Market Whales and Their Recent Bets on Visa Options

Market Whales and Their Recent Bets on Visa Options

Financial giants have made a conspicuous bullish move on Visa. Our analysis of options history for Visa (NYSE:V) revealed 24 unusual trades.

金融巨頭在Visa(紐交所:V)上採取了明顯的看好行動。我們對Visa的期權歷史分析揭示了24筆飛凡交易。

Delving into the details, we found 45% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $880,462, and 18 were calls, valued at $1,310,893.

深入細節,我們發現45%的交易者持看好態度,而37%表現出看淡傾向。在我們所發現的所有交易中,有6筆是看跌期權,價值爲880,462美元,18筆是看漲期權,價值爲1,310,893美元。

What's The Price Target?

價格目標是什麼?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $270.0 and $345.0 for Visa, spanning the last three months.

在評估了交易成交量和未平倉合約後,很明顯主要的市場動向集中在Visa的價格區間在270.0美元到345.0美元之間,涵蓋了過去三個月的時間。

Volume & Open Interest Trends

成交量和未平倉量趨勢

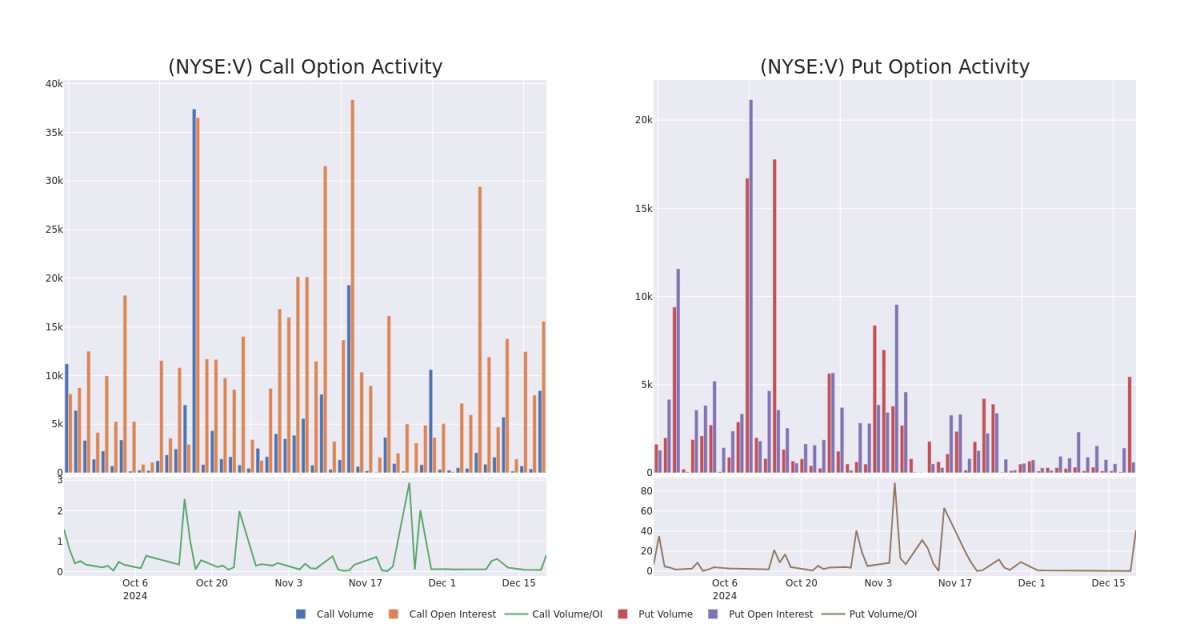

In today's trading context, the average open interest for options of Visa stands at 1350.17, with a total volume reaching 13,904.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Visa, situated within the strike price corridor from $270.0 to $345.0, throughout the last 30 days.

在今天的交易背景下,Visa的期權平均未平倉合約爲1350.17,總成交量達到13,904.00。附帶的圖表描繪了在過去30天內,Visa高價值交易中的看漲期權和看跌期權的成交量和未平倉合約的變化,位於270.0美元到345.0美元的行權價格區間內。

Visa Call and Put Volume: 30-Day Overview

Visa的看漲和看跌期權成交量:30天概述

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| V | PUT | SWEEP | BULLISH | 01/16/26 | $22.2 | $21.55 | $22.15 | $310.00 | $469.6K | 133 | 224 |

| V | CALL | SWEEP | BULLISH | 01/16/26 | $19.6 | $19.55 | $19.6 | $345.00 | $407.0K | 251 | 218 |

| V | PUT | SWEEP | NEUTRAL | 01/16/26 | $21.4 | $21.25 | $21.4 | $310.00 | $275.2K | 133 | 1.4K |

| V | CALL | SWEEP | BULLISH | 01/17/25 | $42.9 | $40.2 | $41.68 | $275.00 | $117.2K | 6.3K | 1.3K |

| V | CALL | TRADE | BEARISH | 03/21/25 | $40.25 | $38.7 | $39.02 | $280.00 | $117.0K | 277 | 30 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| V | 看跌 | 掃單 | 看好 | 01/16/26 | $22.2 | $21.55 | $22.15 | $310.00 | $469.6K | 133 | 224 |

| V | 看漲 | 掃單 | 看好 | 01/16/26 | $19.6 | $19.55 | $19.6 | $345.00 | 407.0K美元 | 251 | 218 |

| V | 看跌 | 掃單 | 中立 | 01/16/26 | $21.4 | $21.25 | $21.4 | $310.00 | 275.2K美元 | 133 | 1.4K |

| V | 看漲 | 掃單 | 看好 | 01/17/25 | $42.9 | $40.2 | $41.68 | $275.00 | $117.2K | 6.3K | 1.3K |

| V | 看漲 | 交易 | 看淡 | 03/21/25 | $40.25 | $38.7 | $39.02 | $280.00 | $117.0K | 277 | 30 |

About Visa

關於Visa

Visa is the largest payment processor in the world. In fiscal 2023, it processed almost $15 trillion in total volume. Visa operates in over 200 countries and processes transactions in over 160 currencies. Its systems are capable of processing over 65,000 transactions per second.

Visa是全球最大的支付處理公司。在2023財年,它的總成交量接近15萬億。Visa在200多個國家運營,處理超過160種貨幣的交易。其系統能夠每秒處理超過65,000筆交易。

Following our analysis of the options activities associated with Visa, we pivot to a closer look at the company's own performance.

在我們分析了與Visa相關的期權活動之後,我們將目光轉向公司本身的表現。

Visa's Current Market Status

Visa當前市場狀態

- Trading volume stands at 4,740,524, with V's price up by 1.18%, positioned at $318.6.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 34 days.

- 交易成交量爲4,740,524,V的價格上漲1.18%,現報318.6美元。

- 相對強弱指數(RSI)因數顯示該股票可能接近超買狀態。

- 收益公告預計將在34天內發佈。

Expert Opinions on Visa

關於Visa的專家意見

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $370.25.

在過去一個月裏,四位行業分析師分享了他們對這隻股票的看法,提出了平均目標價爲370.25美元。

Turn $1000 into $1270 in just 20 days?

在短短20天內將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Consistent in their evaluation, an analyst from Susquehanna keeps a Positive rating on Visa with a target price of $375. * Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on Visa with a target price of $371. * Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on Visa with a target price of $375. * An analyst from Keefe, Bruyette & Woods has decided to maintain their Outperform rating on Visa, which currently sits at a price target of $360.

一位擁有20年經驗的期權交易員揭示了他的單行圖表技巧,顯示何時買入和賣出。複製他的交易,這些交易在每20天內平均獲利27%。點擊此處獲取訪問權限。* 分析師來自Susquehanna對Visa保持看好的評級,目標價爲375美元。* 分析師來自摩根士丹利對Visa保持超配評級,目標價爲371美元。* 分析師來自Oppenheimer對Visa保持跑贏大盤評級,目標價爲375美元。* 分析師來自Keefe, Bruyette & Woods決定維持其對Visa的跑贏大盤評級,目前目標價爲360美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Visa options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在的回報。精明的交易者通過不斷學習、調整策略、監控多個因數以及密切關注市場動向來管理這些風險。使用Benzinga Pro的實時警報,隨時了解Visa的最新期權交易。

In today's trading context, the average open interest for options of Visa stands at 1350.17, with a total volume reaching 13,904.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Visa, situated within the strike price corridor from $270.0 to $345.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Visa stands at 1350.17, with a total volume reaching 13,904.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Visa, situated within the strike price corridor from $270.0 to $345.0, throughout the last 30 days.