Markets Weekly Update (December 20) : U.S. Economy Expands by 3.1% in Q3 2024, Surpassing Previous Estimates

Markets Weekly Update (December 20) : U.S. Economy Expands by 3.1% in Q3 2024, Surpassing Previous Estimates

Welcome to the Markets Weekly Update, the column committed to delivering essential investing insights for the week and key events that could move markets in the week ahead.

歡迎收看《市場週報》,該專欄致力於提供本週的基本投資見解以及可能在未來一週推動市場的關鍵事件。

Macro Matters

宏觀問題

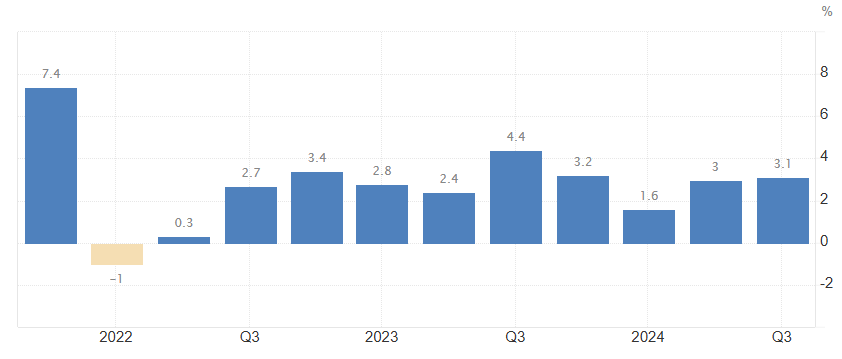

U.S. Economy Expands by 3.1% in Q3 2024, Surpassing Previous Estimates

美國經濟在2024年第三季度增長了3.1%,超過了先前的預期

The US economy expanded an annualized 3.1% in the third quarter of 2024, higher than 2.8% in the second estimate and above 3% in Q2. It is the biggest growth rate so far this year. Personal spending increased at the fastest pace since Q1 2023 (3.7% vs 3.5% in the second estimate). It was boosted by a 5.6% surge in consumption of goods (vs 5.6% in the second estimate) and a robust spending on services (2.8% vs 2.6%). Also, fixed investment rose more than anticipated (2.1% vs 1.7%). Investment in equipment soared (10.8% vs 10.6%) while structures (-5% vs -4.7%) and residential investment (-4.3% vs -5%) declined. Government consumption growth was also revised higher to 5.1% (vs 5%). In addition, the contribution of net trade was less negative (-0.43 pp vs -0.57 pp in the second estimate), with both exports (9.6% vs 7.5%) and imports (10.7% vs 10.2%) revised higher. On the other hand, private inventories dragged 0.22 pp from the growth, compared to a 0.11 pp drop in the second estimate.

美國經濟在2024年第三季度按年計算增長3.1%,高於第二次估計的2.8%,第二季度超過3%。這是今年迄今爲止最大的增長率。個人支出以自2023年第一季度以來最快的速度增長(3.7%,第二次估計爲3.5%)。商品消費增長5.6%(第二次估計爲5.6%)和強勁的服務支出(2.8%對2.6%)推動了這一增長。此外,固定投資的增長幅度超過預期(2.1%對1.7%)。設備投資猛增(10.8%對10.6%),而建築物(-5%對-4.7%)和住宅投資(-4.3%對比-5%)下降。政府消費增長也上調至5.1%(相比爲5%)。此外,淨貿易的貢獻不那麼負數(-0.43個百分點,第二個估計值爲-0.57個百分點),出口(9.6%對7.5%)和進口(10.7%對10.2%)均上調。另一方面,私人庫存拖累了0.22個百分點,而第二次估計的下降了0.11個百分點。

Federal Reserve Cuts Federal Funds Rate, Forecasts Slower Reductions Amid Rising Inflation Concerns

聯儲局下調聯邦基金利率,預測在通貨膨脹擔憂加劇的情況下降幅將放緩

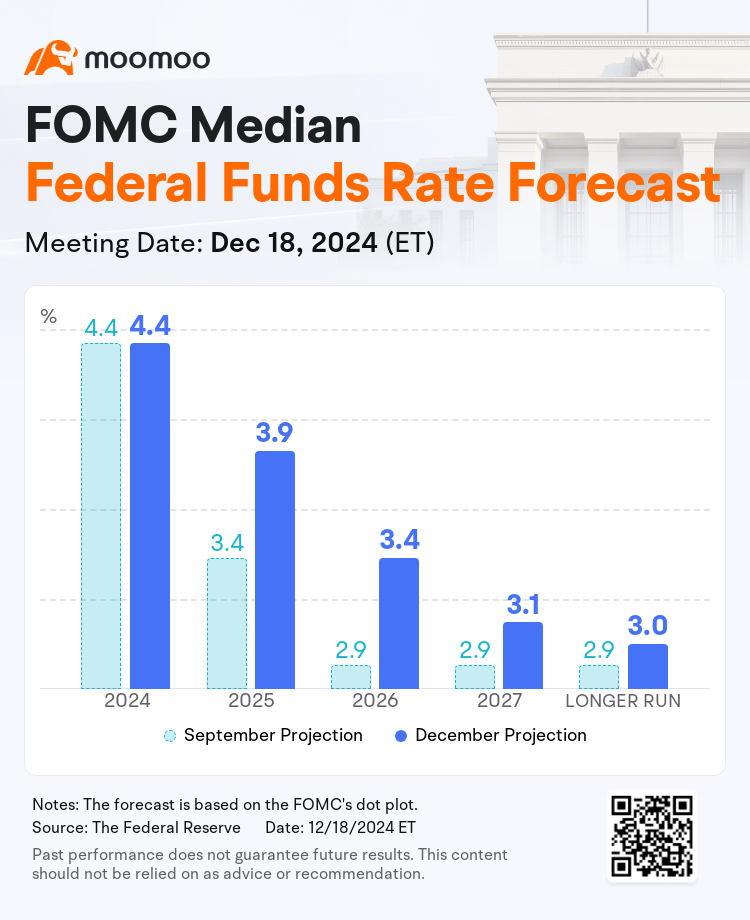

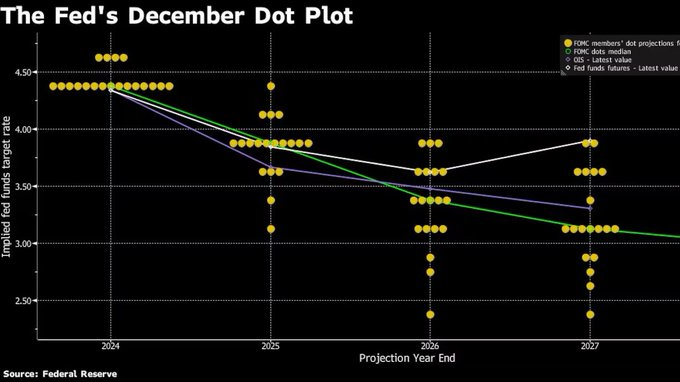

The Federal Open Market Committee lowered the target federal funds rate by 25 basis points and forecast a slower pace of reductions next year as policymakers raised their inflation outlook.

聯邦公開市場委員會將目標聯邦基金利率下調了25個點子,並預測隨着決策者提高通脹前景,明年的下調步伐將放緩。

The target rate was lowered to a range of 4.25%-4.5% Wednesday, the Federal Reserve said in a statement Wednesday at the end of policymakers' two-day meeting. While the previous decision to lower rates was unanimous, this time around, Federal Reserve Bank of Cleveland Beth M. Hammack voted against the move, preferring instead to hold the benchmark borrowing cost steady at 4.5% to 4.75%.

聯儲局週三在爲期兩天的決策者會議結束時發表聲明說,目標利率週三下調至4.25%-4.5%的區間。儘管先前降低利率的決定是一致的,但這一次,克利夫蘭聯邦儲備銀行Beth m. Hammack對這一舉措投了反對票,而是傾向於將基準借貸成本穩定在4.5%至4.75%。

Japan Experiences Sharp Inflation Increase in November 2024, Reaching Highest Rate Since Last Year

日本在2024年11月經歷了通貨膨脹率急劇上升,達到去年以來的最高水平

The annual inflation rate in Japan climbed to 2.9% in November 2024 from 2.3% in the prior month, marking the highest reading since October 2023. Food prices rose at the steepest pace in eight months (4.8% vs 3.5% in October), with fresh vegetables and fresh food contributing the most to the upturn. Meantime, electricity prices (9.9% vs 4.0%) and gas prices (5.6% vs 3.5%) sharply accelerated with the absence of energy subsidies since May. Additional upward pressure also came from housing (0.9% vs 0.8%), clothing (2.9% vs 2.8%), transport (0.9% vs 0.5%), furniture and household utensils (3.7% vs 4.4%), healthcare (1.6% vs 1.7%), recreation (4.5% vs 4.3%), and miscellaneous items (1.1% vs 1.1%). In contrast, prices fell further for communication (-3.0% vs -3.5%) and education (-1.0% vs -1.0%). The core inflation rate rose to a 3-month high of 2.7% in November, up from 2.3% in October and surpassing estimates of 2.6%. Monthly, the CPI increased by 0.6%, the highest figure in 13 months.

日本的年通貨膨脹率從上個月的2.3%攀升至2024年11月的2.9%,創下2023年10月以來的最高水平。食品價格以八個月來最快的速度上漲(4.8%,10月份爲3.5%),其中新鮮蔬菜和新鮮食品對經濟回升的貢獻最大。同時,由於自5月以來沒有能源補貼,電價(9.9%對4.0%)和天然氣價格(5.6%對3.5%)急劇上漲。額外的上行壓力還來自住房(0.9%對0.8%)、服裝(2.9%對2.8%)、交通(0.9%對0.5%)、傢具和家用器具(3.7%對4.4%)、醫療保健(1.6%對1.7%)、娛樂(4.5%對4.3%)和雜項(1.1%對1.1%)。相比之下,通訊(-3.0%對-3.5%)和教育(-1.0%對-1.0%)的價格進一步下跌。核心通貨膨脹率從10月份的2.3%升至11月份的2.7%的3個月高點,超過了預期的2.6%。消費者價格指數每月增長0.6%,爲13個月來的最高數字。

Smart Money Flow

智能資金流

Federal Reserve officials expect only two quarter point rate reductions for 2025.

聯儲局官員預計,2025年僅下調四分之二的利率。

The long run neutral rate is raised to 3%.

長期中性利率提高至3%。

Gold Prices Dip Amid Hawkish Federal Reserve Outlook and Challenges in Future Demand

在聯儲局鷹派前景和未來需求挑戰的背景下,黃金價格下跌

Gold hovered around $2,600 per ounce on Friday, poised for a weekly decline under the influence of a hawkish Federal Reserve. The Fed indicated only two potential rate cuts next year, reflecting a cautious approach to monetary easing. Strong US GDP data and increased consumer spending further supported a slower easing pace. This environment has dampened gold demand, as reduced monetary easing lessens the appeal of non-yielding assets like bullion. Moreover, gold's near-term outlook faces added pressure from declining physical demand in India, where a significant drop in December gold imports is expected.

週五,金價徘徊在每盎司2600美元左右,在鷹派聯儲局的影響下,有望每週下跌。聯儲局表示明年僅可能減息兩次,這反映了對貨幣寬鬆的謹慎態度。強勁的美國國內生產總值數據和消費支出的增加進一步支撐了寬鬆步伐的放緩。這種環境抑制了黃金需求,因爲貨幣寬鬆政策的減少削弱了金條等非收益資產的吸引力。此外,黃金的短期前景面臨印度實物需求下降帶來的額外壓力,預計印度12月黃金進口量將大幅下降。

Bitcoin Eyes $200,000 Milestone by 2025 Amidst Robust Growth and Favorable Market Conditions

在強勁增長和有利的市場條件下,到2025年,比特幣有望達到20萬美元的里程碑

Bitcoin has seen a historic rally in 2024, with its price soaring over 150% and breaking the $100,000 mark. Supported by significant events such as the approval of Bitcoin spot ETFs, rate-cut cycles, and favorable regulatory changes, Bitcoin is now being targeted for a $200,000 valuation by 2025. Amidst this bullish backdrop, the cryptocurrency market anticipates further gains, potentially capping the year with a 'Santa Rally'.

比特幣在2024年出現了歷史性的反彈,其價格飆升了150%以上,突破了10萬美元大關。在比特幣現貨ETF的批准、減息週期和有利的監管變化等重大事件的支持下,比特幣現在的目標是到2025年估值達到20萬美元。在這種看漲的背景下,加密貨幣市場預計將進一步上漲,可能會以 「聖誕老人拉力賽」 爲今年畫上句號。

Top Corporate News

熱門企業新聞

Micron Falls Most in Four Years on Sluggish Sales Outlook

由於銷售前景疲軟,美光四年來跌幅最大

Shares of Micron Technology experienced their largest drop in over four years following the release of disappointing Q1 FY2025 earnings on Wednesday. Both the company’s revenue and EPS guidance for the next quarter fell significantly short of expectations, leading to a decline in share price. The weak outlook can be attributed to three main factors: a slowdown in demand for data center SSDs, slower-than-expected inventory absorption in consumer markets like PCs and smartphones, and an industry-wide oversupply of NAND memory. On a positive note, Micron made significant strides in improving its inventory levels, and its adjusted operating income surpassed Wall Street's forecasts.

繼週三公佈令人失望的 FY2025 第一季度業績後,美光科技的股價經歷了四年多來的最大跌幅。該公司下一季度的收入和每股收益預期均大大低於預期,導致股價下跌。疲軟的前景可以歸因於三個主要因素:對數據中心固態硬盤的需求放緩,個人電腦和智能手機等消費市場的庫存吸收低於預期,以及整個行業的NAND存儲器供過於求。從積極的方面來看,美光在提高庫存水平方面取得了長足的進步,其調整後的營業收入超過了華爾街的預期。

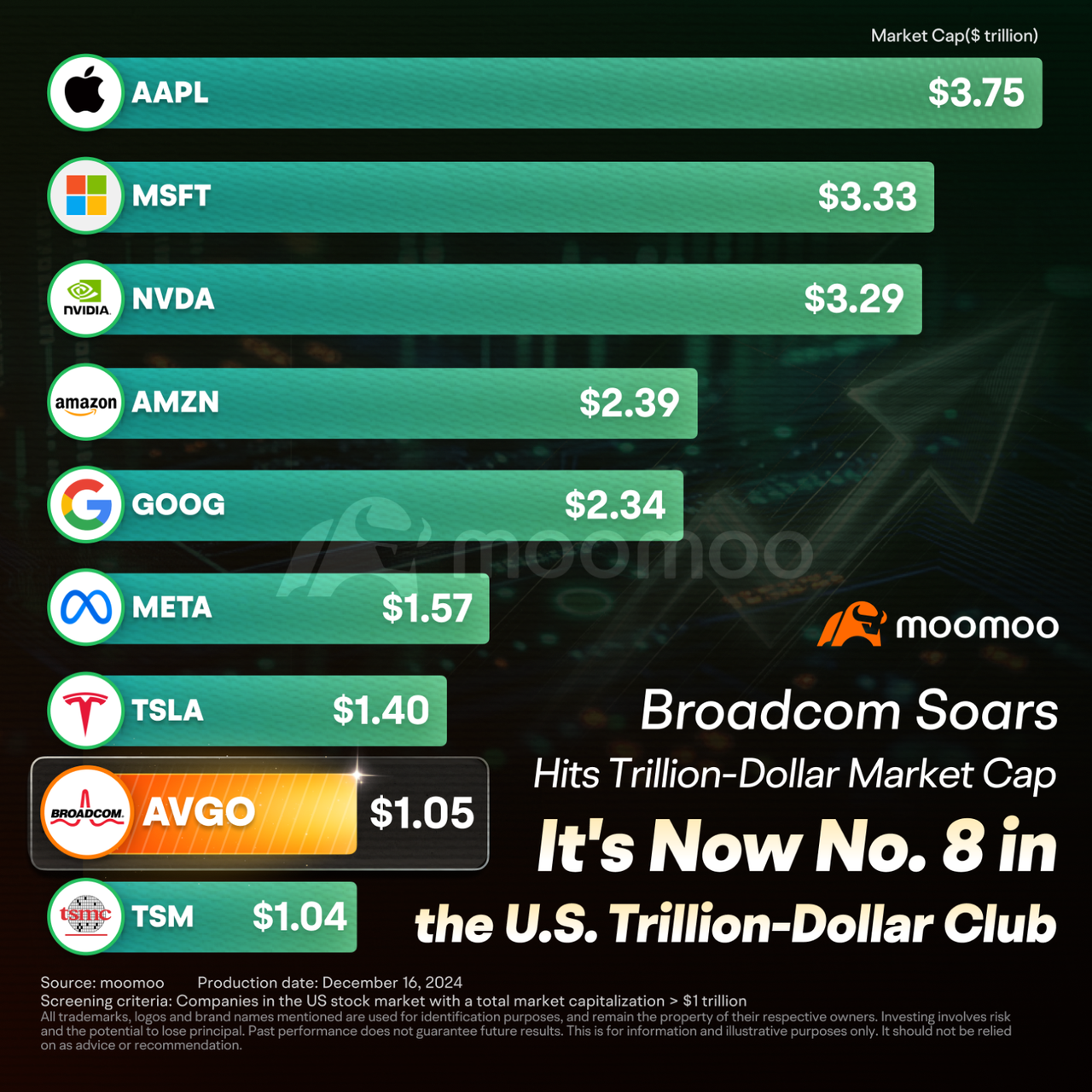

Broadcom Hits $1 Trillion Market Cap, Ranks 8th Globally

博通市值達到1萬億美元,全球排名第8

On December 13th, Broadcom's stock price surged by over 24%, closing at $224.8 per share. The company's market capitalization surpassed the $1 trillion mark for the first time, making it the 12th company globally and the 9th in the United States to achieve a market value of $1 trillion. It also became the third semiconductor company to break the $1 trillion market cap barrier, following NVIDIA and TSMC.

12月13日,博通的股價飆升了24%以上,收於每股224.8美元。該公司的市值首次突破1萬億美元大關,使其成爲全球第12家市值達到1萬億美元的公司,也是美國第9家市值達到1萬億美元的公司。它也成爲繼NVIDIA和台積電之後第三家突破1萬億美元市值壁壘的半導體公司。

Broadcom's ASIC leadership positions it well for future AI competition. The company is developing custom AI chips with three major clients (Google, Meta, ByteDance) and working on next-gen AIXPUs with two others. It aims to convert these into revenue-generating customers by 2027, expanding its market.

博通的澳大利亞證券投資委員會領導地位爲未來的人工智能競爭奠定了良好的基礎。該公司正在與三個主要客戶(谷歌、Meta、ByteDance)開發定製的人工智能芯片,並與另外兩個客戶合作開發下一代AixPUS。它的目標是到2027年將這些客戶轉化爲創收客戶,從而擴大其市場。

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

免責聲明:本演示文稿僅供參考和教育之用,不是對任何特定投資或投資策略的推薦或認可。本內容中提供的投資信息本質上是一般性的,僅用於說明目的,可能不適合所有投資者。其提供時不考慮個人投資者的財務複雜程度、財務狀況、投資目標、投資時間範圍或風險承受能力。在做出任何投資決定之前,您應根據您的相關個人情況考慮這些信息的適當性。過去的投資表現並不表明或保證未來的成功。回報會有所不同,所有投資都有風險,包括本金損失。

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

moomoo是由moomoo Technologies Inc.提供的財務信息和交易應用程序。在美國,moomoo上的投資產品和服務由成員FINRA/SIPC的moomoo Financial Inc. 提供。