成交量達到3,457,009,人工智能的價格上漲2.1%,達到了$43.76。

- 當前的RSI值表明該股票可能被超買。

- 下一次業績將在70天后發佈。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:聰明資金正在行動

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期權異動板塊在市場發生變化之前發現潛在的市場動向。看看大資金在你喜歡的股票上採取了什麼倉位。點擊這裏獲取訪問權限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅僅交易股票相比,期權是一種風險較高的資產,但它們具有更高的盈利潛力。嚴肅的期權交易者通過日常學習、逐步進出交易、關注多個因子以及密切關注市場來管理這種風險。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with AI, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with AI, it often means somebody knows something is about to happen.