Poly Union Chemical Holding Group (SZSE:002037) Shareholders Are Still up 26% Over 5 Years Despite Pulling Back 8.3% in the Past Week

Poly Union Chemical Holding Group (SZSE:002037) Shareholders Are Still up 26% Over 5 Years Despite Pulling Back 8.3% in the Past Week

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And in our experience, buying the right stocks can give your wealth a significant boost. To wit, the Poly Union Chemical Holding Group share price has climbed 23% in five years, easily topping the market return of 15% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 6.5% in the last year.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

Given that Poly Union Chemical Holding Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years Poly Union Chemical Holding Group saw its revenue grow at 5.4% per year. Put simply, that growth rate fails to impress. The modest growth is probably broadly reflected in the share price, which is up 4%, per year over 5 years. We'd be looking for the underlying business to grow revenue a bit faster.

In the last 5 years Poly Union Chemical Holding Group saw its revenue grow at 5.4% per year. Put simply, that growth rate fails to impress. The modest growth is probably broadly reflected in the share price, which is up 4%, per year over 5 years. We'd be looking for the underlying business to grow revenue a bit faster.

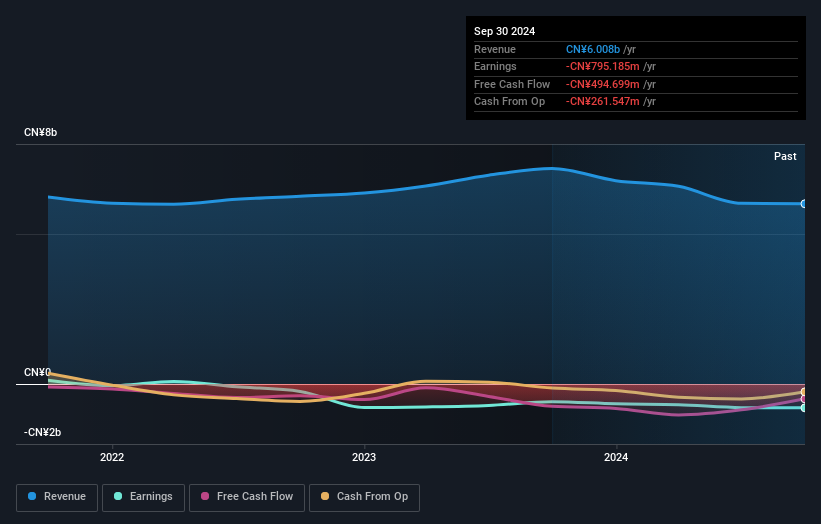

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About The Total Shareholder Return (TSR)?

We've already covered Poly Union Chemical Holding Group's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Poly Union Chemical Holding Group shareholders, and that cash payout contributed to why its TSR of 26%, over the last 5 years, is better than the share price return.

A Different Perspective

Poly Union Chemical Holding Group provided a TSR of 6.5% over the last twelve months. But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 5% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 1 warning sign we've spotted with Poly Union Chemical Holding Group .

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.