Peering Into Murphy USA's Recent Short Interest

Peering Into Murphy USA's Recent Short Interest

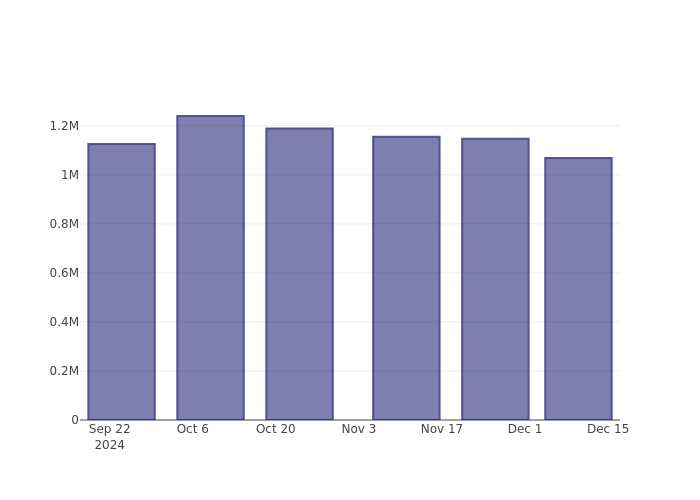

Murphy USA's (NYSE:MUSA) short percent of float has fallen 6.68% since its last report. The company recently reported that it has 1.07 million shares sold short, which is 5.87% of all regular shares that are available for trading. Based on its trading volume, it would take traders 7.21 days to cover their short positions on average.

Murphy USA(紐交所:MUSA)的流通股的空頭比例自上次報告以來下降了6.68%。該公司最近報告其已開空107萬股,這佔所有可交易常規股份的5.87%。根據其成交量,交易者平均需要7.21天來平倉他們的淡仓。

Why Short Interest Matters

爲什麼空頭持倉重要

Short interest is the number of shares that have been sold short but have not yet been covered or closed out. Short selling is when a trader sells shares of a company they do not own, with the hope that the price will fall. Traders make money from short selling if the price of the stock falls and they lose if it rises.

空頭持倉是指已經被做空但尚未被平倉或關閉的股票數量。開空是指交易者賣出他們並不擁有的公司股票,期望價格下跌。如果股票價格下跌,交易者就能從開空中賺錢;如果價格上漲,他們就會虧損。

Short interest is important to track because it can act as an indicator of market sentiment towards a particular stock. An increase in short interest can signal that investors have become more bearish, while a decrease in short interest can signal they have become more bullish.

跟蹤空頭持倉非常重要,因爲它可以作爲市場對特定股票情緒的指標。空頭持倉的增加可能表明投資者變得更加看淡,而減少則可能表明他們變得更加看好。

List of the most shorted stocks

做空集合股名單

Murphy USA Short Interest Graph (3 Months)

Murphy USA 空頭持倉圖(3個月)

As you can see from the chart above the percentage of shares that are sold short for Murphy USA has declined since its last report. This does not mean that the stock is going to rise in the near-term but traders should be aware that less shares are being shorted.

如上圖所示,Murphy USA 被做空的股份比例自上次報告以來有所下降。這並不意味着該股票在短期內會上漲,但交易者應注意,空頭股票的數量減少。

Comparing Murphy USA's Short Interest Against Its Peers

將Murphy USA的空頭持倉與其同行進行比較

Peer comparison is a popular technique amongst analysts and investors for gauging how well a company is performing. A company's peer is another company that has similar characteristics to it, such as industry, size, age, and financial structure. You can find a company's peer group by reading its 10-K, proxy filing, or by doing your own similarity analysis.

同行比較是分析師和投資者用來評估公司表現的流行技術。公司的同行是指與其具有相似特徵的其他公司,例如行業、規模、年齡和財務結構。您可以通過閱讀公司的10-k、代理文件或進行自己的相似性分析來找到公司的同行群體。

According to Benzinga Pro, Murphy USA's peer group average for short interest as a percentage of float is 10.44%, which means the company has less short interest than most of its peers.

根據Benzinga Pro的數據,Murphy USA的同行組空頭持倉佔流通股的平均比例爲10.44%,這意味着該公司的空頭持倉低於大多數同行。

Did you know that increasing short interest can actually be bullish for a stock? This post by Benzinga Money explains how you can profit from it.

你知道增加的空頭持倉實際上可以看好一隻股票嗎?Benzinga Money的這篇發帖解釋了你如何從中獲利。

This article was generated by Benzinga's automated content engine and was reviewed by an editor.

這篇文章由Benzinga的自動內容引擎生成,並由編輯進行審閱。