This Is What Whales Are Betting On Quantum Computing

This Is What Whales Are Betting On Quantum Computing

Whales with a lot of money to spend have taken a noticeably bullish stance on Quantum Computing.

有大量資金可以花的鯨魚對量子計算採取了明顯的看漲立場。

Looking at options history for Quantum Computing (NASDAQ:QUBT) we detected 8 trades.

查看量子計算(納斯達克股票代碼:QUBT)的期權歷史記錄,我們發現了8筆交易。

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 37% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,50%的投資者以看漲的預期開啓交易,37%的投資者持看跌預期。

From the overall spotted trades, 4 are puts, for a total amount of $284,800 and 4, calls, for a total amount of $822,158.

在所有已發現的交易中,有4筆是看跌期權,總額爲284,800美元,4筆是看漲期權,總額爲822,158美元。

Projected Price Targets

預計的目標價格

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $2.5 to $30.0 for Quantum Computing during the past quarter.

分析這些合約的交易量和未平倉合約,大型企業似乎一直在關注量子計算在過去一個季度的價格範圍從2.5美元到30.0美元不等。

Analyzing Volume & Open Interest

分析交易量和未平倉合約

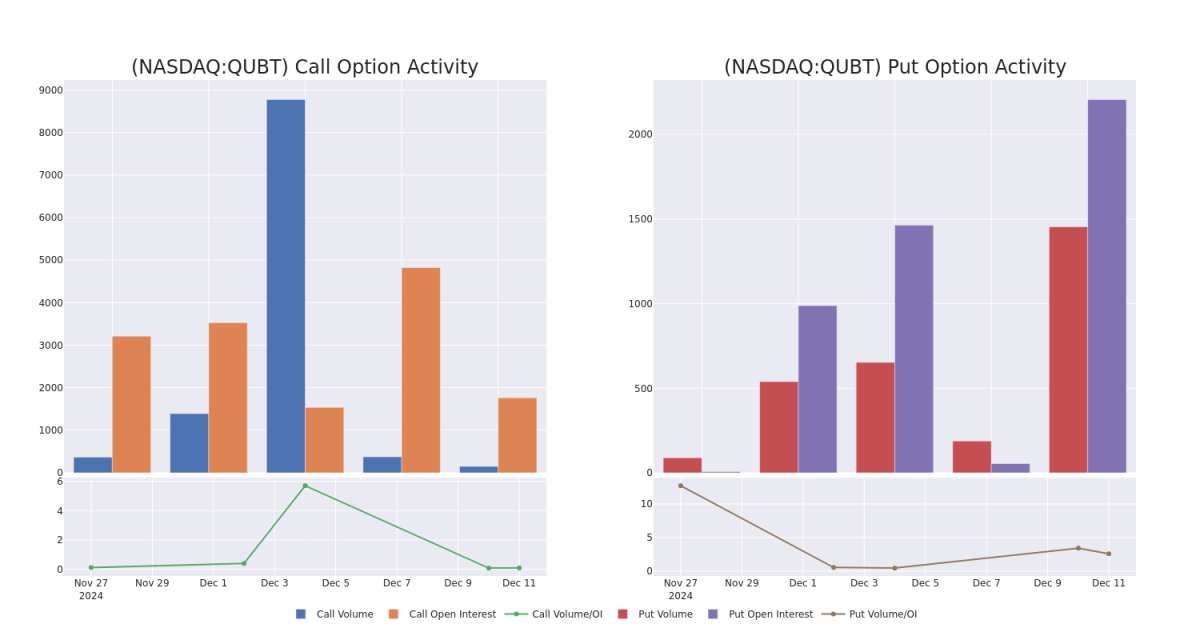

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Quantum Computing's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Quantum Computing's substantial trades, within a strike price spectrum from $2.5 to $30.0 over the preceding 30 days.

評估交易量和未平倉合約是期權交易的戰略步驟。這些指標揭示了量子計算期權在指定行使價下的流動性和投資者對該期權的興趣。即將發佈的數據可視化了過去30天與量子計算的大量交易相關的看漲期權和未平倉合約的交易量和未平倉合約的波動,行使價範圍從2.5美元到30.0美元不等。

Quantum Computing Option Volume And Open Interest Over Last 30 Days

過去30天的量子計算期權交易量和未平倉合約

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QUBT | CALL | SWEEP | BULLISH | 01/17/25 | $3.5 | $3.0 | $3.0 | $30.00 | $600.0K | 883 | 80 |

| QUBT | CALL | TRADE | BEARISH | 04/17/25 | $17.0 | $15.9 | $16.2 | $2.50 | $113.4K | 1.5K | 264 |

| QUBT | PUT | TRADE | BULLISH | 04/17/25 | $9.0 | $8.5 | $8.7 | $18.00 | $113.1K | 75 | 205 |

| QUBT | PUT | TRADE | NEUTRAL | 04/17/25 | $9.6 | $9.0 | $9.35 | $19.00 | $93.5K | 7 | 105 |

| QUBT | CALL | TRADE | BULLISH | 01/17/25 | $15.2 | $14.3 | $15.0 | $5.00 | $67.5K | 10.0K | 50 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QUBT | 打電話 | 掃 | 看漲 | 01/17/25 | 3.5 美元 | 3.0 美元 | 3.0 美元 | 30.00 美元 | 600.0 萬美元 | 883 | 80 |

| QUBT | 打電話 | 貿易 | 粗魯的 | 04/17/25 | 17.0 美元 | 15.9 美元 | 16.2 美元 | 2.50 美元 | 113.4 萬美元 | 1.5K | 264 |

| QUBT | 放 | 貿易 | 看漲 | 04/17/25 | 9.0 美元 | 8.5 美元 | 8.7 美元 | 18.00 美元 | 113.1 萬美元 | 75 | 205 |

| QUBT | 放 | 貿易 | 中立 | 04/17/25 | 9.6 美元 | 9.0 美元 | 9.35 美元 | 19.00 美元 | 93.5 萬美元 | 7 | 105 |

| QUBT | 打電話 | 貿易 | 看漲 | 01/17/25 | 15.2 美元 | 14.3 美元 | 15.0 美元 | 5.00 美元 | 67.5 萬美元 | 10.0K | 50 |

About Quantum Computing

關於量子計算

Quantum Computing Inc is an American company utilizing non-linear quantum optics (optical devices whose output due to quantum effects is exponentially, not linearly, related to inputs) to deliver quantum products for high-performance computing applications. QCi's products are designed to operate at room temperature and use low power at an affordable cost. The Company's portfolio of core technology and products offer new capabilities in the areas of high-performance computing, artificial intelligence, cyber security as well as remote sensing applications.

Quantum Computing Inc是一家利用非線性量子光學(光學器件,其輸出因量子效應與輸入呈指數而不是線性關係)爲高性能計算應用提供量子產品的美國公司。QCi 的產品設計用於在室溫下運行,並以可承受的成本使用低功耗。該公司的核心技術和產品組合在高性能計算、人工智能、網絡安全和遙感應用領域提供了新的能力。

After a thorough review of the options trading surrounding Quantum Computing, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對圍繞量子計算的期權交易進行了全面審查之後,我們將對該公司進行更詳細的審查。這包括評估其當前的市場狀況和表現。

Present Market Standing of Quantum Computing

量子計算的當前市場地位

- Trading volume stands at 48,943,180, with QUBT's price down by -28.74%, positioned at $18.3.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 102 days.

- 交易量爲48,943,180美元,QUBT的價格下跌了-28.74%,爲18.3美元。

- RSI指標顯示該股可能被超買。

- 預計將在102天內公佈業績。

Turn $1000 into $1270 in just 20 days?

在短短 20 天內將 1000 美元變成 1270 美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年專業期權交易員透露了他的單線圖技術,該技術顯示何時買入和賣出。複製他的交易,平均每20天獲利27%。點擊此處訪問。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的盈利潛力。嚴肅的期權交易者通過每天進行自我教育、擴大交易規模、遵循多個指標以及密切關注市場來管理這種風險。

From the overall spotted trades, 4 are puts, for a total amount of $284,800 and 4, calls, for a total amount of $822,158.

From the overall spotted trades, 4 are puts, for a total amount of $284,800 and 4, calls, for a total amount of $822,158.