Top 3 Tech Stocks That Could Blast Off In Q4

Top 3 Tech Stocks That Could Blast Off In Q4

The most oversold stocks in the information technology sector presents an opportunity to buy into undervalued companies.

信息技術領域超賣最多的股票爲買入被低估的公司提供了機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI是一個動量指標,它比較股票在價格上漲的日子裏的走強與價格下跌的日子的走強。與股票的價格走勢相比,它可以讓交易者更好地了解股票在短期內的表現。根據Benzinga Pro的數據,當相對強弱指數低於30時,資產通常被視爲超賣。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是該行業主要超賣參與者的最新名單,其相對強弱指數接近或低於30。

Axcelis Technologies Inc (NASDAQ:ACLS)

阿克塞利斯科技公司(納斯達克股票代碼:ACLS)

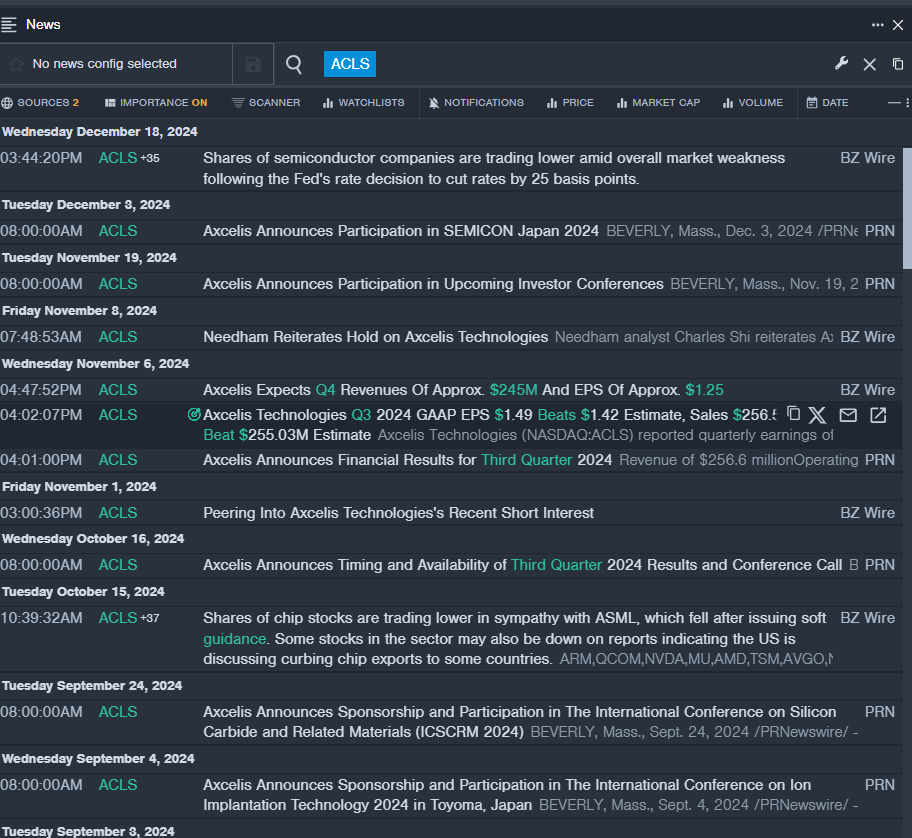

- On Nov. 6, Axcelis Technologies posted better-than-expected quarterly earnings. President and CEO Russell Low commented, "Axcelis executed well in the third quarter with results relatively in-line with our expectations. While we anticipate a near term digestion of mature node capacity through the first half of 2025, customer engagement is strong and our long-term growth opportunity remains squarely intact highlighted by attractive secular growth in silicon carbide, a cyclical recovery in our memory and general mature markets, market share gains in advanced logic and regional penetration of the Japan market." The company's stock fell around 9% over the past five days and has a 52-week low of $68.79.

- RSI Value: 29.60

- ACLS Price Action: Shares of Axcelis Technologies fell 2.5% to close at $69.18 on Thursday.

- Benzinga Pro's real-time newsfeed alerted to latest ACLS news.

- 11月6日,Axcelis Technologies公佈的季度收益好於預期。總裁兼首席執行官羅素·洛評論說:「Axcelis在第三季度表現良好,業績相對符合我們的預期。儘管我們預計,到2025年上半年,成熟節點容量將在短期內消化,但客戶參與度強勁,我們的長期增長機會仍然完好無損,這體現在碳化硅誘人的長期增長、存儲器和一般成熟市場的週期性復甦、先進邏輯的市場份額增加以及日本市場的區域滲透率。」該公司的股價在過去五天中下跌了約9%,跌至52周低點68.79美元。

- RSI 值:29.60

- ACLS價格走勢:週四,Axcelis Technologies的股價下跌2.5%,收於69.18美元。

- Benzinga Pro的實時新聞提醒了ACLS的最新消息。

Applied Materials Inc (NASDAQ:AMAT)

應用材料公司(納斯達克股票代碼:AMAT)

- On Dec. 6, Wells Fargo analyst Joseph Quatrochi maintained the stock with an Overweight rating and lowered the price target from $220 to $210.. The company's stock fell around 4% over the past five days and has a 52-week low of $148.06.

- RSI Value: 29.31

- AMAT Price Action: Shares of Applied Materials fell 2.4% to close at $161.44 on Thursday.

- Benzinga Pro's charting tool helped identify the trend in AMAT stock.

- 12月6日,富國銀行分析師約瑟夫·夸特羅奇維持該股增持評級,並將目標股價從220美元下調至210美元。該公司的股票在過去五天中下跌了約4%,跌至52周低點148.06美元。

- RSI 值:29.31

- AmaT價格走勢:應用材料公司股價週四下跌2.4%,收於161.44美元。

- Benzinga Pro的圖表工具幫助確定了AmAT股票的走勢。

Microchip Technology Inc (NASDAQ:MCHP)

微芯科技公司(納斯達克股票代碼:MCHP)

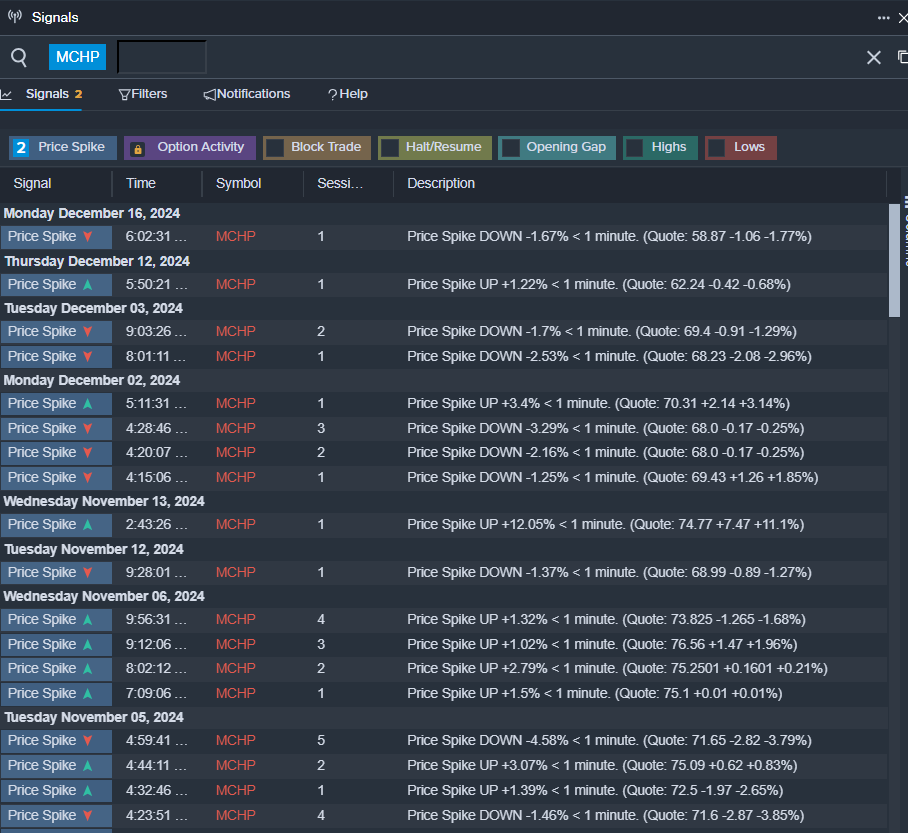

- On Dec. 11, Stifel analyst Nathan Jones maintained A.O. Smith with a Buy and lowered the price target from $91 to $90. The company's stock fell around 14% over the past month and has a 52-week low of $55.90.

- RSI Value: 27.86

- MCHP Price Action: Shares of Microchip Technology fell 0.3% to close at $55.99 on Thursday.

- Benzinga Pro's signals feature notified of a potential breakout in MCHP shares.

- 12月11日,Stifel分析師內森·瓊斯維持了A.O. Smith的買入,並將目標股價從91美元下調至90美元。該公司的股票在過去一個月中下跌了約14%,跌至52周低點55.90美元。

- RSI 值:27.86

- MCHP價格走勢:週四,微芯科技股價下跌0.3%,收於55.99美元。

- Benzinga Pro的信號功能被告知MCHP股票可能出現突破。

Read More:

閱讀更多:

- Top 3 Consumer Stocks You May Want To Dump This Quarter

- 本季度您可能想拋售的三大消費股